United States Wound Care Market Size, Share, and COVID-19 Impact Analysis, By Type (Advanced Wound Dressings, Traditional Wound Care Products, Negative Pressure Wound Therapy, Bioactives, Others), By Application (Chronic Wounds, Acute Wounds), By End User (Hospitals, Clinics, Homecare Settings, Others), and United States Wound Care Market Insights Forecasts to 2033

Industry: HealthcareUnited States Wound Care Market Size Insights Forecasts to 2033

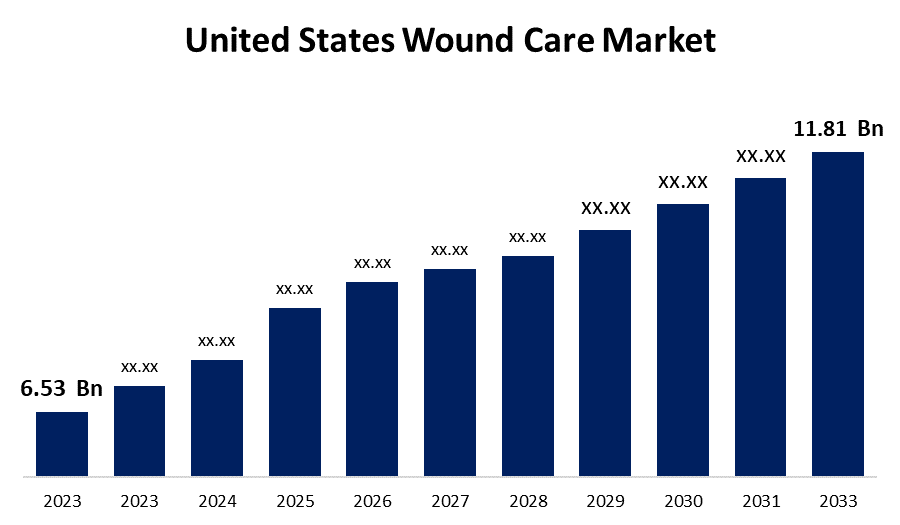

- The United States Wound Care Market Size was valued at USD 6.53 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.1% from 2023 to 2033.

- The United States Wound Care Market Size is Expected to Reach USD 11.81 Billion by 2033.

Get more details on this report -

The United States Wound Care Market Size is Expected to reach USD 11.81 Billion by 2033, at a CAGR of 6.1% during the Forecast period 2023 to 2033.

Market Overview

Wound healing can be facilitated in two ways: traditional wound care (TWC) and advanced wound care (AWC). Chronic wounds take longer to heal and are more expensive to treat. Thus, advanced wound care is becoming the standard treatment for chronic wounds. Furthermore, traditional wound care products such as hydrocolloids, hydrogels, film and foam dressings, and alginates are increasingly being replaced by advanced wound care products, due to their enhanced efficiency and effectiveness in wound management by enabling rapid healing. Furthermore, they provide various benefits such as maintaining a hydrated environment for proper oxygen flow, maintaining temperature consistency, protecting the wound site from exogenous infection, and reducing pain associated with dressing changes. Chronic wounds are common and costly to the United States healthcare system. According to a study of Medicare beneficiaries, more than 15% experience a chronic wound or infection each year, with diabetes and venous or arterial insufficiency being the most common causes market growth over the forecast period.

Report Coverage

This research report categorizes the market for United States wound care market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States Wound Care market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States Wound Care market.

United States Wound Care Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | 6.53 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.1% |

| 2033 Value Projection: | 11.81 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Application, By End User, and COVID-19 Impact Analysis |

| Companies covered:: | 3M, Smith & Nephew, ConvaTec Group PLC, Cardinal Health, Johnson & Johnson Services, Inc., Medtronic, Integra Lifesciences, Medline Industries, LP, Molnlycke Health Care AB, Ethicon (Johnson & Johnson), Baxter International, URGO Medical, Coloplast Corp., Derma Sciences Inc. (Integra LifeSciences), Advancis Medical, B. Braun Melsungen AG, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The shifting focus of key players, such as ConvaTec Group Plc, Smith & Nephew, and others, on investing in research and development, and launching advanced products in the country is anticipated to increase the adoption of these products among patients. Furthermore, regulatory bodies in the country are increasing the approval of various wound management products, which is expected to boost market growth. Furthermore, rising initiatives by key market players to integrate digital technologies to increase awareness and improve wound management among healthcare professionals are expected to contribute to market growth.

Restraining Factors

Despite various initiatives by key manufacturers to develop and launch technologically advanced products to treat a wide range of wounds, recent product recalls due to malfunction, expiry, and low quality are expected to impede adoption of these products, thereby hamper the United States wound care market growth during forecast period.

Market Segment

- In 2023, the advanced wound dressings segment accounted for the largest revenue share over the forecast period.

Based on the type, the United States wound care market is segmented into advanced wound dressings, traditional wound care products, negative pressure wound therapy, bioactives, and others. Among these, the advanced wound dressings segment has the largest revenue share over the forecast period. As a result of their low cost, these products are becoming increasingly popular. Furthermore, the widespread availability of advanced wound dressings, as well as the launch and approval of new products, are all contributing to the segmental growth over the forecast period.

- In 2023, the chronic wounds segment accounted for the largest revenue share over the forecast period.

Based on the application, the United States wound care market is segmented into chronic wounds & acute wounds. Among these, the chronic wounds segment has the largest revenue share over the forecast period. The chronic wounds category is further divided into diabetic foot ulcers, pressure ulcers, venous leg ulcers, and other chronic wounds. Diabetic foot ulcers are commonly treated with moist wound dressings because they grow in a moist wound healing environment. These ulcers, which frequently occur in individuals with diabetes, can be slow to heal and prone to complications because of the underlying factors associated with diabetes.

- In 2023, the hospitals segment accounted for the largest revenue share over the forecast period.

Based on the end user, the United States wound care market is segmented into hospitals, clinics, homecare settings, and others. Among these, the hospitals segment has the largest revenue share over the forecast period. The increasing number of well-established hospitals with dedicated wound management centers driving market growth. Furthermore, the availability of advanced devices and comprehensive reimbursement policies offered by hospitals has resulted in an increase in the admission rate of patients suffering from chronic wounds, which is contributing to the growth of the United States wound care market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States wound care market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M

- Smith & Nephew

- ConvaTec Group PLC

- Cardinal Health

- Johnson & Johnson Services, Inc.

- Medtronic

- Integra Lifesciences

- Medline Industries, LP

- Molnlycke Health Care AB

- Ethicon (Johnson & Johnson)

- Baxter International

- URGO Medical

- Coloplast Corp.

- Derma Sciences Inc. (Integra LifeSciences)

- Advancis Medical

- B. Braun Melsungen AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2023, ConvaTec Group PLC introduced ConvaFoam in the United States. The ConvaFoam dressing family includes improved silicone technology for better adhesion, a seven-day wear time, higher absorbency, superabsorbent layers, and exudate monitoring. Because of all the advancements, the product can be used on a wide range of wounds.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States wound care market based on the below-mentioned segments:

United States Wound Care Market, By Type

- Advanced Wound Dressings

- Traditional Wound Care Products

- Negative Pressure Wound Therapy

- Bioactives

- Others

United States Wound Care Market, By Application

- Chronic Wounds

- Acute Wounds

United States Wound Care Market, By End User

- Hospitals

- Clinics

- Homecare Settings

- Others

Need help to buy this report?