Europe Electric Vehicle (EV) Market Size, Share, and COVID-19 Impact Analysis, By Propulsion Type (BEV, FCEV, HEV), By Power Output (Less Than 100kW, 100 kW to 250 kW), By Vehicle Type (Passenger Vehicle, LCV, HCV, Two-wheeler, e-Scooters & Bikes), By End-Use (Private Use, Commercial Use, Industrial Use, Others), By Country (Germany, UK, France, Italy, Spain, Russia, Rest of Europe), and Europe Electric Vehicle (EV) Market Insights Forecasts to 2032

Industry: Automotive & TransportationEurope Electric Vehicle (EV) Market Insights Forecasts to 2032.

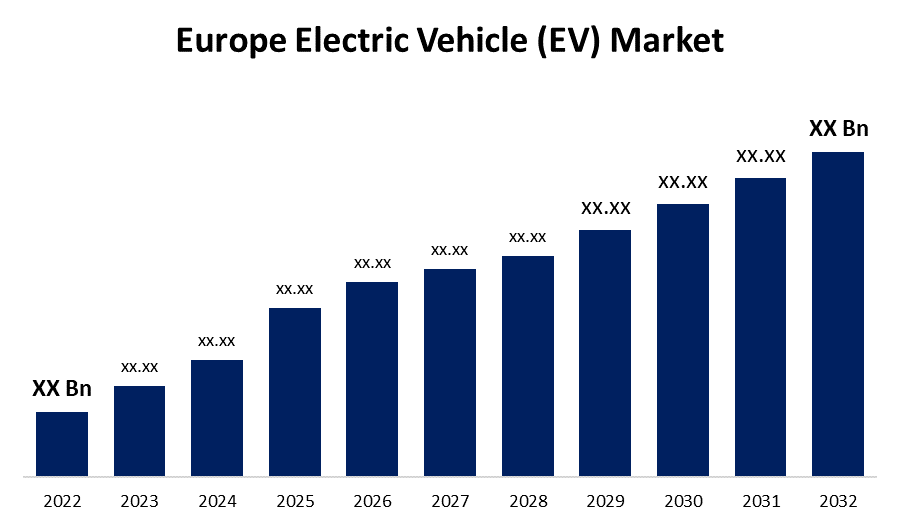

- The Europe Electric Vehicle (EV) Market Size was valued at USD XX Billion in 2022.

- The Market is Growing at a CAGR of 18.3% from 2022 to 2032.

- The Europe Electric Vehicle (EV) Market Size is expected to reach XX Billion by 2032.

- Germany is expected to Grow the fastest during the Forecast period.

Get more details on this report -

The Europe Electric Vehicle (EV) Market Size is expected to reach USD XX Billion by 2032, at a CAGR of 18.3% during the forecast period 2022 to 2032.

Market Overview

An electric vehicle operates on electricity unlike its counterpart, which runs on fuel (internal combustion engine-powered vehicles). Instead of internal combustion engines, these vehicles run on an electric motor that requires a constant supply of energy from batteries to operate. A variety of batteries, such as lithium-ion, molten salt, zinc-air, and various nickel-based designs, are used in these vehicles. An electric vehicle was specially designed for another choice to conventional ways of travel as they lead to environmental pollution. It has gained popularity, owing to numerous technological advancements. The European market for automotive electric vehicles is relatively consolidated and highly competitive, with manufacturers such as BMW Group, Daimler AG, and Volkswagen AG, among others, present. To deliver the greatest technology to electric vehicle customers, companies are launching new models and investing in R&D projects. Governments are also aggressively revising their laws in order to boost the use of electric vehicles.

Report Coverage

This research report categorizes the market for Europe Electric Vehicle (EV) Market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe Electric Vehicle (EV) Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe Electric Vehicle (EV) Market.

Europe Electric Vehicle (EV) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD XX Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 18.3% |

| 2032 Value Projection: | USD XX Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Propulsion Type, By Power Output, By Vehicle Type, By End-Use, By Country |

| Companies covered:: | AB Volvo, BMW Group, Daimler AG, Audi AG, General Motors Europe, Honda Motor Europe Limited, Nissan Automotive Europe, Mitsubishi Motors Europe and Other Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

An increase in demand for fuel-efficient, high-performance, and low-emission vehicles, as well as strict government rules and regulations on vehicle emissions, contribute to the growth of the European electric vehicle industry. Battery electric vehicles (BEVs) are gaining immense traction in the Europe electric vehicle industry, owing to advantages such as changing perceptions toward the adoption of electric vehicles. Developments carried out by different vehicle manufacturers related to electric vehicles driving the growth of the electric car market in Europe. Moreover, technological advancements and proactive government initiatives supports the growth of the Europe electric vehicle market during the forecast period.

Restraining Factors

A lack of standardization among countries could hamper charging station connections, restricting industry expansion. Using different charging standards makes synchronizing electric vehicle charging stations around the world difficult. As a result, the absence of standardization restricts market growth throughout the forecast period. Also, uncertainty in laws and regulations related to distributed energy generation are expected to restrain the market growth over the forecast period. Despite the growing interest in distributed energy production, there are no clear rules, policies, or regulatory bodies governing the impact of distributed generation integration into electric power systems.

Market Segment

- In 2022, the battery electric vehicle (BEV) segment accounted for the largest revenue share over the forecast period.

Based on propulsion type, the Europe electric vehicle (EV) market is segmented into battery electric vehicles (BEV), fuel cell electric vehicles (FCEV), and hybrid electric vehicles (HEV). Among these, the hybrid electric vehicle (HEV) segment has the largest revenue share over the forecast period. Stricter emissions limits and climate targets have caused governments to provide incentives and tax breaks for EV adoption, which has stimulated consumer interest. Further, improved charging infrastructure has reduced range anxiety, which has increased demand for hybrid electric vehicles.

- In 2022, the 100 kW to 250 kW segment is expected to hold the largest share of the Europe electric vehicle (EV) market during the forecast period.

Based on the power output, the Europe electric vehicle (EV) market is classified into less than 100kW, 100 kW to 250 kW. Among these, the 100 kW to 250 kW segment is expected to hold the largest share of the Europe electric vehicle (EV) market during the forecast period. The rapid expansion of this category can be due primarily to increased initiatives by key automotive OEMs to produce more powerful electric vehicles, rising rules for reducing tailpipe emissions, and rising adoption of electric vehicles in developed economies.

- In 2022, the passenger vehicle segment accounted for the largest revenue share over the forecast period.

Based on the vehicle type, the Europe electric vehicle (EV) market is segmented into passenger vehicles, LCVs, HCVs, two-wheelers, e-scooters & bikes. Among these, the passenger vehicle segment has the largest revenue share over the forecast period. Stringent emissions regulations and ambitious climate objectives have driven governments to provide attractive incentives, such as subsidies and tax breaks, to encourage people to purchase electric vehicles (EVs). Concerns regarding infrastructure and range anxiety have been addressed by expanding charging networks and advancements in battery range.

- In 2022, the commercial segment is expected to hold the largest share of the Europe electric vehicle (EV) market during the forecast period.

Based on the end-use, the Europe electric vehicle (EV) market is classified into private use, commercial use, and industrial use. Among these, the lithium-ion segment is expected to hold the largest share of the Europe electric vehicle (EV) market during the forecast period. The rapid growth of this segment can be attributed primarily to the increasing use of electric vehicles in shared mobility services and corporate taxi fleets, increased regulations to reduce fleet emissions, and encouragement by global and state-level regulatory bodies to implement policies promoting the adoption of electric vehicles for mobility services.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe electric vehicle (EV) market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AB Volvo

- BMW Group

- Daimler AG

- Audi AG

- General Motors Europe

- Honda Motor Europe Limited

- Nissan Automotive Europe

- Mitsubishi Motors Europe

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2023, Renault announced 20 billion in spending on electric vehicles and software by 2030. By 2025, the business plans on launching 30 new electric vehicles, including 10 new Renault models and 20 new Dacia and Alpine models.

- In November 2022, Feintool signed an agreement with a well-known European Original Equipment Manufacturer (OEM). The contract calls for the supply of stators and rotors used in the production of primary electric drives for electric vehicles. It has a lifetime volume in the hundreds of millions of Euros.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Europe Electric Vehicle (EV) Market based on the below-mentioned segments:

Europe Electric Vehicle (EV) Market, By Vehicle Type

- Passenger Vehicle

- LCV

- HCV

- Two-wheeler

- e-Scooters & Bikes

Europe Electric Vehicle (EV) Market, By Connectivity

- Battery Electric Vehicle (BEV)

- Fuel Cell Electric Vehicle (FCEV)

- hybrid electric vehicle (HEV)

Europe Electric Vehicle (EV) Market, By Power Output

- Less Than 100kW

- 100 kW to 250 kW

Europe Electric Vehicle (EV) Market, By End-Use

- Private use

- Commercial Use

- Industrial Use

- Others

Europe Electric Vehicle (EV) Market, By Country

- Germany

- UK

- France

- Italy

- Spain

- Russia

Need help to buy this report?