United States Yogurt Market Size, Share, and COVID-19 Impact Analysis, By Type (Non-Flavored, Flavored), By Form (Conventional Yogurt, Set Yogurt, Greek Yogurt, Frozen Yogurt, Yogurt Drinks and Others), By Sales Channel (Supermarkets/Hypermarkets, Convenience Stores, Online, and Others), and United States Yogurt Market Insights Forecasts 2023 – 2033

Industry: Food & BeveragesUnited States Yogurt Market Insights Forecasts to 2033

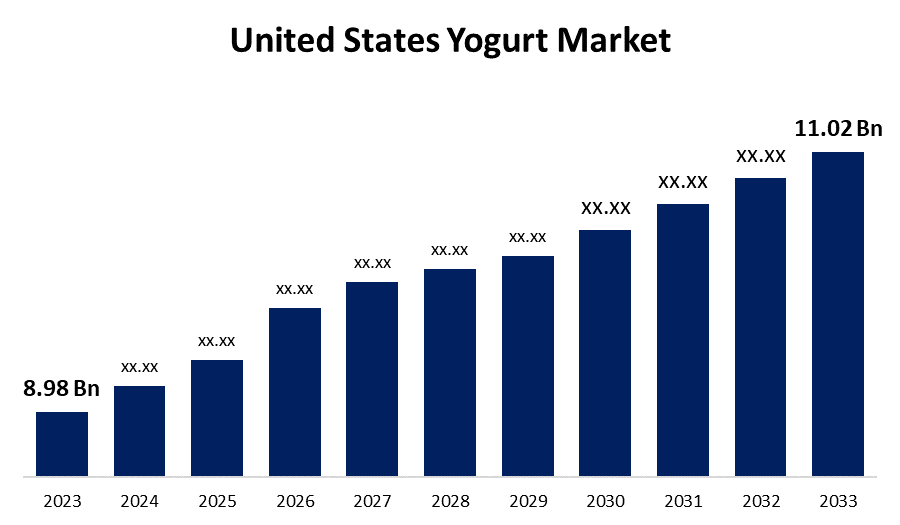

- The United States Yogurt Market Size was valued at USD 8.98 Billion in 2023

- The Market Size is Growing at a CAGR of 2.07% from 2023 to 2033.

- The United States Yogurt Market Size is Expected to Reach USD 11.02 Billion by 2033.

Get more details on this report -

The United States Yogurt Market size is Expected to Reach USD Billion by 2033, at a CAGR of 2.07% during the forecast period 2023 to 2033.

Market Overview

Yogurt is a food made from the bacterial fermentation of milk. Lactic acid is produced by these bacteria as a byproduct of sugar formation in milk. Lactic acid acts as a protein, giving it texture and a distinct tart flavor. It contains high levels of protein, calcium, vitamin B6, folic acid, vitamin B12, riboflavin, potassium, and magnesium. Yogurt's high nutritional value provides numerous health benefits. It also improves the immune system, lowers the risk of type 2 diabetes, strengthens bones and teeth, prevents digestive problems, and lowers high blood pressure and bad cholesterol. In recent years, manufacturers have introduced a wide range of flavors. The growing number of health-conscious consumers in the United States is a major driver of the yogurt market. Yogurt is regarded as a healthy food choice due to its probiotic content, which promotes gut health, and its high protein concentration. As people become more aware of the importance of gut health, there is a greater demand for probiotic-rich yogurts. Innovation and flavor variety have been critical to maintaining consumer interest. Yogurt manufacturers have introduced a diverse range of flavors, including exotic and unique options, to appeal to consumers seeking new taste experiences.

Report Coverage

This research report categorizes the market for the United States yogurt market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States yogurt market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States yogurt market.

United States Yogurt Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 8.98 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 2.07% |

| 2033 Value Projection: | USD 11.02 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Form, By Sales Channel and COVID-19 Impact Analysis. |

| Companies covered:: | Danone SA, Chobani LLC, General Mills Inc., FAGE USA Dairy Industry Inc, Lactalis, Dairy Farmers of America Inc., Anderson Erickson Dairy, Tillamook County Creamery Association, Hain Celestial Group, Dean Foods, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The yogurt market in the United States has grown significantly in recent years, and one of the key drivers behind this expansion is consumers' increasing emphasis on health and wellness. Convenience is another key driver of growth in the United States yogurt market. As people's lives become increasingly hectic, they seek out portable and convenient food options. Yogurt, particularly in single-serve containers, perfectly meets this demand for on-the-go snacking. Innovation and product diversification play an important role in propelling the United States yogurt market forward. One notable aspect of this innovation is the rise of plant-based yogurts to meet the growing demand of vegetarians, vegans, and people who are lactose intolerant. Furthermore, yogurt manufacturers are investing in R&D to create healthier, more nutritious, and functional yogurts. Packaging innovation is also a key driver. Smaller portion sizes, resealable lids, and eco-friendly packaging options are becoming more popular, making yogurt both appealing and environmentally responsible.

Restraining Factors

One of the most significant obstacles in the United States yogurt market is intense competition and market saturation. The changing consumer preferences and dietary trends, in addition to supply chain disruptions and price volatility, all pose significant challenges to the United States yogurt market.

Market Segment

- In 2023, the flavored segment accounted for the largest revenue share over the forecast period.

Based on type, the United States Yogurt market is segmented into non-flavored, and flavored. Among these, the flavored segment has the largest revenue share over the forecast period. One of the primary reasons for flavored yogurt's success is its appeal to a diverse range of consumers. The United States is known for its diverse population, and flavored yogurt reflects this diversity by offering a variety of flavors, textures, and ingredients to suit different tastes. From traditional fruit flavors like strawberry and blueberry to innovative options like salted caramel and key lime pie, the possibilities seem limitless. This variety ensures that flavored yogurt is enjoyed by people of all ages and backgrounds. Convenience is also important to the success of flavored yogurt. Single-serving yogurt cups in a variety of flavors are widely available in grocery stores and easy to transport, making them a popular choice for busy people and families. Furthermore, yogurt companies' marketing efforts have contributed to a major market share for flavored yogurt. These companies frequently use clever advertising campaigns to emphasize the delicious taste, health benefits, and versatility of their flavored products. This marketing has helped to make flavored yogurt a staple in the American diet.

- In 2023, the yogurt drinks segment is witnessing significant growth over the forecast period.

Based on form, the United States Yogurt market is segmented into conventional yogurt, set yogurt, Greek yogurt, frozen yogurt, yogurt drinks, and others. Among these, the yogurt drinks segment is witnessing significant growth over the forecast period. Yogurt drinks were the largest segment. Yogurt drinks are liquid yogurts that are usually packaged in bottles or cartons. They are frequently flavored and may contain added sugars or artificial sweeteners. Yogurt drinks are ideal for on-the-go consumption and can provide a quick way to reap the nutritional benefits of yogurt. is expected to continue, with packaging dominating the yogurt market.

- In 2023, the online segment accounted for the largest revenue share over the forecast period.

Based on sales channels, the United States Yogurt market is segmented into supermarkets/hypermarkets, convenience stores, online, and others. Among these, the online segment has the largest revenue share over the forecast period. The wide range of products available is one of the driving forces behind the yogurt market's online growth. Customers can select from traditional yogurts, Greek yogurts, dairy-free alternatives, and innovative flavors. This variety caters to a wide range of preferences, dietary restrictions, and health-conscious consumers, making it an appealing option for a diverse audience, and the online platform has enabled emerging yogurt brands to enter the market and gain exposure. Despite the strong presence of online sales in the United States yogurt market, traditional brick-and-mortar stores have held their ground.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States yogurt market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Danone SA

- Chobani LLC

- General Mills Inc.

- FAGE USA Dairy Industry Inc

- Lactalis

- Dairy Farmers of America Inc.

- Anderson Erickson Dairy

- Tillamook County Creamery Association

- Hain Celestial Group

- Dean Foods

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In 2023, Unilever agreed to acquire Yasso Holdings, Inc., a premium frozen Greek yogurt brand in the United States. This acquisition complements Unilever's Ice Cream Business Group's premiumization strategy, joining other premium brands in the portfolio such as Ben & Jerry's, Magnum, and Talent.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States Yogurt Market based on the below-mentioned segments:

United States Yogurt Market, By Type

- Non-Flavored

- Flavored

United States Yogurt Market, By Form

- Conventional Yogurt

- Set Yogurt

- Greek Yogurt

- Frozen Yogurt

- Yogurt Drinks and Others

United States Yogurt Market, By Sales Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online

- Others

Need help to buy this report?