Global Variable Valve Timing Market Size, Share, and COVID-19 Impact Analysis, By Phaser Type (Hydraulic Cam Phaser, Electric Cam Phaser), By Technology (Cam-Phasing, Cam-Phasing & Changing), By Vehicle Type (Passenger Vehicle, Commercial Vehicle) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030

Industry: Automotive & TransportationGlobal Variable Valve Timing Market Insights Forecasts to 2030

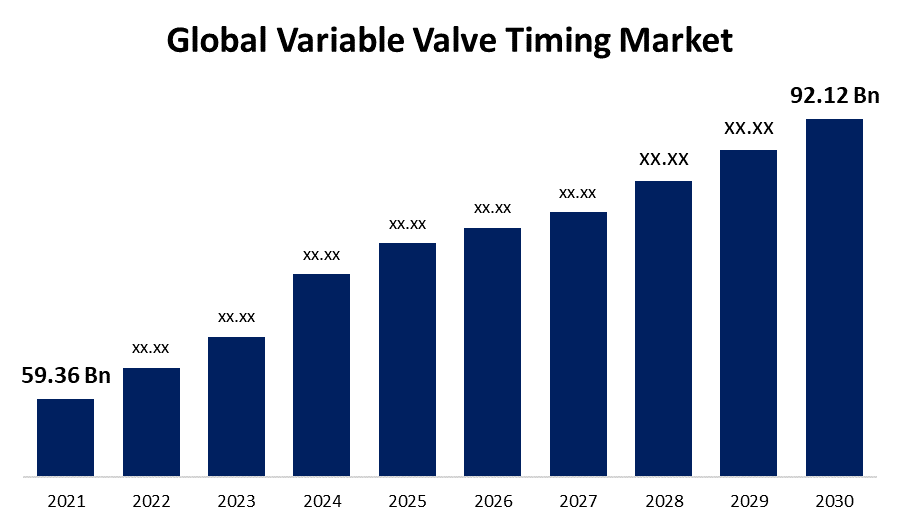

- The Global Variable Valve Timing Market Size was valued at USD 59.36 Billion in 2021

- The Global Variable Valve Timing Market Share is growing at a CAGR of 6.49% from 2022 to 2030

- The Worldwide Variable Valve Timing Market Size is expected to reach USD 92.12 Billion by 2030

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Variable Valve Timing Market Size is expected to reach USD 92.12 billion by 2030, at a CAGR of 6.49% during the forecast period 2022 to 2030. The rising adoption of passenger and commercial vehicles is increasing vehicular emissions around the world, making it a serious concern to produce automobiles with efficient fuel systems. The increasing hybridization of new vehicles, demands to improve fuel efficiency and vehicle performance, and rigorous emission requirements in both developed and emerging countries are some of the primary drivers driving the variable valve timing market expansion. The COVID-19 pandemic had a significant impact on manufacturing activities around the world. Since supply chain operations are disrupted, it has impacted variable valve timing system manufacturing and consumer demand, adversely affecting the market during the pandemic.

Market Overview

Variable valve timing or VVT, which alters the timing of a valve lift event in internal combustion engines, is frequently applied to enhance performance, fuel economy, or carbon emission. Many vehicle Manufactures are employing VVT systems due to increasingly stringent emissions restrictions. Variable valve timing was used on early steam locomotives with variable cutoff to regulate the moment at which steam admission to the cylinders is cut off while performing the power stroke. They were frequently employed in stationary locomotives with constant speed variable loading, with admission cutoff and hence torque mechanically regulated by a centrifugal governor and trip valves. The Cadillac Runabout and Tonneau used variable valve timing for the first time in the 1903s, while Kawasaki used variable valve timing for the first time in a motorbike engine with the 2007 Kawasaki 1400GTR/Concours 14.

Report Coverage

This research report categorizes the market for Global Variable Valve Timing Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Global Variable Valve Timing Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Global Variable Valve Timing Market.

Global Variable Valve Timing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 59.36 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 6.49% |

| 2030 Value Projection: | USD 92.12 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Phaser Type, By Technology, By Vehicle Type, By Region, And COVID-19 Impact Analysis |

| Companies covered:: | Mitsubishi Electric Corporation, Hilite International, Camcraft, DENSO CORPORATION, Hitachi Ltd., Sumitomo Electric Industries, Ltd., Toyota Motor Corporation, BorgWarner Inc., Schaeffler Technologies AG & Co. KG, Eaton Corporation PLC, Maruti Suzuki, Maxwell Ultracapacitors, Perodua, Aisin Seiki Co. Ltd., Husco International, Delphi Auto Parts, Metaldyne Sintered Products, Johnson Electric, Valeo S.A., Honda Motor Co., Ltd., Continental AG, Mikuni American Corporation |

| Pitfalls & Challenges: | Covid-19 Impact Analysis |

Get more details on this report -

Driving Factors

The rising market demand for fuel-efficient vehicles, which is expected to drive the market significantly throughout the forecasted period, is supporting the market growth significantly. The development of advanced technology such as cam phasing is expected to escalate the hybridization of the vehicles, which is also anticipated to witness significant growth in the market. The manufacturers are majorly focusing on advancing new engine technology that could enhance capabilities beneficial to fulfil the carbon emission restriction and renewable efforts.

The variable valve timing system is utilized to mainly decrease the vehicle's overall carbon output. As such, the demand for multi-valve timing is rising rapidly to augment the total efficiency of the vehicle and fuel consumption. Automotive original equipment manufacturers and engine manufacturers are utilizing multi-valve timing in their VVT systems, which could drive the production of the overall variable valve timing market globally.

Restraining Factors

The rising popularity and increasing adoption of electric vehicles, especially for passenger cars, due to the growing environmental concerns of vehicular emission and rising fuel prices used by traditional vehicles, which has been a major problem for government officials. As result, this is expected to restrain the IC engine automotive market which uses variable valve timing systems in their vehicles. In addition, higher maintenance cost is also a major challenge encountered by the users of VVT, since the after-market supply variable valve timing systems are limited.

Market Segmentation

- In 2021, the hydraulic cam phaser segment dominated the market with the largest share over the forecast period

Based on phaser type, the Global Variable Valve Timing Market is segmented into hydraulic cam phaser and electric cam phaser. Among them, the hydraulic cam phaser segment dominated the market with the largest share over the forecast period. The hydraulic cam phaser is among the most widely utilized phaser types. Modern engines are designed to be highly efficient to reduce fuel consumption. While being reliable and having a history of success in numerous applications, the hydraulic cam phaser technology scurries into its technological constraints.

The electric cam phaser type segment, on the other hand, is expected to increase rapidly during the projection period. Furthermore, electric cam phaser techniques provide faster phasing than hydraulic cam phaser systems. Due to the adoption of rigorous pollution standards to improve vehicle fuel efficiency is projected to increase global demand for hybrid automobiles. Increased investment in hybrid automobiles around the world is expected to boost demand for electric cam phasers during the projected period.

- In 2021, the cam-phasing segment is witnessing significant CAGR growth over the forecast period

On the basis of technology, the Global Variable Valve Timing Market is segmented into cam-phasing and cam-phasing & changing. Among these, the cam-phasing segment is expected to grow at a significant CAGR during the forecast period. The application has a significant impact on the increasing use of cam-phasing VVT technologies in passenger vehicles. In addition, as variable valve timing technologies, the cam phasing approach is widely used in the automotive sector. The cam-phasing variable valve timing is the most popular, least expensive and most widely utilized technique. The reduced price of cam-phasing VVT systems than other types is also a main reason for their popularity in the Asia-Pacific region as well.

- In 2021, the passenger vehicles segment is dominating the market with the largest market share of 53% over the forecast period

Based on vehicle type, the Global Variable Valve Timing Market is segmented into passenger vehicles and commercial vehicles. Among these, the passenger vehicles segment dominates the market with the largest market share of 53% over the forecast period owing to the rapid adoption of variable valve timing to be faster in passenger vehicles than in LCVs and HCVs. Increasing purchasing power in developing nations is also a major contributor to the expansion of the passenger vehicle market. As a result of the intense competition in the high-end car market, luxury OEMS car manufacturers such as Audi, BMW, Mercedes Benz, and others have intensified their emphasis on fuel efficiency and cutting-edge innovations offered by electric cam phasers.

Regional Segment Analysis of the Global Variable Valve Timing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is dominating the market with the largest market share of 54%.

Get more details on this report -

Asia Pacific is expected to remain the industry's leading region during the forecast period, with a 54% market share, owing to the increasing automotive production in Japan, China, and India. Increasing consumer interest in sophisticated vehicle technology, as well as increased sales of passengers and commercial cars in the region, are likely to fuel market demand. Additionally, soaring gasoline and fuel costs are likely to increase the requirement for the fuel-efficient internal combustion engine, driving the expansion of variable valve timing technologies. Major companies in the automotive industry are investing heavily in research and development in order to provide OEMs with solutions that improve engine performance and fuel efficiency.

India is expanding rapidly as a result of a growing demand for diesel-powered vehicles that have resulted in a significant market for variable valve timing systems for diesel engines in the nation. For instance, in February 2021, Maruti Suzuki launched the all-new Swift 2021, engineered to further excite the customer with an advanced powertrain, appealing dual-tone exterior, and new exciting features. It is equipped with ‘The Next Gen K-Series Dual Jet Dual VVT engine with Idle Start Stop (ISS) technology. The Dual Jet technology (2 injectors per cylinder), coupled with Dual VVT (variable valve timing) and EGR system results in higher fuel efficiency with lower emissions. This leads to the fuel efficiency of 23.20 km/l in MT and 23.76 km/l in AGS (Automatic Gear Shift) variants. The engine also offers an increased power output of 66 KW at 6,000 rpm.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Global Variable Valve Timing Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Market Top Players

- Mitsubishi Electric Corporation

- Hilite International

- Camcraft

- DENSO CORPORATION

- Hitachi Ltd.

- Sumitomo Electric Industries, Ltd.

- Toyota Motor Corporation

- BorgWarner Inc.

- Schaeffler Technologies AG & Co. KG

- Eaton Corporation PLC

- Maruti Suzuki

- Maxwell Ultracapacitors

- Perodua

- Aisin Seiki Co. Ltd.

- Husco International

- Delphi Auto Parts

- Metaldyne Sintered Products

- Johnson Electric

- Valeo S.A.

- Honda Motor Co., Ltd.

- Continental AG

- Mikuni American Corporation

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2022, Toyota announced the launch of the 2023 Highlander receiving a new, higher-torque, high-efficiency turbocharged engine. The 2023 Highlander Hybrid, offered in both FWD and AWD, combines a high-efficiency 2.5-liter DOHC four-cylinder engine with two electric motor-generators. The gas engine employs a Variable Valve Timing-intelligent system by an Electric motor (VVT-iE) on the intake camshaft, and VVT-i on the exhaust camshaft.

- In October 2020, Hilite International, a global producer of automotive components and systems, announced a USD 9.6 million investment in Whitehall, Michigan, with help from the Michigan Strategic Fund. Hilite International, a global provider focused on the development and production of components an aimed at decreasing fuel consumption and exhaust gases, as well as future technologies like as e-mobility and thermal management, is a market leader in variable valve timing and transmission valves.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the Global Variable Valve Timing Market based on the below mentioned segments:

Global Variable Valve Timing Market, By Phaser Type

- Hydraulic Cam Phaser

- Electric Cam Phaser

Global Variable Valve Timing Market, By Technology

- Cam-Phasing

- Cam-Phasing & Changing

Global Variable Valve Timing Market, By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

Global Variable Valve Timing Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?