Europe’s EV Surge: 600,000 Electric Cars Registered in Record-Breaking Quarter

RELEASE DATE: Aug 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Introduction

The electric vehicle (EV) revolution is ramping up faster than ever in Europe, representing a historic moment for the continent's direction towards sustainable transport. In the 3 months from April to June 2025, there were almost 600,000 battery electric vehicles (BEVs) registered across Western Europe, the highest quarterly registration ever. The increase represents a radical change in driving habits, policy change from government, changes in the automobile market, and a shift in attitudes toward electric cars, as more and more consumers, even private ones, adopt EVs. Cheap models, along with more charging points and good incentives, created a rollercoaster of EV use, which is changing the face of the auto industry in Europe.

Record-Breaking EV Registration in Western Europe

Western Europe's EV registrations have reached a record high of nearly 600,000 new battery electric vehicles on the roads in the second quarter of 2025. This milestone is driven primarily by the arrival of smaller, cheaper EV models that attract price-sensitive private buyers, which the industry did not previously have access to. According to analysts like Matthias Schmidt, EVs are no longer just the realm of corporate fleets and company car drivers; they are now appealing to everyday customers.

While EVs remain a higher upfront cost than ICE vehicles, the overall lower running costs – plus government support and subsidies - enhance their relative value. Many nations in Europe are ramping up support for EVs, e.g., France has social leases; the UK offers subsidies of up to 3,750 ( USD 5,062) for qualifying models costing below 37,000 ( USD 49,953), and so on. All of which encourages demand.

Highlights of Europe's EV Boom

- Nearly 600,000 battery electric vehicles (BEVs) were registered in Western Europe between April and June 2025, showing strong consumer interest and adoption despite economic pressures. This growth reflects ongoing shifts toward electrification and government incentives across Europe.

- EV registrations are expected to surpass 600,000 in the third quarter of 2025, boosted by seasonal factors such as the UK’s September license plate change, which typically encourages new car purchases. This trend highlights the importance of policy and cultural factors in shaping EV demand.

- BYD, a leading Chinese EV manufacturer, accounts for one in every four EVs shipped to Europe, with the UK as its biggest market. This dominance shows BYD’s strong foothold and growing influence in the European EV sector.

- Despite a steep 35% tariff on Chinese-made EVs, these vehicles still make up 10% of Europe’s EV fleet, underscoring a strong consumer preference and competitive pricing that overcome trade barriers.

- The UK government offers subsidies up to £3,750 ($5,062) for ‘green’ electric cars priced under £37,000 ($49,953), significantly lowering purchase costs and fueling market growth. Such incentives play a critical role in accelerating EV adoption and reducing carbon emissions.

- Europe’s current EV boom is more than a momentary spike; it signals a fundamental shift that reflects the continent’s ambitious climate goals and consumer preferences. The increase in affordable EV options combined with supportive policies encourages a move away from fossil fuel dependency, cutting greenhouse gas emissions and urban air pollution.

Europe’s current EV boom is more than a momentary spike; it signals a fundamental shift that reflects the continent’s ambitious climate goals and consumer preferences. The increase in affordable EV options combined with supportive policies encourages a move away from fossil fuel dependency, cutting greenhouse gas emissions and urban air pollution.

Rapid Expansion of Charging Networks Combats Range Anxiety

A significant factor contributing to consumer confidence is the increase in easy-to-access charging options. The fear of "range anxiety" (running out of charge too far from a charging point) is being eased by the increase in fast-charging stations around Europe, while the expansion of the existing infrastructure means that owning an EV will be more practical, enabling both EV adoption, particularly for drivers who are reliant on their vehicles for daily commutes and longer trips.

The increase in EV ownership is not limited to one sector of EV: manufacturers that produce budget options (such as Renault and Stellantis) are deploying vehicles into the market to meet emissions regulations, and to satisfy demand from cost-sensitive consumers - particularly in southern Europe. These low-cost EVs are making EV use more accessible, providing access to a cohort of consumers who may have been reluctant to act due to expense, or for groups that were unable to engage with the technology before entering this sector.

Shifting Market Composition Behind Europe’s Electric Vehicle Surge

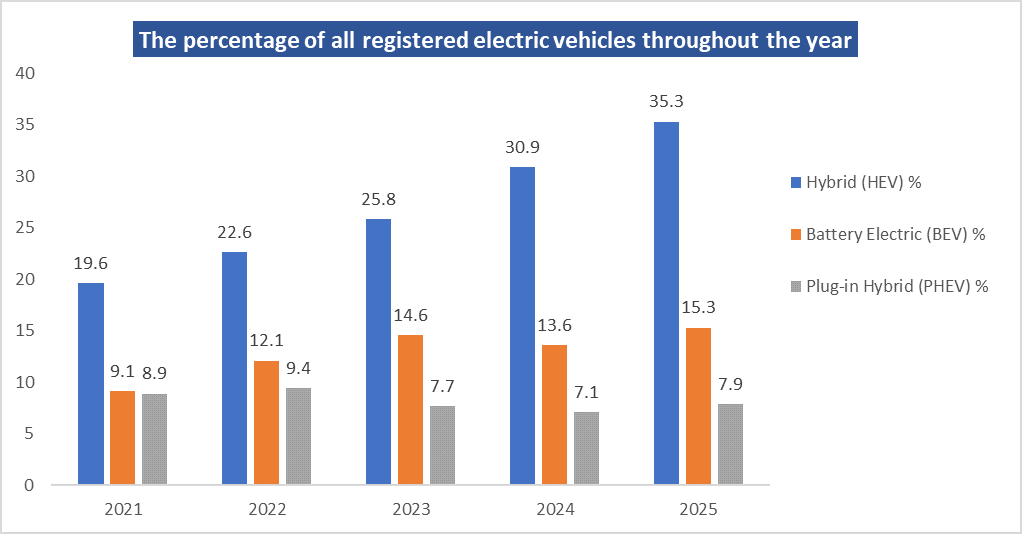

The recent surge in electric vehicle registrations across Europe is not only marked by a record number of battery electric vehicles but also reflects a shifting mix in market composition, as illustrated by the latest data on vehicle types. Between 2021 and 2025, hybrid electric vehicles (HEVs) have seen a remarkable rise in market share from 19.6% to 35.3%, signaling growing consumer confidence in hybrid models that balance electric efficiency with extended range. Meanwhile, battery electric vehicles (BEVs), which are at the core of Europe’s EV boom, steadily increased their share to 15.3% in 2025, driven by the affordability of new models and expanded charging infrastructure highlighted in the blog. Plug-in hybrid electric vehicles (PHEVs) continue to hold a consistent, though slightly fluctuating, position, serving as a crucial transitional technology for consumers navigating the shift to full electrification. This evolving EV landscape underscores the dynamic and multifaceted nature of Europe’s transition to cleaner, sustainable transport options.

Here is the EV market share data in Europe from 2021 to 2025, presented in a table format:

|

Year |

Hybrid (HEV) % |

Battery Electric (BEV) % |

Plug-in Hybrid (PHEV) % |

|---|---|---|---|

|

2021 |

19.6 |

9.1 |

8.9 |

|

2022 |

22.6 |

12.1 |

9.4 |

|

2023 |

25.8 |

14.6 |

7.7 |

|

2024 |

30.9 |

13.6 |

7.1 |

|

2025* |

35.3 |

15.3 |

7.9 |

This data shows a consistent increase in the share of Hybrid (HEV) vehicles, steady growth in Battery Electric Vehicles (BEV), and slight fluctuations in Plug-in Hybrid Electric Vehicles (PHEV). This trend highlights the rising preference for hybrid and full electric vehicles as Europe advances its sustainable transportation goals.

Conclusion

The second quarter of 2025 has seen Western Europe achieve its strongest quarter yet for EV adoption, with nearly 600,000 battery electric vehicles registered. This historic milestone is a testament to the successful convergence of affordable EV models, expanding charging networks, and robust government incentives. According to Spherical Insight, the Europe electric vehicle market is growing at a CAGR of 18.3% from 2022 to 2032, reflecting sustained and rapid expansion. The infusion of Chinese-made EVs into the European market despite tariffs adds an extra layer of dynamic competition, offering consumers greater choice. As EV technology continues to improve and infrastructure expands, this EV boom promises to accelerate, underpinning Europe’s broader transition to a cleaner, more sustainable transport future.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?