Global Wood Bio-Products Market Size By Type (Finished Wood Product, Manufactured Wood Material), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2032

Industry: Advanced MaterialsGlobal Wood Bio-Products Market Insights Forecasts to 2032

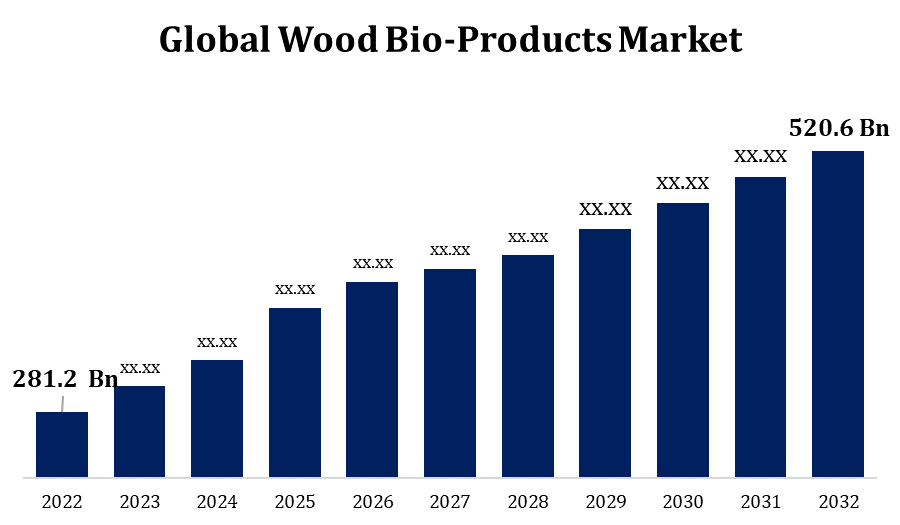

- The Wood Bio-Products Market Size was valued at USD 281.2 Billion in 2022.

- The Market Size is Growing at a CAGR of 9.4% from 2022 to 2032

- The Global Wood Bio-Products Market Size is expected to reach USD 520.6 Billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Wood Bio-Products Market Size is expected to reach USD 520.6 Billion by 2032, at a CAGR of 9.4% during the forecast period 2022 to 2032.

The market for wood bio-products is an intriguing sector where traditional materials meet modern innovation. It includes a wide range of wood-derived items that go beyond traditional applications such as construction and furniture. Consider biomaterials, biochemicals, and even biofuels. The transition to more environmentally friendly practises has spurred the expansion of this market, with wood serving as a renewable resource. Wood-based biofuels, bioplastics, and biochemicals are gaining popularity. They provide environmentally friendly alternatives to their traditional counterparts, which are frequently sourced from fossil fuels. Environmental concerns, technical improvements, and a shift towards sustainable practises are driving the growth of the wood bio-products market. As people become more aware of the environmental impact of established businesses, there is a growing need for eco-friendly alternatives, and wood bio-products suit the bill.

Wood Bio-Products Market Value Chain Analysis

The process starts with the sustainable collection of forest timber. Sustainable forestry practises ensure responsible forest management and ecological balance. Wood is harvested and processed to extract key components such as cellulose, lignin, and hemicellulose. To break down wood into its basic elements, advanced technologies such as enzymatic or chemical procedures are used. Extracted components are used to make intermediate goods such as wood-based chemicals, biofuels, and bioplastics. This stage includes a variety of production techniques that are adapted to the individual end product. Companies concentrate on creating a diverse range of finished products using wood-derived materials. Transportation of raw materials, intermediary products, and finished goods to various sites. Logistics efficiency is critical for reducing environmental impact.

Wood Bio-Products Market Opportunity Analysis

The global shift towards sustainability and environmental consciousness raises the demand for wood bio-products significantly. Construction, packaging, and manufacturing industries that seek eco-friendly options contribute to market growth. Technological advancements enable the creation of novel wood-derived biochemicals and bioplastics. These bio-based materials provide a renewable and biodegradable alternative to petrochemical-based products. Because of the emphasis on renewable energy sources, wood bio-products such as biofuels and biomass are seen as feasible options. The generation of bioenergy from wood waste contributes to the move to cleaner, more sustainable energy sources. The wood bio-products industry adheres to circular economy concepts, emphasising recycling and responsible waste management. Wood bio-products' adaptability allows them to be used in a variety of industries, including construction, automotive, textiles, and others.

Global Wood Bio-Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 281.2 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 9.4% |

| 2032 Value Projection: | USD 520.6 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Distribution Channel and By Region |

| Companies covered:: | Weyerhaeuser, Stora Enso, UFP Industries, Metsä Group, UPM-Kymmene Corporation, Lixil Group, West Fraser Timber, Sappi, Canfor Corporation, JELD-WEN, Celulosa Araucoy Constitución, Louisiana-Pacific Corporation, and Others. |

| Growth Drivers: | Increased environmental concerns in Wood Bio-Products Market growth |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Wood Bio-Products Market Dynamics

Increased environmental concerns in Wood Bio-Products Market growth

Wood bio-products, such as biofuels and bioplastics, offer a solution to minimise carbon emissions when compared to typical fossil fuel-based alternatives. Companies and industries wanting to reduce their carbon footprint encourage the adoption of these environmentally friendly alternatives. Wood bio-products adhere to circular economy concepts by emphasising recycling and waste reduction. Consumers and businesses are increasingly interested in items with little environmental impact, which is driving the market forward. Growing consumer understanding of environmental issues influences shopping decisions. Products with eco-friendly labels, particularly those made from renewable wood resources, find growing demand, contributing to market expansion. The demand for sustainable energy sources favours wood bio-products, particularly biomass and bioenergy. By providing alternatives, the wood bio-products sector contributes to climate change mitigation.

Restraints & Challenges

Bio-products derived from wood frequently compete with well-established traditional materials. It is difficult to overcome engrained industry practises and views. It is critical to balance the demand for wood supplies with the necessity for sustainable forestry practises. Concerns about deforestation can occur if not managed correctly. Complex methods are required for the extraction and processing of wood components into bio-based products. It might be difficult to develop and apply these processes in an efficient manner. When compared to traditional materials, wood bio-products may encounter economic issues, particularly if production techniques are not optimised for efficiency. The infrastructure required for large-scale production of wood bio-products necessitates significant investment. Obtaining funds and overcoming financial obstacles can be difficult. Managing the end-of-life phase of wood bio-products, which includes recycling and disposal, poses difficulties. It is critical to have a fully sustainable lifespan.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Wood Bio-Products Market from 2023 to 2032. Consumers and industries in North America are increasingly emphasising sustainability, which is fueling demand for wood bio-products. North America is aggressively looking at bioenergy solutions, such as the use of wood bio-products for renewable energy. This is consistent with the region's pledge to reduce dependency on fossil fuels. North American customers are becoming more conscious of the environmental impact of their purchasing decisions. The desire for environmentally friendly products fuels the expansion of the wood bio-products market. The emphasis on circular economy principles, such as recycling and proper waste management, fits with the goals of the North American wood bio-products sector. Wood bio-products are being used in a variety of industries in North America, including construction, packaging, textiles, and automotive, which is fueling market growth.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. Many Asia Pacific countries' rapid population growth and economic expansion lead to rising demand for wood bio-products in construction, packaging, and other industries. Concerns about energy security and environmental sustainability are driving interest in wood bio-products for bioenergy in Asia Pacific countries. Increasing environmental consciousness among Asia Pacific consumers and companies is boosting demand for eco-friendly alternatives, such as wood bio-products. Many Asia Pacific countries' continuing infrastructure development provides opportunity for the inclusion of wood bio-products in construction and other initiatives. Wood has cultural significance in many Asia Pacific countries, influencing the use of wood-based materials in a variety of applications.

Segmentation Analysis

Insights by Type

Finished wood product segment accounted for the largest market share over the forecast period 2023 to 2032. Green building certification requirements, such as LEED (Leadership in Energy and Environmental Design), are increasing, encouraging the use of sustainable resources, including finished wood products. Technological advancements in wood processing have resulted in the development of innovative finished wood products with improved qualities, which has contributed to market growth. Finished wood products provide a natural and visually beautiful alternative, which is why they are so popular in interior design, furniture, and architectural applications. Consumers are increasingly looking for environmentally friendly and sustainable furniture solutions. This demand is met by finished wood goods, which are in line with changing consumer preferences. Wood-based fibres are utilised in the manufacture of bio-based textiles, which contributes to the expansion of the finished wood product segment in the apparel and textile industry.

Insights by Distribution Channel

Offline segment accounted for the largest market share over the forecast period 2023 to 2032. Traditional distribution channels, such as physical retail stores, distributors, and dealers, are frequently used in the wood bio-products industry. The development of these offline channels is affected by the industry's established partnerships and networks. Participation in trade shows, exhibits, and industry events is still essential for networking, exhibiting products, and cultivating commercial relationships. Face-to-face interactions and exposure gained through such events benefit the offline segment. Local retail shops and specialised stores are important in the distribution of wood bio-products, particularly in areas where traditional retail is prevalent. These offline methods are frequently used for consumer education and product awareness. Offline channels are essential for product presentations and sample distribution to potential clients, allowing them to experience the quality of wood bio-products.

Recent Market Developments

- In April 2023, the Weyerhaeuser Company and American Forests, the country's oldest national nonprofit conservation organisation, recently announced a new partnership on a creative project to expand American Forests' Tree Equity programme into smaller, more rural communities while providing environmental education centred on careers in urban and community forestry to hundreds of young people.

Competitive Landscape

Major players in the market

- Weyerhaeuser

- Stora Enso

- UFP Industries

- Metsä Group

- UPM-Kymmene Corporation

- Lixil Group

- West Fraser Timber

- Sappi

- Canfor Corporation

- JELD-WEN

- Celulosa Araucoy Constitución

- Louisiana-Pacific Corporation

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Wood Bio-Products Market, Type Analysis

- Finished Wood Product

- Manufactured Wood Material

Wood Bio-Products Market, Distribution Channel Analysis

- Online

- Offline

Wood Bio-Products Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Need help to buy this report?