India's Retail sector hits a massive sale of 6.05 Lakh Crore in this festive season

RELEASE DATE: Oct 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

India's retail sector is greatly influenced by its diverse and impressive festival history. Culturally significant festivals like Ganapati, Diwali, Durga Puja, and the wedding season serve as key financial drivers that encourage purchasing and retail activity. These celebrations are planned by the retail sector, which sees higher profits across various categories such as clothing, electronics, automobiles, jewellery, and household goods. Favorable aspects like tax incentives, GST cuts, greater internet adoption, and substantial rural market engagement supported the holiday season, triggering phenomenal shopping occasions. India’s retail sales during the 2025 festive season reached an incredible Rs. 6.05 lakh crore - the highest ever in the country’s history.

Market value:

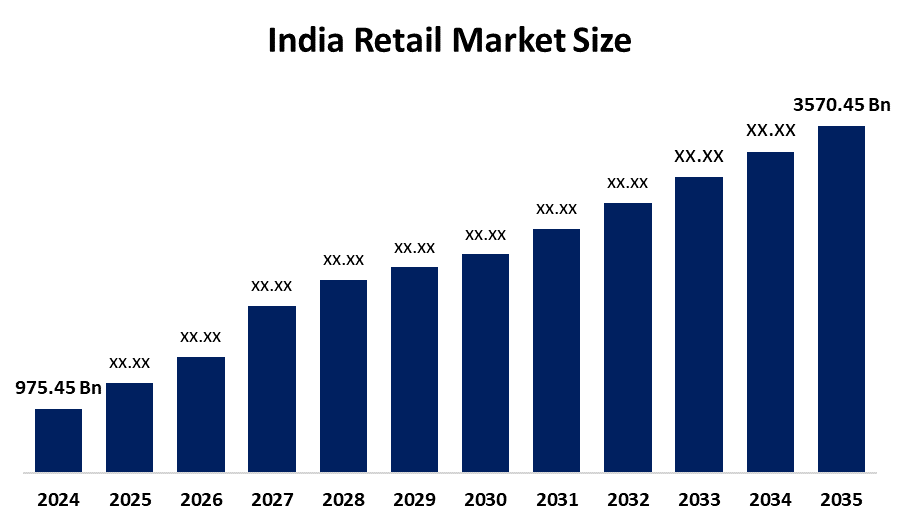

According to a research report published by Spherical Insights & Consulting, The India Retail Market Size was valued at USD 975.45 Billion in 2024. The Market Size is Expected to Grow at a CAGR of 12.52% during the forecast period of 2025-2035 to reach a value of USD 3,570.45 Billion by 2035.

Current Revenue Stats:

- According to the Confederation of All India Traders (CAIT), overall turnover increased by 25% over the same period as the previous year.

- 65,000 crore was contributed by services like logistics, hospitality, packaging, travel, and event management, while 5.40 lakh crore came from goods.

- Rural and semi-urban areas contributed close to 28% of total sales, indicating expanding demand beyond metropolitan regions.

Category-wise split up:

- FMCG (fast-moving consumer goods): 12%

- Jewellery: 10%

- Electrical appliances: 8%

- Clothing: 7%

- Consumer durables: 7%

- Novelty: 7%

- Sweets, furniture, and home decor: 5% each

Past Retail Outlook during Festival:

In 2024, E-commerce experienced a 14% increase compared to the previous year, driven by fashion and home furnishings. For instance, Surat’s textile sector thrived, sending out 80,000 packages valued at 250 crore during one of its most active seasons in years.

In 2023, the “Vocal for Local” initiative gained strong traction. Trade volume of 3.75 lakh crore indicated consumer nationalism, causing Chinese imports to slip by almost 1 lakh crore in market share.

In 2022, with 1.5 lakh crore in commerce, gold acquisitions increased by 20%, and vehicle sales in Noida reached a five-year peak. Diwali marked a bold return to affluence.

In 2021: During the recovery from the pandemic, retail markets registered sales of 1.25 lakh crore. Local craftsmen and merchants thrived as Chinese imports fell drastically.

What are the reasons behind such booming billions?

India's festive season sales broke all previous records. This boom was driven by a strong 'Vocal for Local' movement and lower GST rates, as consumers favoured Indian goods. This achievement demonstrates a strong upturn in consumer and retail spending. Prime Minister Narendra Modi is a "brand ambassador" for Indian-made goods, and his appeal, noted by consumers who boost purchasing domestically, was well received nationwide. The lower GST rates greatly enhanced price competitiveness and boosted purchase momentum in important consumer and retail categories, including ready-made clothing, consumer durables, footwear, confectionery, and everyday use items. Both metropolitan and Tier 2 and Tier 3 marketplaces, where consumption was still high, contributed greatly to this spike.

Some other driving aspects:

Festive outlook: Strong consumer confidence and increased expenditure on necessities, presents, and upscale goods contributed to the rise. The retail growth was seen in sectors such as jewellery, electronics, home and lifestyle, and regional handicrafts.

Category expansion: Purchases of gold and silver stayed strong, with Rs 20,000 crore in gold and Rs 2,500 crore in silver sold on Dhanteras alone. Additional important categories encompassed apparel, gadgets, home goods, and confectionery. With approximately 8% of festive expenditures attributed to the electronics sector, as shoppers upgraded their appliances and gadgets.

Regional involvement: The retail surge extended beyond metropolitan areas. For example, Kolkata's shopping for Diwali and Kali Puja hit almost Rs 17,000 crore, a 16% increase from the previous year, emphasising growing demand in local markets. Besides, furniture, home decorations, and kitchen items experienced strong sales as individuals spent on upgrading their homes before the festival started.

E-commerce role for uplifting such turnover:

This festive season saw a notable uptick in the e-commerce industry in India. With a gross merchandise value (GMV) that increased by 24% year over year, e-commerce order volumes were primarily driven by quick commerce, which saw a 120% increase in order volume. Marketplaces remained in control, making up 38% of all online transactions, while brand websites reported a robust 33% increase in orders. The impressive digital penetration in Tier II and III cities, lower GST rates that made products more affordable, and increased consumer preference for online shopping because of its convenience and exclusive holiday discounts were some of the main factors driving this e-commerce trend. The rise of e-commerce highlights how India's retail scene is going digital, enhancing traditional retail and increasing festive consumption in both urban and emerging areas. FMCG, home decor, beauty and wellness, and electronics were the top-performing online categories, indicating changing consumer preferences for a range of essentials and lifestyle enhancements.

Recognition from the key authorities:

Harvansh Chawla, the chairman of the BRICS Chamber of Commerce & Industry, declared: "I have already said that this Diwali will be huge. This is the most enthusiastic and successful period of our economy's history. All praise is due to Prime Minister Narendra Modi. The results of the "Made in India" campaign will become more apparent, he added.

The success of the holiday season was also recognised by Naresh Pachisia, the president of the Commerce state in Kolkata. We haven't witnessed this level of customer demand in a very long time. One important factor was the GST reduction on consumption-related items.

PHDCCI President Rajeev Juneja emphasised the importance of continuing to support smaller industries as part of the "Viksit Bharat" vision. Their mission is to create connections between government agencies and small and medium-sized businesses. By providing all the assistance that makes small businesses grow into larger ones," he said.

Why U.S. tariffs can’t impact on such a sector, and what are the reasons behind it?

The Indian retail industry as a whole is shielded from the direct effects of U.S. tariffs, but U.S. tariffs pose serious export and supply chain difficulties for Indian manufacturers with ties to the American market, particularly in industries like jewellery and textiles. Further, the retail industry in India is primarily driven by domestic demand and local distribution networks. Moreover, rising demand in rural and semi-urban areas, government incentives like GST reductions on necessities, and increased discretionary spending are the main drivers of India's retail growth during festivals. Despite having an impact on some labour-intensive industries, such as textiles and gems, the domestic retail volumes remain steady during the festival season. Diversified supply chains that lessen reliance on tariffed imports and a robust "Vocal for Local" campaign contribute to the resilience of the retail sector. Thus, the strong, consumption-driven momentum of India's festival retail market is unaffected by U.S. tariffs.

Browse Related Reports

Global Green Tires Market Size To Exceed USD USD 462.8 Million by 2035 | CAGR of 12.29% : Market Study Report

Global Canopy Market Size To Exceed USD 2.55 Billion by 2035 | CAGR of 2.86% : Market Study Report

Global Vegan Yogurt Market Size To Exceed USD 26.81 Billion by 2035 | CAGR of 19.47% : Market Study Report

Global Organic Chocolate Spreads Market Size Exceed To USD 1159.6 Million by 2035 | CAGR of 5.01% : Market Study Report

Global Food Packaging Equipment Market Size Exceed To USD 36.75 Billion by 2035 | CAGR of 5.56% : Market Study Report

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?