United States Used Car Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Hybrid, Conventional, Electric), By Fuel Type (Diesel, Petrol, Others), By Sales Channel (Offline, Online), and United States Used Car Market Insights Forecasts 2022 – 2032

Industry: Automotive & TransportationUnited States Used Car Market Insights Forecasts to 2032

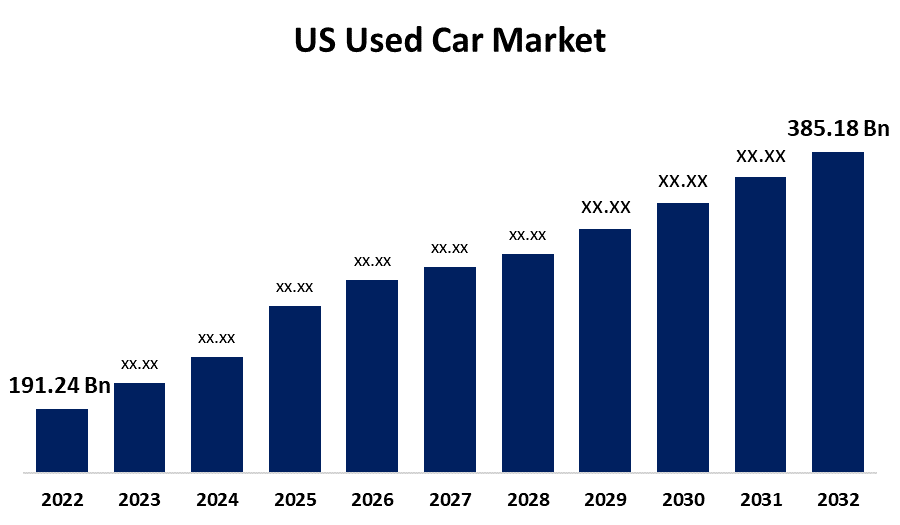

- The United States Used Car Market Size was valued at USD 191.24 Billion in 2022.

- The Market is Growing at a CAGR of 7.25% from 2022 to 2032.

- The United States Used Car Market Size is Expected to reach USD 385.18 Billion by 2032.

Get more details on this report -

The United States Used Car Market Size is expected to reach USD 385.18 Billion by 2032, at a CAGR of 7.25% during the forecast period 2022 to 2032.

The demand for the used car market due to the increasing number of online platforms for used car sales in the United States, and the high price of new cars, worries about affordability factors are contributing to the expansion of the used car market.

Market Overview

A used car is a vehicle that has been driven previously but is still in good working order for resale. Consumers are becoming more aware of the vehicle, the value of its remaining third-party margin, and other factors as a result of internet booking. The combination of such trends resulted in a significant increase in demand for used vehicles in the U.S. Used cars are sold through a variety of outlets, including franchise and independent car dealers, rental automobile businesses, auctions, private party sales, and leasing offices. Several variables, including the exceptional value for money offered by used cars, the shorter car ownership cycle, and the rising level of technological advancements in passenger cars, influence the market's growth in the United States. Furthermore, factors such as the high cost of new vehicles, affordability concerns, an increase in demand for off-lease vehicles, and subscription service by franchises, leasing offices, and car dealers have been observed to boost the growth of the used vehicle market. Moreover, the introduction of automotive e-commerce and online technologies, a steady increase in organized/semi-organized sales in emerging U.S., an increase in electric vehicle business globally, and demand for car-sharing services are expected to provide lucrative opportunities for the growth of the used vehicle market growth in the United States.

Report Coverage

This research report categorizes the market for the U.S. used car market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. used car market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the U.S. used car market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. used car market.

United States Used Car Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 191.24 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.25% |

| 2032 Value Projection: | USD 385.18 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Vehicle Type, By Fuel Type, By Sales |

| Companies covered:: | TrueCar, CarGurus, Manheim, Greater Rockford Auction Group, ServNet, Copart Inc., McConkey Auction, KAR Auction Services, ACV Auctions, Auto Auction Mall, Major Online E-Commerce Platform, CarMax, Carvana, Vroom, Shift Technologies and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The inability of customers to purchase new cars became one of the reasons for the increasing used car sales volume, which is complemented by investments made by companies in the sector to establish their dealership networks in the market. These dealership networks aided market participants in branding and making used car options a viable option. Furthermore, E-commerce companies have used digital transformation to expand their presence in their respective markets. E-commerce allows companies to break down geographic barriers and sell in places that are difficult to reach with traditional models, leading to used car market players around the world shifting their focus to online sales channels. Because of all of these factors, the expansion of internet-based sales is expected to drive demand for used cars during the estimated period in the US. In addition, the United States will be boosted by more convenient methods of swapping vehicles with other well-maintained vehicles via an online website.

Restraining Factors

The increased market competition and the threat of new entrants are factors that hamper the growth of the used vehicle dealership business.

Market Segment

• In 2022, the conventional segment accounted for the largest revenue share over the forecast period.

Based on the vehicle type, the United States used car market is segmented into hybrid, conventional, and electric. Among these, the conventional segment has the largest revenue share over the forecast period. Growing concerns about climate change and pollution have created a high demand for an alternative to conventional vehicles. As a result, the market has experienced significant growth, fueled by electric used cars. Conventional petrol vehicles with a large inventory provide a variety of options at a reasonable price.

• In 2022, the petrol segment is expected to hold the largest share of the United States used car market during the forecast period.

Based on the fuel type, the United States used car market is classified into diesel, petrol, and others. Among these, the petrol segment is expected to hold the largest share of the U.S. used car market during the forecast period. Petrol engines generate fewer polluting particles. As a result, they are less harmful to the environment. Petrol cars are more affordable to purchase than diesel vehicles. With taxes, new diesel vehicles cost a fortune. They also have a lower annual depreciation than diesel cars. Depreciation is the rate at which the value of a car decreases if it is sold as a used car. Also, petrol cars are less expensive to service than diesel cars.

• In 2022, the online segment held a considerable market share over the forecast period.

Based on sales channels, the United States used car market is segmented into online and offline. Among these, the online segment has the largest revenue share over the forecast period. Online dealers provide distinctive delivery options, a wealth of vehicle photos and data search tools, and complete end-to-end purchasing capabilities to empower tech-savvy customers. Dealers are expanding their network and customer base by utilizing technologically advanced tools that are integrated with artificial intelligence and machine learning technology. AI applications can analyze data stored in the dealer management system and aid in the refinement of marketing and sales strategies by altering the car-buying experience.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. used car market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- TrueCar

- CarGurus

- Manheim

- Greater Rockford Auction Group

- ServNet

- Copart Inc.

- McConkey Auction

- KAR Auction Services

- ACV Auctions

- Auto Auction Mall

- Major Online E-Commerce Platform

- CarMax

- Carvana

- Vroom

- Shift Technologies

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2023, America's Group, a leading national vehicle auction and remarketing firm announced the acquisition of DAA Las Vegas, a full-service auction provider.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the United States used car market based on the below-mentioned segments:

United States Used Car Market, By Vehicle Type

- Hybrid

- Conventional

- Electric

United States Used Car Market, By Fuel Type

- Diesel

- Petrol

- Others

United States Used Car Market, By Sales Channel

- Offline

- Online

Need help to buy this report?