United States White Cement Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Type I, Type II, and Others), By Applications (Infrastructure, Commercial, Residential, Institutional, and Industrial), and US White Cement Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUSA White Cement Market Insights Forecasts to 2035

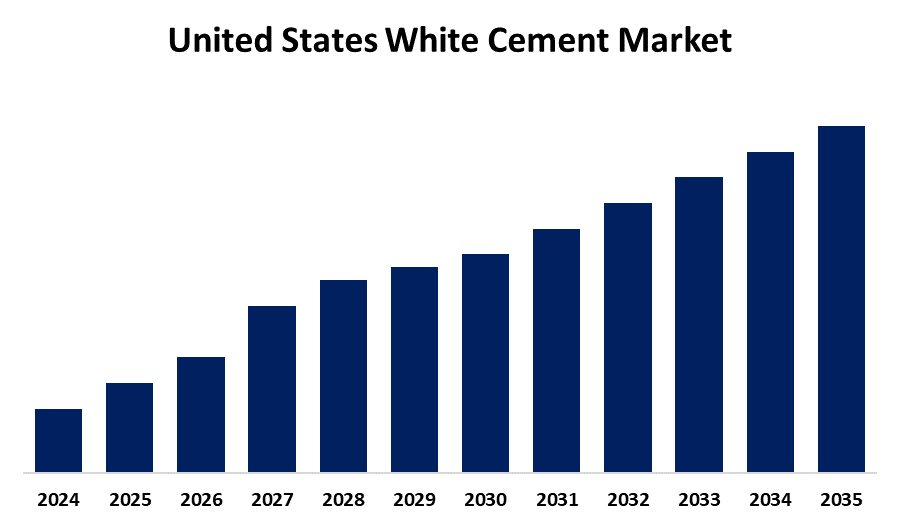

- The United States White Cement Market Size is Expected to Grow at a CAGR of around 2.53% from 2025 to 2035

- The USA White Cement Market Size is Expected to Hold a Significant Share By 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US White Cement Market Size is Anticipated to Hold a Significant Share by 2035, Growing at a CAGR of 2.53% from 2025 to 2035. The market growth is owing to the growing trend of decorative concretes and projects, advancement in the cement material, and sustainability.

Market Overview

The production, distribution, and use of white Portland cement, which is well-known for its exceptional blending ability, high whiteness, and color consistency, are the focus of the US white cement market. The market for white cement is driven by several factors, including infrastructure development, urbanization, the need for high-end and decorative applications, sustainable building methods, and improvements in manufacturing technology. Precast structural units, architectural concrete, wall putty, grouts, mosaic tiles, terrazzo, swimming pools, exterior facades, and decorative designs are all applications for white cement, a refined form of Portland cement. It gives concrete cracks a better visual assessment, improves texture and finish, increases reflectivity, and improves visual appeal. Technological developments are propelling market expansion, including optimization techniques and energy-efficient production methods. Increased income in residential and commercial settings, a wide variety of product options, and interest in cutting-edge building concepts like colored and off-white concrete are all factors propelling market expansion.

Report Coverage

This research report categorizes the market for the US white cement market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US white cement market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US white cement market.

United States White Cement Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 2.53% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Applications and COVID-19 Impact Analysis. |

| Companies covered:: | Cimsa, Holcim, Argos USA LLC, Cementer Holdings NV, Almaty’s GMBH, And Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

Advancements in the infrastructure and urbanization:

The market for white cement is being driven by rapid urbanization and the development of infrastructure in both developed and developing nations. White cement's strength, durability, and aesthetic appeal make it a popular choice for public, commercial, and residential infrastructure. Additionally, it is utilized in precast concrete units, ornamental designs, and decorative concrete to improve urban landscapes. White cement is also required for repairs and renovations in infrastructure refurbishment projects. White cement is still in high demand as urbanization continues.

Growing trend of decorations and usage of superior concrete materials:

The growing need for aesthetically pleasing and high-end applications in both residential and commercial settings is propelling the white cement market. Due to its color consistency and compatibility with color pigments, white cement is used in mosaics, terrazzo, designer flooring, and decorative tiles. The market is expanding due to the growing number of luxury hotels, commercial spaces, and high-end real estate projects that prefer white cement for a high-end appearance and finish.

Restraining Factors

High production costs, scarce raw material supplies, strict environmental laws, competition from substitute materials, shifts in building demand, and an energy-intensive manufacturing process may hinder the growth of the market.

Market Segmentation

The USA white cement market share is classified into product type and applications.

- The type I segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US white cement market is segmented by product type into type I, type II, and others. Among these, the type I segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Type I white cement is a durable and high-strength material used in various applications such as marble fitting, tile finishing, and countertop installation. It is widely used in cast-in-place wall panels, slabs, floors, and traffic safety items.

- The residential segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US white cement market is segmented by applications into infrastructure, commercial, residential, institutional, and industrial. Among these, the residential segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Residential construction, especially that of apartments, bungalows, and villas, is being driven by nuclear families, migration to service sector clusters, and the expansion of the US population. Massive home renovations drive the segment growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US white cement market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cimsa

- Holcim

- Argos USA LLC

- Cementer Holdings NV

- Almaty’s GMBH

- Others

Recent Developments:

- In August 2022, Royal White Cement signed a long-term lease at Industrial Realty Group's Houston Ship Channel project, allowing for efficient raw material transportation and meeting the demands of its growing business in the western and southern United States. The expansion will be managed by Houston Peninsula Terminal.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US white cement market based on the below-mentioned segments:

US White Cement Market, By Product Type

- Type I

- Type II

- Others

US White Cement Market, By Applications

- Infrastructure

- Commercial

- Residential

- Institutional

- Industrial

Need help to buy this report?