US Energy Drink Market Size, Share, and COVID-19 Impact Analysis, By Packaging Type (Bottles, Cans), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Convenience Stores, Online Retail Stores, & Others), and US Energy Drink Market Insights Forecasts 2023 – 2033

Industry: Food & BeveragesUS Energy Drink Market Insights Forecasts to 2033

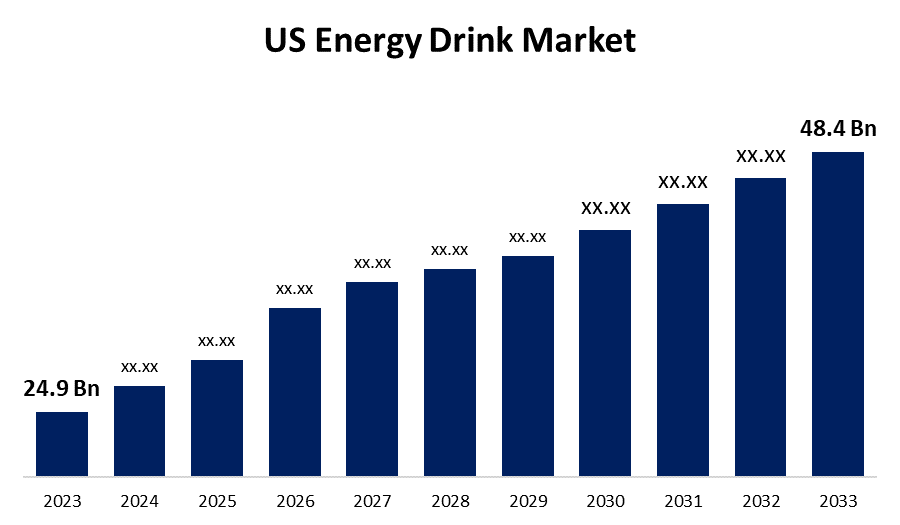

- The US Energy Drink Market Size was valued at USD 24.9 Billion in 2023

- The Market Size is Growing at a CAGR of 6.87% from 2023 to 2033.

- The US Energy Drink Market Size is Expected to Reach USD 48.4 Billion by 2033.

Get more details on this report -

The US Energy Drink Market Size is expected to reach USD 48.4 Billion by 2033, at a CAGR of 6.87% during the forecast period 2023 to 2033.

Market Overview

A drink formulated to give a rapid boost of energy and alertness is called an energy drink. In addition to sugar or artificial sweeteners for flavor, energy drinks typically contain stimulant chemicals such taurine, caffeine, and vitamins. These beverages are frequently promoted as tools for improving endurance, mental clarity, and physical performance—particularly after a long day or during physical exertion. Depending on the brand and mix, additional components in energy drinks may include amino acids, botanical extracts, and functional additives. While consuming too many energy drinks can have negative health impacts, such as elevated heart rate, anxiety, and insomnia, they can also provide a brief energy boost. As such, it is normally recommended to consume in moderation. Because diabetes and many other chronic diseases are so common, consumers are become increasingly conscious of the value of nutritious beverages and an active lifestyle this factor is boosting the US energy drink market.

Report Coverage

This research report categorizes the market for the US energy drink market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US energy drink market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US energy drink market.

US Energy Drink Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 24.9 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.87% |

| 2033 Value Projection: | USD 48.4 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Packaging Type, By Distribution Channel and COVID-19 Impact Analysis. |

| Companies covered:: | PepsiCo Inc., Nor-Cal Beverage Co. Inc., Monster Beverage Corporation, Vital Pharmaceuticals Inc., National Beverage Corp., Living Essentials Marketing LLC, Campbell Soup Co., Arizona Beverages, Red Bull GmbH, Amway Corp., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The demand for energy drinks in this region is being driven by the growing number of working Americans as well as the increased prevalence of burnout and exhaustion from increased workloads. Energy drinks are high in caffeine, which increases alertness and energy. Energy drink use is also thought to enhance general cognitive abilities including memory and response speed. For this reason, energy drink usage is highly prevalent among athletes. It is expected that during the forecast period, this propels market expansion. Moreover, the on-trade channels are reporting a considerable demand for energy drinks. A significant increase in pubs, restaurants, hotels, nightclubs, and other establishments is being caused by the fast urbanization and shifting consumer lifestyles. Moreover, the United States' thriving tourism industry is likewise having an impact on the growing quantity of on-trade channels. It is projected that during the forecast period, this will increase demand for energy drinks.

Restraining Factors

Energy drinks give users momentary stimulus while they're feeling mentally and physically exhausted. But since it is harmful to people's health, it shouldn't be used in place of health drinks. The high caffeine and sugar content of energy drinks can lead to a number of health problems when consumed in excess. As a result, exceeding the recommended dosage of energy drinks might cause an increase in heart rate and blood pressure. This serves as a significant barrier to the growth of the energy drink industry in the US.

Market Segment

- In 2023, the cans segment accounted for the largest revenue share over the forecast period.

Based on packaging type, the US energy drink market is segmented into bottles, cans. Among these, the cans segment accounted for the largest revenue share over the forecast period. Cans are popular because they are airtight and retain their fizz, especially because most energy drinks are carbonated. Additionally, cans are lightweight and practical because they are also composed of aluminum.

- In 2023, the convenience stores segment is witnessing significant growth over the forecast period.

Based on distribution channel, the US energy drink market is segmented into supermarkets and hypermarkets, specialty stores, convenience stores, online retail stores, and others. Among these, the convenience stores segment is witnessing significant growth over the forecast period. Because a broad variety of products from various brands and flavors are available under one roof, convenience stores hold the biggest market share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US energy drink market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PepsiCo Inc.

- Nor-Cal Beverage Co. Inc.

- Monster Beverage Corporation

- Vital Pharmaceuticals Inc.

- National Beverage Corp.

- Living Essentials Marketing LLC

- Campbell Soup Co.

- Arizona Beverages

- Red Bull GmbH

- Amway Corp.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2022, the new Power Burn product line from Rowdy Energy is set to debut in four flavors: watermelon, pineapple passionfruit, pink lemonade, and mango dragon fruit.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the US Energy Drink Market based on the below-mentioned segments:

US Energy Drink Market, By Packaging Type

- Bottles

- Cans

US Energy Drink Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retail Stores

- Others

Need help to buy this report?