United States Xylitol Market Size, Share, and COVID-19 Impact Analysis, By Form (Liquid and Solid), By Application (Confectionery, Pharmaceutical, Chewing Gum, Personal Care, and Others), and US Xylitol Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUSA Xylitol Market Insights Forecasts to 2035

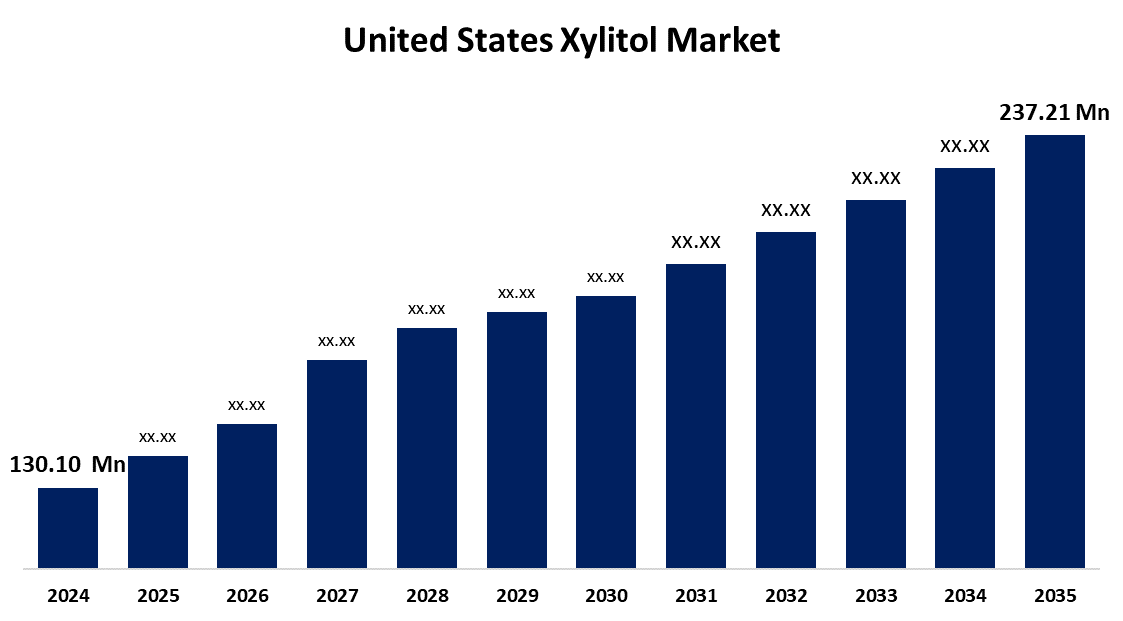

- The US Xylitol Market Size was Estimated at USD 130.10 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.61% from 2025 to 2035

- The USA Xylitol Market Size is Expected to Reach USD 237.21 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Xylitol Market Size is Anticipated to reach USD 237.21 Million by 2035, Growing at a CAGR of 5.61% from 2025 to 2035. The market is steadily growing as a result of growing food and beverage applications, regulatory support, advantageous laws encouraging natural sweeteners, and an increase in the prevalence of diabetes and obesity.

Market Overview

The production, distribution, and use of xylitol, a naturally occurring sugar alcohol used as a low-calorie sweetener in food, beverages, oral hygiene products, medications, and cosmetics, are the main priorities for the US xylitol market. A naturally occurring 5-carbon sugar with anticarcinogenic qualities, xylitol serves as a substitute for sucrose. As a member of the polyol family, it is sourced from hardwood and birch trees. Xylitol decreases enamel demineralization, bacterial adhesion, and plaque formation. It is also used to prevent dry mouth, ear infections, and dental plaque. In the US, products containing xylitol are allowed to claim they reduce cavity risk. Due to its anticarcinogenic properties, it is a favored sweetener. The market outlook for xylitol is improving because of government regulations and policies that support natural sweeteners. Regulatory agencies of the USA now recognize xylitol as a healthier sugar alternative. Demand for xylitol is fueled by approvals and endorsements from major food authorities, promoting its usage across various applications. The increase in xylitol use is also driven by government campaigns that encourage a low-sugar diet to combat diabetes and obesity. All of this is boosting the demand for products like salad dressings.

Report Coverage

This research report categorizes the market for the US xylitol market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US xylitol market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US xylitol market.

United States Xylitol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 130.10 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.61% |

| 2035 Value Projection: | USD 237.21 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Form, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Cargill, Shandong Longlive Bio-Technology, Dynamic Food Ingredients, Foodchem International Corporation, DuPont de Nemours Inc, Mitsubishi Corp, Godavari Biorefineries, Futaste, Nova Green (NovaGreen), Herboveda, Zhejiang Huakang Pharmaceutical, and Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rising awareness of the healthy lifestyle and well-being:

The market for xylitol is being driven by consumers' increasing awareness of health and wellness, which is causing them to choose natural, low-calorie sweeteners over conventional sugars. A polyol present in fruits and plants, xylitol is well-liked because of its low glycemic index, which makes it safe for people with diabetes and pre-diabetes. Also, it provides dental health advantages like tooth decay prevention and cavity prevention, which are highly sought after by consumers who are concerned about their health. The desire for natural ingredients in food and drink, and rising health consciousness in the US, are two more factors driving up demand for xylitol.

Upsurge in the application of xylitol in the food and beverage sectors:

Fruits and vegetables naturally contain xylitol, a sugar alcohol that has gained commercial prominence due to its many uses as a substitute sweetener in food and medicine. The chemical method is employed for large-scale production. Yellow plums, bananas, raspberries, and strawberries are just a few of the fruits and vegetables rich in xylitol. Additionally, plant husks and hardwood trees also contain it. In the food and beverage industry, xylitol is extensively used in sugar-free and light-food products because it has a sweetness profile comparable to that of sugar but offers fewer calories. Its beneficial properties, such as moisture retention and shelf-life extension, drive market demand through ongoing innovation and the introduction of new xylitol-containing products tailored to consumer preferences.

Restraining Factors

The high cost of production, stringent regulations, the presence of alternative sweeteners, taste and texture limitations, geopolitical tensions, and supply chain dependence may hinder the growth of the market.

Market Segmentation

The USA xylitol market share is classified into form and application.

- The solid segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US xylitol market is segmented by form into liquid and solid. Among these, the solid segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This growth is attributed to its widespread use in various industries. Its powder and granulated forms are widely used in food manufacturing, confectionery, chewing gum, and bakery. Its stability, ability to combine flavors, and popularity in sugar-free medications and oral hygiene products.

- The chewing gum segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US xylitol market is segmented by application into confectionery, pharmaceutical, chewing gum, personal care, and others. Among these, the chewing gum segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Chewing gum is the primary use of xylitol due to its health benefits and anti-plaque properties. It's also used in sugar-free gums for health-conscious consumers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US xylitol market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill

- Shandong Longlive Bio-Technology

- Dynamic Food Ingredients

- Foodchem International Corporation

- DuPont de Nemours Inc

- Mitsubishi Corp

- Godavari Biorefineries

- Futaste

- Nova Green (NovaGreen)

- Herboveda

- Zhejiang Huakang Pharmaceutical

- Others

Recent Developments:

- In May 2024, Wisdom Natural Brands introduced its first single-ingredient SweetLeaf® Xylitol Reduced Calorie Sweetener, offering a natural sugar substitute with only 10 calories per serving, a sugar-like taste, and no negative effects on blood sugar levels or tooth decay. It's keto-friendly, gluten-free, vegan, and Non-GMO Project Verified.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US xylitol market based on the below-mentioned segments:

US Xylitol Market, By Form

- Liquid

- Solid

US Xylitol Market, By Application

- Confectionery

- Pharmaceutical

- Chewing Gum

- Personal Care

- Others

Need help to buy this report?