Global X-Ray Security Screening System Market Size, Share, and COVID-19 Impact Analysis, End-Use (Transit, Commercial, and Government), By Application (Product Screening and People Screening), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: Semiconductors & ElectronicsGlobal X-Ray Security Screening System Market Insights Forecasts to 2032

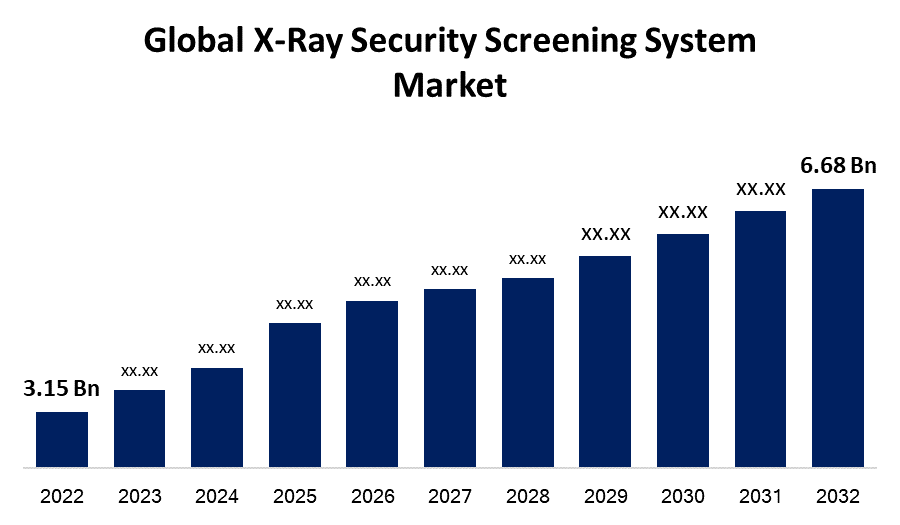

- The X-ray Security Screening System Market Size was valued at USD 3.15 Billion in 2022.

- The Market Size is Growing at a CAGR of 7.8% from 2022 to 2032

- The Worldwide X-ray security screening system market is expected to reach USD 6.68 Billion by 2032

- Asia-Pacific is Expected To Grow the fastest during the forecast period.

Get more details on this report -

The Global X-ray security screening system market is expected to reach USD 6.68 billion by 2032, at a CAGR of 7.8% during the forecast period 2022 to 2032.

Market Overview

X-ray security screening systems are essential tools used to enhance security measures in various settings, including airports, government buildings, and high-security facilities. These systems utilize X-ray technology to create detailed images of bags, packages, and other items, allowing security personnel to identify potential threats effectively. By analyzing the X-ray images, these systems can detect hidden weapons, explosives, and contraband items that may pose a danger to public safety. The technology behind X-ray security screening systems has evolved significantly, enabling faster and more accurate threat detection while minimizing false alarms. These systems play a vital role in preventing unauthorized items from entering secure areas, thereby safeguarding individuals and critical infrastructure. Moreover, they provide a non-intrusive and efficient screening process that maintains a balance between security requirements and passenger convenience.

Report Coverage

This research report categorizes the market for X-ray security screening system market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the X-ray security screening system market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the X-ray security screening system market.

Global X-Ray Security Screening System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 3.15 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.8% |

| 2032 Value Projection: | USD 6.68 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Application, By Region |

| Companies covered:: | • Thales • Smiths Detection • NEC Corporation • Teledyne FLIR LLC • Burker • Analogic Corporation • OSI Systems • Aware, Inc. • Kromek Group PLC • Astrophysics Inc. • Eurologix Security Holding Group • Gilardoni S.P.A. • Leidos Holdings, Inc. • Scanna MSC Ltd. • Tsinghua Tongfang Co., Ltd. • Vanderlande Industries B.V. • VJ Group, Inc. • Westminster International Ltd. • YXLON International GmbH |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The X-ray security screening system market is driven by several factors, including increasing security threats, rising demand for non-invasive and advanced screening technologies, and the growing need for enhanced public safety measures. Moreover, the surge in air passenger traffic and the consequent need for more advanced screening procedures at airports, coupled with the increasing adoption of digital X-ray technology, are driving the growth of the market. Additionally, the rise in cross-border trade and the need to prevent illegal trade of goods are further boosting the demand for X-ray security screening systems. The market is also driven by the increasing adoption of X-ray security screening systems in other sectors such as healthcare and manufacturing industries. Furthermore, the ongoing technological advancements and the increasing use of artificial intelligence and machine learning algorithms are expected to offer lucrative growth opportunities for the market in the near future.

Restraining Factors

The X-ray security screening system market faces certain restraints that impact its growth potential. One major restraint is the high cost associated with implementing and maintaining these systems, limiting their adoption, especially in smaller organizations or developing regions. Moreover, concerns regarding radiation exposure and privacy issues related to the detailed imaging of personal belongings can hinder market growth. Additionally, the presence of alternative screening technologies, such as millimeter-wave scanners and explosive trace detectors, poses a challenge to the widespread adoption of X-ray security screening systems. Furthermore, strict regulations and compliance standards imposed by regulatory bodies add to the operational challenges and costs for businesses, limiting market expansion.

Market Segmentation

- In 2022, the government segment accounted for around 47.3% market share

On the basis of end-use, the global X-ray security screening system market is segmented into transit, commercial, and government. The government segment is dominating with the largest market share in 2022. This is primarily due to the crucial role played by government entities in ensuring public safety and national security. Government organizations, including defense, transportation, and border control agencies, are responsible for implementing robust security measures to safeguard critical infrastructure and protect citizens. Governments worldwide have stringent regulations and compliance standards in place to prevent security breaches and the illegal transportation of goods. X-ray security screening systems offer an effective solution for detecting prohibited items, weapons, explosives, and contraband at airports, seaports, border checkpoints, and government buildings. Moreover, governments have substantial budgets allocated for defense and security purposes, enabling them to invest in advanced technologies like X-ray security screening systems. These systems provide real-time imaging, threat detection algorithms, and enhanced capabilities, aligning with the government's focus on leveraging cutting-edge solutions to combat evolving security threats. The government's commitment to public safety, coupled with its purchasing power and regulatory influence, positions it as a key driver in the adoption and growth of the X-ray security screening system market.

- In 2022, the product screening segment dominated with more than 65.7% market share

Based on the type of application, the global X-ray security screening system market is segmented into product screening and people screening. Out of this, the product screening segment is dominating the market with the largest market share in 2022. This is primarily due to the wide range of applications and industries where product screening is crucial for safety and compliance. X-ray security screening systems are extensively used for inspecting and analyzing the contents of bags, packages, luggage, and cargo. These systems play a vital role in detecting prohibited items, weapons, explosives, and contraband across various sectors, including transportation, logistics, manufacturing, and healthcare. The ability to generate detailed images and provide real-time threat detection makes product screening with X-ray systems highly effective and efficient. Moreover, the increasing need for enhanced security in airports, customs, and logistics facilities, as well as the rise in cross-border trade, further drives the demand for product screening systems, contributing to their dominant market share.

Regional Segment Analysis of the X-Ray Security Screening System Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

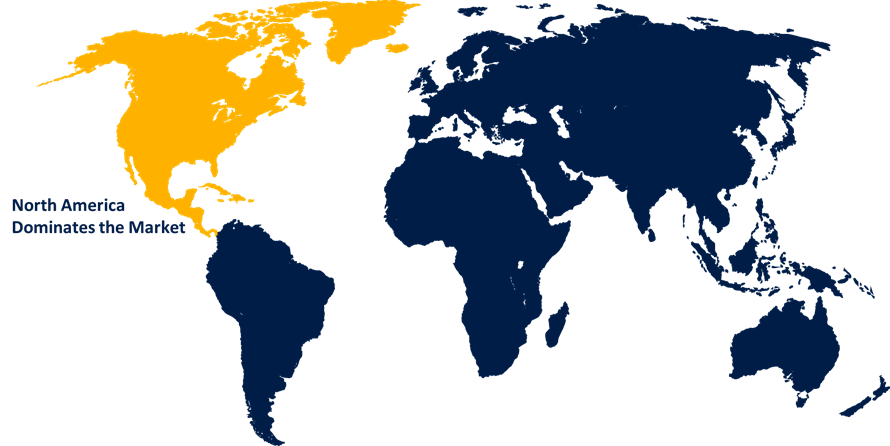

North America dominated the market with more than 36.5% revenue share in 2022.

Get more details on this report -

Based on region, North America is the largest market for X-ray security screening systems, accounting for a significant share of the global market. The region's dominance is primarily attributed to the high adoption rate of advanced security screening technologies, stringent government regulations, and a significant presence of key market players. Moreover, the region's large transportation industry, including airports, seaports, and border crossings, drives the demand for X-ray security screening systems to ensure public safety. Additionally, the region's high spending on defense and security infrastructure further fuels the market growth. Furthermore, the growing focus on enhancing healthcare infrastructure and the increasing demand for non-invasive diagnostic procedures using digital X-ray systems contribute to the market's expansion. The presence of leading technology innovators and a high rate of technological advancements in the region are expected to drive market growth further.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global X-ray security screening system market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Thales

- Smiths Detection

- NEC Corporation

- Teledyne FLIR LLC

- Burker

- Analogic Corporation

- OSI Systems

- Aware, Inc.

- Kromek Group PLC

- Astrophysics Inc.

- Eurologix Security Holding Group

- Gilardoni S.P.A.

- Leidos Holdings, Inc.

- Scanna MSC Ltd.

- Tsinghua Tongfang Co., Ltd.

- Vanderlande Industries B.V.

- VJ Group, Inc.

- Westminster International Ltd.

- YXLON International GmbH

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2022, The Bureau of Civil Aviation Security (BACS) has released technical guidelines for Indian airports, requiring them to adopt advanced screening equipment that can scan bags without necessitating the removal of electronic devices. This can be achieved through the use of advanced technologies, such as neutron beam technology and computed tomography, which enable security agencies to effectively detect potential threats while avoiding the need for passengers to remove their electronic devices

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global X-ray security screening system market based on the below-mentioned segments:

X-Ray Security Screening System Market, By End-Use

- Transit

- Commercial

- Government

X-Ray Security Screening System Market, By Application

- Product Screening

- People Screening

X-Ray Security Screening System Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africal.

Need help to buy this report?