United States Workwear Market Size, Share, and COVID-19 Impact Analysis, By Demography (Women and Men), By Product (Work Footwear and Work Apparel), By Application (Chemical, Food & Beverages, Construction, and Biological), and US Workwear Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUSA Workwear Market Insights Forecasts to 2035

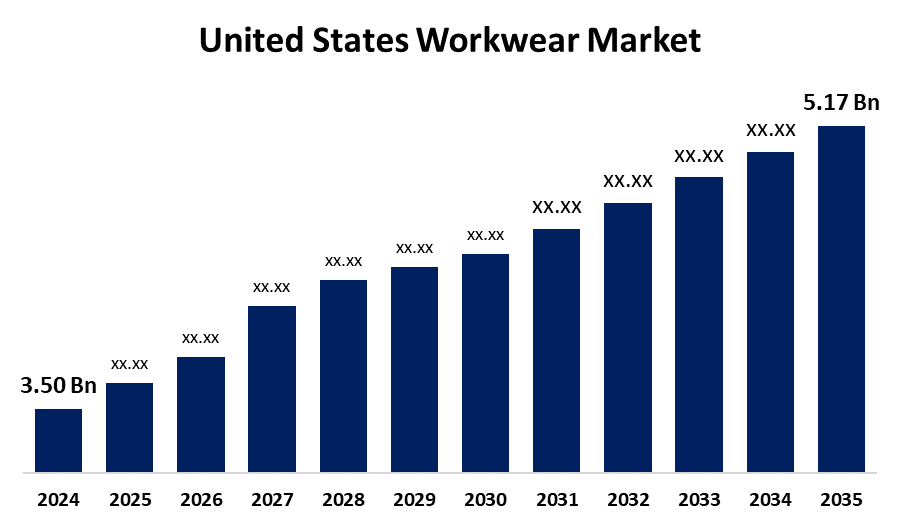

- The US Workwear Market Size was Estimated at USD 3.50 Billion in 2024

- The Market Size is expected to grow at a CAGR of around 3.61% from 2025 to 2035

- The USA Workwear Market Size is Expected to reach USD 5.17 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Workwear Market Size is anticipated to reach USD 5.17 Billion by 2035, Growing at a CAGR of 3.61% from 2025 to 2035. The market has grown as a result of technological developments in the textile sector and increased employment rates in different sectors.

Market Overview

The manufacturing, distribution, and use of protective and functional apparel for work environments is the focus of the US workwear market, which serves industries including manufacturing, food processing, construction, healthcare, and hospitality. Workwear serves a variety of functions beyond fashion and is apparel made for particular industries and professions. The market is changing dramatically as a result of consumers' increasing desire for eco-friendly and sustainable products like recycled polyester, organic cotton, and biodegradable clothes. Water-saving dyeing methods and bio-based textiles are two examples of fabric technology advancements that are becoming more popular. Government initiatives that support waste minimization and sustainable manufacturing are fueling this change. Protective clothing is required by the Occupational Safety and Health Administration to reduce workplace risks, which increases demand for clothing that is chemically, flame, and visibly resistant.

Report Coverage

This research report categorizes the market for the US workwear market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US workwear market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US workwear market.

United States Workwear Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.50 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.61% |

| 2035 Value Projection: | USD 5.17 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 229 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Demography, By Product, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Ansell Ltd., Carhartt, Inc., Honeywell International, Inc., Alexandra, Kimberly-Clark Corporation, Hard Yakka, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing awareness of safety in sectors like manufacturing, mining, and construction has led to an increase in demand for technical workwear. This demand stems from the need to safeguard employees against risks like chemicals, fire, and extreme heat or cold. The market is also being driven by the growing demand for ethically and environmentally produced sustainable workwear. In the upcoming years, it is anticipated that the use of sustainable workwear will increase as companies look to lessen their environmental impact. E-commerce's expansion has also made it simpler for companies to buy workwear in bulk, providing a large selection and enabling economical purchases.

Restraining Factors

The high production costs, fluctuating raw material prices, regulatory compliance, and sustainability concerns. High production costs require specialized materials and technologies, fluctuating raw material prices, regulatory compliance adds complexity to production may hinder the market growth.

Market Segmentation

The USA workwear market share is classified into demography, product, and application.

- The men segment held the largest market share of 85.23% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US workwear market is segmented by demography into women and men. Among these, the men segment held the largest market share of 85.23% in 2024 and is expected to grow at a significant CAGR during the forecast period. Painters' apparel, mechanic uniforms, and hospital uniforms are part of manufacturers' product lines due to the growing demand for stylish, comfortable men's workwear. This trend blends style and utility, making workwear both fashionable for casual wear and useful for the office.

- The work apparel segment accounted for the largest share of 73.22% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US workwear market is segmented by product into work footwear and work apparel. Among these, the work apparel segment accounted for the largest share of 73.22% in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to workwear companies are using cutting-edge technologies to regulate heat and make workplaces safer for employees. This reduces health risks like heat stroke, fainting, and dehydration, which increases adherence to safety equipment and guarantees comfortable and long-lasting workwear.

- The construction segment held the largest share of 21.02% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US workwear market is segmented by application into chemical, food & beverages, construction, and biological. Among these, the construction segment held the largest share of 21.02% in 2024 and is expected to grow at a significant CAGR during the forecast period. Construction sites are dangerous places that require more safety precautions. Workwear and clothing are made to shield employees from potential risks such as electrical shocks, falls, and collisions. UV-protective materials and fabrics that wick away moisture are features of contemporary workwear and drive the construction workwear.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US workwear market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ansell Ltd.

- Carhartt, Inc.

- Honeywell International, Inc.

- Alexandra

- Kimberly-Clark Corporation

- Hard Yakka

- Others

Recent Developments:

- In May 2025, Thorogood Workwear launched its new USA-Made Workwear Collection, featuring rugged work pants, functional overalls, quilted vests, and heavyweight tees. The collection is designed and manufactured in the US with USA and globally sourced components, with most apparel treated with DWR coating for added protection. The pieces are engineered with tradespeople in mind for long-lasting durability.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US workwear market based on the below-mentioned segments:

US Workwear Market, By Demography

- Women

- Men

US Workwear Market, By Product

- Workwear Footwear

- Workwear Apparel

US Workwear Market, By Application

- Chemical

- Food & Beverages

- Construction

- Biological

Need help to buy this report?