United States Wireless Security System Market Size, Share, and COVID-19 Impact Analysis, By Type (Wireless Network Security and Wireless Home Security), By End User (Commercial & Residential, Government, Retail, and BFSI), and United States Wireless Security System Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited States Wireless Security System Market Insights Forecasts to 2035

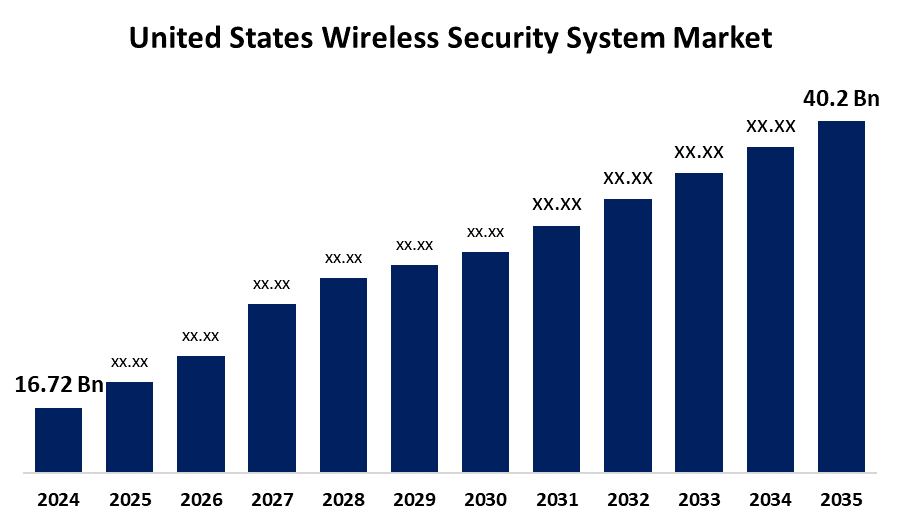

- The United States Wireless Security System Market Size was Estimated at USD 16.72 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.30% from 2025 to 2035

- The United States Wireless Security System Market Size is Expected to Reach USD 40.2 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United States wireless security system market Size is anticipated to reach USD 40.2 Billion by 2035, growing at a CAGR of 8.30% from 2025 to 2035. The US wireless security system market is growing due to rising demand for safer homes and businesses, coupled with the ease and affordability of wireless security systems. People are increasingly concerned about safety, and wireless systems, which are easy to install and use, are appealing. The integration of smartphones and smart home technology makes these systems accessible and user-friendly, further driving their adoption.

Market Overview

The United States wireless security system market encompasses advanced technologies that provide real-time surveillance, remote monitoring, and seamless integration with smart home ecosystems. Key drivers include rising concerns over residential safety, increased adoption of IoT-enabled devices, and advancements in AI and wireless communication technologies. These systems offer benefits such as cost-effectiveness, ease of installation, and scalability, making them appealing to both homeowners and businesses. The market’s strengths lie in advanced technology integration, user-friendly installation, and enhanced real-time monitoring capabilities. Opportunities lie in the growing demand for smart home automation, the expansion of cloud-based services, and the integration of AI-powered analytics for enhanced security. Government initiatives, such as the U.S. Cyber Trust Mark, aim to establish cybersecurity standards for smart devices, fostering consumer confidence and encouraging manufacturers to prioritize security in their products. Additionally, the adoption of the Matter standard for smart home interoperability enhances device compatibility, promoting a unified and secure user experience.

Report Coverage

This research report categorizes the market for the United States wireless security system market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States wireless security system market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States wireless security system market.

United States Wireless Security System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 16.72 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 8.30% |

| 2035 Value Projection: | USD 40.2 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 256 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type and By End User |

| Companies covered:: | Brinks Home Security, Lorex Technology, Eagle Eye Networks, Guardian Alarm, Cove Security, Eufy Security, Supercircuits, Scout Alarm, Nest Secure, SimpliSafe, ADT Inc., Vivint, Ring, Abode, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

An increasing awareness about safety and security among residential and commercial users. The growing surge for smart home technologies and IoT devices has fueled demand for wireless security solutions that offer convenience, easy installation, and remote monitoring. Advancements in AI and cloud computing enable enhanced features like real-time alerts, facial recognition, and video analytics, improving threat detection. Growing concerns about burglary, theft, and vandalism also motivate consumers and businesses to invest in advanced security systems. Moreover, government initiatives promoting smart city projects and public safety improvements contribute to market growth. Additionally, the expanding e-commerce sector, which increases the need for secure retail environments, and the rising trend of work-from-home, boost demand for residential security systems, which further drives the market.

Restraining Factors

The high initial setup costs, concerns over cybersecurity and data breaches, and limited connectivity in rural areas. Compatibility issues between different smart devices and reliance on stable internet connections also hinder adoption. Additionally, consumer hesitation due to privacy concerns further slows the widespread implementation of wireless security solutions.

Market Segmentation

The United States Wireless Security System Market share is classified into type and end user.

- The wireless network security segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States wireless security system market is segmented by type into wireless network security and wireless home security. Among these, the wireless network security segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is largely due to growing concerns about residential safety, the increasing popularity of smart homes, and user-friendly features like remote monitoring and real-time alerts. Affordable DIY systems and integration with voice assistants further boost consumer adoption and market growth.

- The residential segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States wireless security system market is segmented by end user into commercial & residential, government, retail, and BFSI. Among these, the residential segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the rising demand for home automation, increased awareness of personal safety, and the growing adoption of smart security solutions. Easy installation, remote access, and affordability make these systems popular among homeowners, especially with the rise of DIY and app-controlled devices.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States wireless security system market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Brinks Home Security

- Lorex Technology

- Eagle Eye Networks

- Guardian Alarm

- Cove Security

- Eufy Security

- Supercircuits

- Scout Alarm

- Nest Secure

- SimpliSafe

- ADT Inc.

- Vivint

- Ring

- Abode

- Others

Recent Developments:

- In July 2024, ADT launched its new smart security system, ADT Plus, which integrates with Google Nest devices and features the Yale Assure Lock 2, enabling the "Trusted Neighbor" feature. This system allows homeowners to grant temporary access to trusted individuals using facial recognition and smart locks.

- In June 2023, SimpliSafe announced the release of 24/7 live guard protection and the Smart Alarm Wireless Indoor Security Camera. The industry-first professional monitoring feature, which is enabled by the new Smart Alarm Indoor Camera, can help stop crime in real time by allowing monitoring agents to see and speak directly with intruders.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States wireless security system market based on the below-mentioned segments:

U.S. Wireless Security System Market, By Type

- Wireless Network Security

- Wireless Home Security

U.S. Wireless Security System Market, By End User

- Commercial & Residential

- Government

- Retail

- BFSI

Need help to buy this report?