US Ophthalmic Drugs Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Anti-allergy, Anti-inflammatory, and Anti-VEGF Agents), By Disease (Dry Eye, Allergies, Glaucoma, Eye Infection, and Retinal Disorders), By Route of Administration (Topical, Local Ocular, and Systemic), and US Ophthalmic Drugs Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUS Ophthalmic Drugs Market Insights Forecasts to 2033

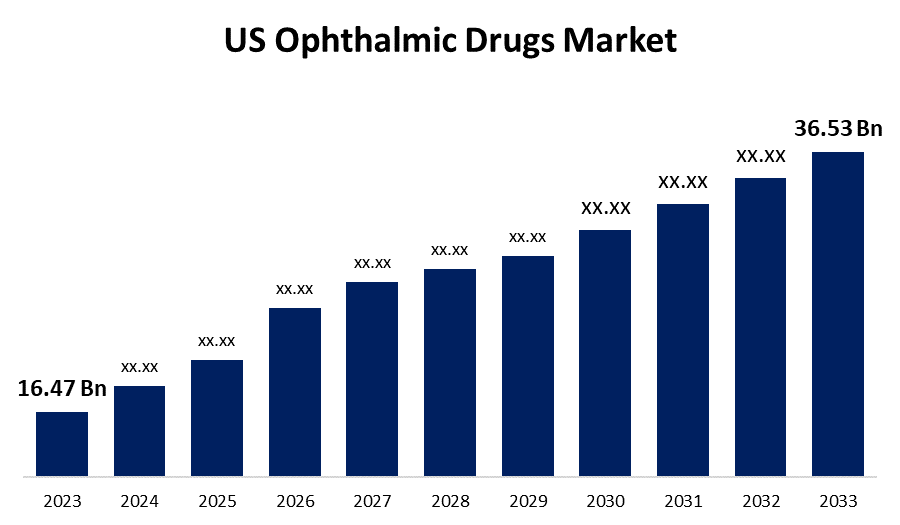

- The US Ophthalmic Drugs Market Size was valued at USD 16.47 Billion in 2023.

- The Market Size is Growing at a CAGR of 8.29 % from 2023 to 2033.

- The US Ophthalmic Drugs Market Size is expected to reach USD 36.53 Billion by 2033

Get more details on this report -

US Ophthalmic Drugs Market Size is anticipated to exceed USD 36.53 Billion by 2033, Growing at a CAGR of 8.29 % from 2023 to 2033.

Market Overview

The administration of a medication to the eyes is known as ophthalmic drug administration; this typically occurs in the form of eye drops. Several ocular disease conditions are treated with topical preparations. These diseases can include glaucoma, dry eye, bacterial infections, and eye trauma. The six main characteristics of ophthalmic preparations are as follows: eye comfort, pH, stability, particle limitations, sterility, and preservation. The main requirement is sterility; it is crucial to ensure that any pharmaceuticals used in the eyes are sterile. The demand for ophthalmic medications is predicted to continue to be significantly impacted by the country's steadily rising aging population as well as the rising prevalence of eye-related diseases in both adults and children. According to estimations from the 2022 National Health Interview Survey, more than 50 million Americans who are 18 years of age or older reported having some degree of vision loss. Among this group, about 4 million reported having serious visual problems even with glasses, and 340,000 reported being completely blind.

Report Coverage

This research report categorizes the market for the US ophthalmic drugs market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the ophthalmic drugs market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the ophthalmic drugs market.

US Ophthalmic Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 16.47 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 8.29 % |

| 2033 Value Projection: | USD 36.53 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Drug Class, By Disease, By Route of Administration |

| Companies covered:: | Pfizer Inc., Regeneron Pharmaceuticals Inc., Novartis AG, Merck & Co., Inc., Bayer Corporation, AbbVie Inc., Nicox Ophthalmics, Inc., Alcon, Genentech, Inc., Bausch Health Companies Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising prevalence of diabetes among the general public as a result of poor and sedentary lifestyle choices has raised the risk of diabetic retinopathy (DR), which has resulted in a major increase in the demand for pharmaceuticals. Furthermore, it is anticipated that the growing prevalence of allergies and eye infections will offer substantial growth opportunities for this industry. Additionally, the U.S. market is expanding because of regular approvals and the introduction of new products. Moreover, rising awareness regarding ophthalmic diseases is anticipated to propel the overall market during the predicted period.

Restraining Factors

Strict regulations in the US are the main factor hampering the growth of the market. Furthermore, a lack of awareness regarding preventive medications in the market that can prevent further eye disorders. These factors can restrain the growth of the market.

Market Segmentation

The US ophthalmic drugs market share is classified into drug class, disease, and route of administration.

- The anti-VEGF agents segment is expected to hold the largest market share through the forecast period.

The US ophthalmic drugs market is segmented by drug class into anti-allergy, anti-inflammatory, and anti-VEGF agents. Among these, the anti-VEGF agents segment is expected to hold the largest market share through the forecast period. Anti-VEGF (vascular endothelial growth factor) therapies are among new pharmaceutical groups that are anticipated to grow in demand as the frequency of illnesses like diabetic retinopathy and macular degeneration steadily increases in the US.

- The retinal disorders segment dominates the market with the largest market share over the predicted period.

The US ophthalmic drugs market is segmented by disease into dry eye, allergies, glaucoma, eye infection, and retinal disorders. Among these, the retinal disorders segment dominates the market with the largest market share over the predicted period. The aging population of the country has steadily increased in recent years, which has coupled with an increase in the prevalence of widespread retinal conditions such as AMD and diabetic retinopathy. The expansion of this segment is driven by increasing numbers of strategic collaborations and technological advancements.

- The topical segment is expected to hold the largest share of the US ophthalmic drugs market during the forecast period.

Based on the route of administration, the US ophthalmic drugs market is divided into topical, local ocular, and systemic. Among these, the topical segment is expected to hold the largest share of the US ophthalmic drugs market during the forecast period. To enhance the effectiveness of the delivery of topical drugs to the essential site, firms are coming up with diverse strategies, which are anticipated to support segment growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US ophthalmic drugs market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pfizer Inc.

- Regeneron Pharmaceuticals Inc.

- Novartis AG

- Merck & Co., Inc.

- Bayer Corporation

- AbbVie Inc.

- Nicox Ophthalmics, Inc.

- Alcon

- Genentech, Inc.

- Bausch Health Companies Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, the U.S. biosimilar CIMERLI (ranibizumab-eqrn) was acquired by Sandoz from Coherus BioSciences, Inc. Sandoz anticipates that the acquisition can strengthen its ophthalmology platform in the United States and enable it to diversify its range of biosimilars. The product treats specific retinal problems, which are a major cause of disability in the United States and can result in visual loss if left untreated.

Market Segment

This study forecasts revenue at US, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US Ophthalmic Drugs Market based on the below-mentioned segments:

US Ophthalmic Drugs Market, By Drug Class

- Anti-allergy

- Anti-inflammatory

- Anti-VEGF Agents

US Ophthalmic Drugs Market, By Disease

- Dry Eye

- Allergies

- Glaucoma

- Eye Infection

- Retinal Disorder

US Ophthalmic Drugs Market, By Route of Administration

- Topical

- Local Ocular

- Systemic

Need help to buy this report?