U.S. & U.K. Aerospace and Defense PCB Market Size, Share, and COVID-19 Impact Analysis, By Type (Double-Sided PCB, Multi-Layer, Single-Sided), By Material (Metal, Non-metal), By Application (Radio Communication, Radars, Health Monitoring Sensors, Power Converters, Power Supplies, Engine Control Systems Others), and U.S. & U.K. Aerospace and Defense PCB Market Insights Forecasts to 2033

Industry: Aerospace & DefenseU.S. & U.K. Aerospace and Defense PCB Market Insights Forecasts to 2033

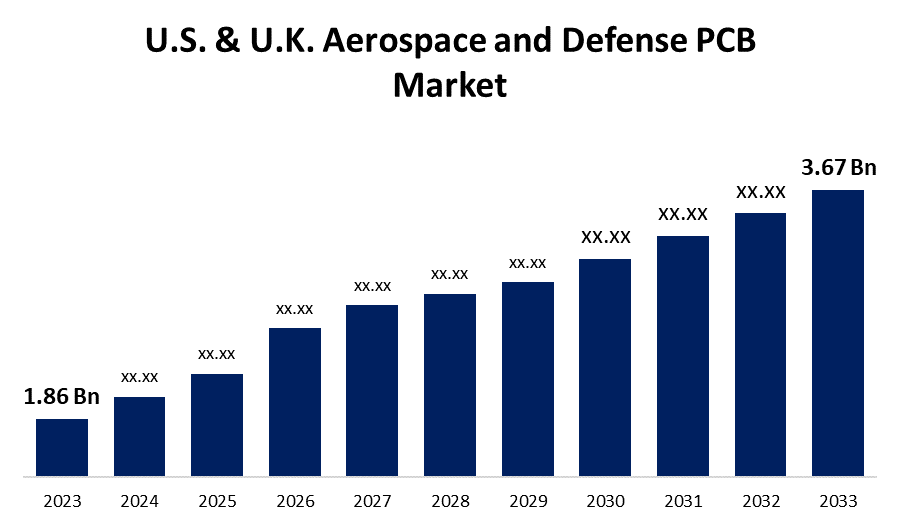

- The U.S. & U.K. Aerospace and Defense PCB Market Size was valued at USD 1.86 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.03% from 2023 to 2033.

- The U.S. & U.K. Aerospace and Defense PCB Market Size is Expected to Reach USD 3.67 Billion by 2033.

Get more details on this report -

The U.S. & U.K. Aerospace and Defense PCB Market Size is expected to reach USD 3.67 Billion by 2033, at a CAGR of 7.03% during the forecast period 2023 to 2033.

Market Overview

Aerospace and defense printed circuit boards, or PCBs, are electronic components that must function at a high level technically and withstand harsh environmental conditions in order to carry out intricate and dependable tasks. These PCBs are integrated into weapon systems, defense and aerospace gear, and vital subsystems and systems as well as the components used in them, must meet demanding reliability and lifetime requirements. Furthermore, traditional PCB manufacturing is based on energy-intensive and high-emission processes that use copper, epoxy resin, glass fibre, and water. Future operational requirements for aerospace and defense demand highly-complex, highly reliable, high-performance, and advanced multilayered PCB solutions for applications like engine control systems and other aerospace & defense applications. This is due to the high adoption rate of aerospace and defense PCBs for various applications amid a high demand for process automation. Furthermore, the military forces collaborate with local and international aerospace and defense PCB producers to design, develop, produce, and facilitate PCBs that meet the strict certification requirements set by the armed forces. In addition, one of the primary drivers of U.S. and U.K. aerospace & defense PCB market growth is the rapid adoption of these glass cockpits in older and newer generation aircraft outfitted with LED and LCD screens. Numerous sensors, including temperature, ultrasonic, barometers, GPS gyroscopes, and more, can be found on these PCBs. Data can be transmitted between data stations in a variety of ways, such factors propelling U.S. & U.K. aerospace & defense PCB market growth in the forecast period.

Report Coverage

This research report categorizes the market for U.S. & U.K. aerospace and defense PCB market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. & U.K. aerospace and defense PCB market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the U.S. & U.K. aerospace and defense PCB market.

U.S. & U.K. Aerospace and Defense PCB Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.86 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.03% |

| 2033 Value Projection: | USD 3.67 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Material, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | SMTC Corporation, Epec Engineered Technologies LLC, Amitron Corporation, Amphenol Printed Circuits Inc., TTM Technologies Inc., Firan Technology Group Corporation, APCT Inc., TechnoTronix Inc., Advanced Circuits Inc., Corintech Ltd., Delta Circuits Inc, Sanmina Corporation, IEC Electronics Corporation, Firan Technology Group Corporation, APCT Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The industry's key players in U.S. & U.K. have created printed circuit boards made from natural cellulose fibres extracted from agricultural wastes and byproducts. With this technique, PCBs with various shapes or designs can be printed to meet product specifications. Additionally, Higher growth rates are therefore anticipated in the near future when taking into account the aforementioned factors and process. The UAV, like space/satellites and avionics, is a small device that requires little weight and has limited design space. Furthermore, because these drones must operate in space, they need printed circuit boards of the highest calibre and durability. The VOXL CAMTM perception engine and the Seeker micro-development drone the first in the world designed for indoor and outdoor autonomous navigation development were unveiled by ModalAI, Inc. in November 2021. The VOXL CAM, which is based on the VOXL Flight Deck, is a single PCB that connects to robots, drones, or Internet of Things (IoT) devices with ease to enable autonomy for a variety of uses.

Restraining Factors

The total cost of PCB production in the United States and United Kingdom. The key players say that labor costs are increasing, and four out of five say that material costs are rising as well. In an effort to lessen the harm that different bottlenecks in the global supply chain are causing to their bottom lines, manufacturers are raising their prices. In particular, labor has proven to be a valuable resource for businesses and their supply chains as they work to keep up with the increasing demand. Workers are requesting pay that meets industry standards, which is costly for small businesses and large corporations with a large workforce. Consequently, high labor and material cost these factors are hamper the market growth in U.S. & U.K.

Market Segment

- In 2023, the multi-layer segment accounted for the largest revenue share over the forecast period.

Based on the type, the U.S. & U.K. aerospace and defense PCB market is segmented into double-sided, multi-layer, and single-sided. Among these, the multi-layer segment has the largest revenue share over the forecast period. The growing demand for multilayered PCBs for military applications, due to their high reliability in extreme conditions, is expected to drive market growth. The market is expected to grow as a result of an increase in demand for dependable and high-performing multilayer PCBs brought on by the growing popularity of complex circuits, nanotechnology, and miniaturization. The adoption of unmanned vehicles for combat, ISR, and combat support applications, as well as the growing need for extremely complex circuit boards for high-performance, mission-critical military hardware, are the reasons for the growth.

- In 2023, the metal segment accounted for the largest revenue share over the forecast period.

On the basis of material, the U.S. & U.K. aerospace and defense PCB market is segmented into metal, and non-metal. Among these, the metal segment has the largest revenue share over the forecast period. Polymer-core PCBs are in high demand for use in space, defense, and commerce and this are made from metal. Furthermore, the high demand for various satellite and missile applications during the forecast period.

- In 2023, the radio communication segment is expected to hold the largest share of the U.S. & U.K. aerospace and defense PCB market during the forecast period.

Based on the application, the U.S. & U.K. aerospace and defense PCB market is classified into radio communication, radars, health monitoring sensors, power converters, power supplies, engine control systems and others. Among these, the radio communication segment is expected to hold the largest share of the U.S. & U.K. aerospace and defense PCB market during the forecast period. Rising demand for advanced next-generation aircraft from countries, including U.S. & U.K. and others, is expected to drive market growth during the forecast period. Furthermore, the market growth is expected to be driven by the growing need for battlefield communications enhancement and the high demand for military communication networks for various command and control operations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. & U.K. aerospace and defense PCB market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SMTC Corporation

- Epec Engineered Technologies LLC

- Amitron Corporation

- Amphenol Printed Circuits Inc.

- TTM Technologies Inc.

- Firan Technology Group Corporation

- APCT Inc.

- TechnoTronix Inc.

- Advanced Circuits Inc.

- Corintech Ltd.

- Delta Circuits Inc

- Sanmina Corporation

- IEC Electronics Corporation

- Firan Technology Group Corporation

- APCT Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the U.S. & U.K. Aerospace and Defense PCB Market based on the below-mentioned segments:

U.S. & U.K. Aerospace and Defense PCB Market, By Type

- Double-Sided

- Multi-Layer

- Single-Sided

U.S. & U.K. Aerospace and Defense PCB Market, By Material

- Metal

- Non-metal

U.S. & U.K. Aerospace and Defense PCB Market, By Application

- Radio Communication

- Radars

- Health Monitoring Sensors

- Power Converters

- Power Supplies

- Engine Control Systems

- Others

Need help to buy this report?