Global Virtual Warehousing Market Size, Share, and COVID-19 Impact Analysis, By Deployment (Cloud, On-premises), By End User (Transportation & Logistics, Retail & E-Commerce, Manufacturing, Healthcare, Energy & Utilities, Automotive, Food & Beverages, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Information & TechnologyGlobal Virtual Warehousing Market Insights Forecasts to 2033

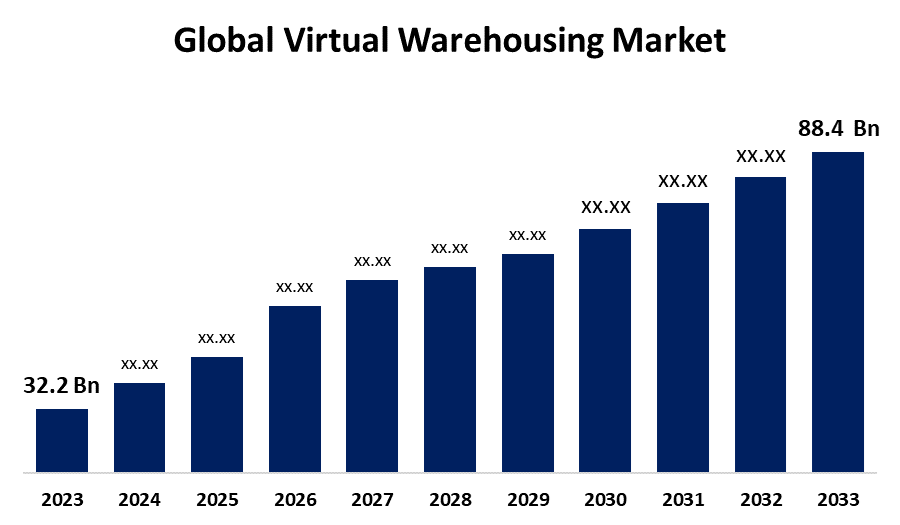

- The Global Virtual Warehousing Market Size was Valued at USD 32.2 Billion in 2023

- The Market Size is Growing at a CAGR of 10.63% from 2023 to 2033

- The Worldwide Virtual Warehousing Market Size is Expected to Reach USD 88.4 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Virtual Warehousing Market Size is Anticipated to Exceed USD 88.4 Billion by 2033, Growing at a CAGR of 10.63% from 2023 to 2033.

Market Overview

A virtual warehouse, often known as a digital or cloud-based warehouse, is a concept that challenges traditional inventory storage and administration methods. A virtual warehouse functions in the digital sphere as opposed to a physical warehouse, which needs staff, infrastructure, and physical space. It stores and manages inventory data by utilizing cloud-based systems, sophisticated software, and data analytics. A state of real-time worldwide visibility for logistical assets, including cars and merchandise, is referred to as a virtual warehouse. In a nutshell, it's software that offers a thorough view of materials and assets for fulfilment and logistical needs. This makes it possible to store merchandise anywhere across the world and distribute it as needed. Utilizing virtual warehouse systems to "reserve" inventory units for a certain usage is another common practice. To take advantage of virtual warehousing to boost business growth, businesses need technology and software that can gather, analyses, and share information throughout. The virtual warehouse's algorithm level will advance from its functional level. This, along with its algorithmic approach, allows the virtual warehouse to filter and process data in a way that helps business leaders make the best operational decisions.

Report Coverage

This research report categorizes the market for the global virtual warehousing market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global virtual warehousing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global virtual warehousing market.

Virtual Warehousing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 32.2 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.63% |

| 2033 Value Projection: | USD 88.4 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Deployment, By End User, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Flowspace, Connect 4.0, Fieldmade, INDUTRAX, Stockarea, Others, and other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Virtual warehouses are incredibly flexible and scalable. Companies can quickly modify their inventory management and storage systems to accommodate seasonal or varying demand. Because there are no physical restrictions, storage capacity can easily grow or shrink in response to changing business needs, guaranteeing efficient resource use and smooth operation. In addition, via a virtual warehouse, cooperation within the supply chain ecosystem is improved. Suppliers, distributors, and other stakeholders can communicate and share information more easily through to cloud-based platforms and digital tools. Better demand forecasting, more effective order fulfilment, and more efficient inventory restocking are made possible by this real-time collaboration, which raises customer happiness.

Restraining Factors

Maintaining a virtual warehouse requires a certain degree of technological know-how. For employees to make the most of the virtual warehouse's possibilities, they must receive training in digital tools, data analysis, and inventory management systems. It is important to guarantee a proficient labour force and offer continuous education and assistance to overcome that challenge.

Market Segmentation

The global virtual warehousing market share is classified into deployment and end user.

- The cloud segment is expected to hold the largest share of the global virtual warehousing market during the forecast period.

Based on the deployment, the global virtual warehousing market is categorized into cloud and on-premises. Among these, the cloud segment is expected to hold the largest share of the global virtual warehousing market during the forecast period. Cloud solutions allow organizations to quickly integrate innovative virtual warehouse technology, resulting in a faster return on investment. Without requiring human interaction, cloud services' automatic updates and maintenance provide access to the newest features and improved security. Cloud platforms' integration capabilities facilitate an interconnected virtual warehousing environment, enabling enterprises to take advantage of a wide range of instruments and technologies. By facilitating effective data analytics and insights, cloud solutions enable businesses to make well-informed decisions.

- The transportation & logistics segment is expected to grow at the fastest CAGR during the forecast period.

Based on the end user, the global virtual warehousing market is categorized into transportation & logistics, retail & e-commerce, manufacturing, healthcare, energy & utilities, automotive, food & beverages, and others. Among these, the transportation & logistics segment is expected to grow at the fastest CAGR during the forecast period. To improve operational efficiency and satisfy the expectations of a market that is changing quickly, the transportation and logistics sector is implementing virtual warehousing. Implementing real-time tracking solutions and IoT-enabled devices allows for exact cargo tracking, ensuring timely deliveries and minimizing disruptions. Furthermore, the integration of automation technologies such as conveyor systems, autonomous mobile robots (AMRs), and guided vehicles (AGVs) is revolutionizing warehouse operations and enabling the transportation and logistics sectors to fulfil orders more quickly and accurately.

Regional Segment Analysis of the Global Virtual Warehousing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is projected to hold the largest share of the global virtual warehousing market over the forecast period.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the global virtual warehousing market over the forecast period. Increasing technological developments and investments in a variety of industries. In the Asia-Pacific area, manufacturing, retail, and e-commerce are the next largest industry verticals after BFSI. Lower operating expenses and increased productivity have emerged as top concerns for local manufacturers as a result of global competition; these issues must be resolved right away if they are to remain competitive in the market. Businesses in this area are still concentrating on enhancing customer service as a means of gaining a competitive edge and increasing sales. This is compelling businesses to investigate hosted and cloud-based substitutes for virtual warehouse solutions that are built on-premises. The top three nations in the region for data warehouse service adoption are China, Japan, Australia, and New Zealand (ANZ).

North America is expected to grow at the fastest CAGR growth of the global virtual warehousing market during the forecast period. As the need for automated warehouse cycles to boost efficiency, accuracy, and production grows, virtual warehousing technologies, solutions, and services are anticipated to become more popular in this field. More labour capacity and more adaptability are made possible by virtual warehouse systems.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global virtual warehousing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Flowspace

- Connect 4.0

- Fieldmade

- INDUTRAX

- Stockarea

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global virtual warehousing market based on the below-mentioned segments:

Global Virtual Warehousing Market, By Deployment

- Cloud

- On-premises

Global Virtual Warehousing Market, By End User

- Transportation & Logistics

- Retail & E-Commerce

- Manufacturing

- Healthcare

- Energy & Utilities

- Automotive

- Food & Beverages

- Others

Global Virtual Warehousing Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?