United States Watch Market Size, Share, and COVID-19 Impact Analysis, By Product (Traditional Watch, Smart Watch, and Hybrid Watch), By Type (Quartz and Mechanical), and United States Watch Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited States Watch Market Insights Forecasts to 2035

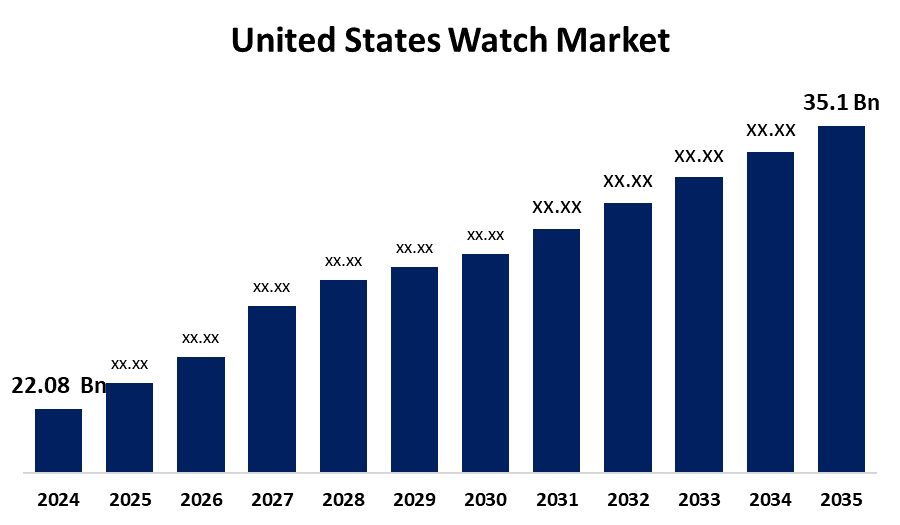

- The US Watch Market Size Was Estimated at USD 22.08 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.3% from 2025 to 2035

- The US Watch Market Size is Expected to Reach USD 35.1 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Watch Market is anticipated to reach USD 35.1 billion by 2035, growing at a CAGR of 4.3% from 2025 to 2035. The expansion of the United States watch market is propelled by rising living standards and the introduction of new goods into the market.

Market Overview

A watch is classed as a timepiece that is on a user's wrist or in a pocket with practical, decorative components. There are numerous forms of timepieces, including luxury, smart, digital, and analogue. Watches have gained immense popularity in the U.S. as practical accessories, status symbols, and fashion pieces. Meanwhile, the popularity of smartwatches from companies like Apple and Garmin, together with their features for tracking fitness, health, and notifications, has upended the business. The U.S. market is broad, with a wide range of consumer types in different shapes and styles, including watch collectors, consumers interested in technology, and fitness celebrities. The desire from consumers for durable, stylish, and cutting-edge timepieces appears to be increasing. The U.S. watch industry has been impacted greatly by the rise of online shopping.

The U.S. government's support for the domestic watch industry focuses on workforce training, manufacturing development, and small business innovation. Major initiatives include the Manufacturing Extension Partnership (MEP) and the larger Manufacturing USA network, which provide cost-sharing, technical assistance, and public-private collaboration to help small-scale manufacturers including precision component makers and micro-machining firms modernize operations, and the Small Business Innovation Research STTR grants, which fund high-risk, high-reward R&D for small enterprises awarded by agencies like NIST and DoD.

Report Coverage

This research report categorizes the market for the United States watch market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States watch market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States watch market.

United States Watch Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 22.08 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.3% |

| 2035 Value Projection: | USD 35.1 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Product, By Type and COVID-19 Impact Analysis |

| Companies covered:: | Fossil Group Inc, Apple Inc., LVMH Group, The Swatch Group Ltd, Fitbit, Inc., Garmin Ltd., Swatch Group Inc., Movado Group, Inc., Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The growth of the United States watch market is boosted by the Increasing consumer demand for smartwatches. Wearable technology continues to improve, resulting in an increase in consumer demand for smartwatches that accommodate consumer needs in terms of health monitoring, mobile connectivity, as well as fitness tracking. The smartwatch category targets tech-savvy consumers looking for multifunctionality. Apple and Garmin are the most significant companies in the smartwatch category. Smartwatches have quickly become an essential component of everyday lifestyles because of the increasing awareness of health and wellness. Greater emphasis on health and wellness has led to an increased demand for smartwatches with health monitoring.

Restraining Factors

The United States watch market faces obstacles like the smartwatch and other wearable technology poses. watch market. The shift towards multifunctionality causes many younger consumers to view traditional watches as less relevant or outdated, particularly with a smartwatch offering similar or more useful features at lower price points.

Market Segmentation

The United States watch market share is classified into product and type.

- The traditional watch segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States watch market is segmented by product into traditional watch, smart watch, and hybrid watch. Among these, the traditional watch segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because today's society, traditional watches may be viewed as heirlooms or social status. Most wristwatches are limited to a small quantity, complex movements, made from precious metals, or have jewels. Traditional timepieces may be more palatable to consumers because of their quality, craftsmanship, and they can tax the price accordingly.

- The inhalers segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the United States watch market is segmented into quartz and mechanical. Among these, the quartz segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because of quartz crystal oscillators, which provide more reliability. Quartz watches have excelled over mechanical clocks in accuracy and precision. Cost has eliminated the price advantage of mechanical watches and made quartz wristwatches more appealing to an international market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States watch market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fossil Group Inc

- Apple Inc.

- LVMH Group

- The Swatch Group Ltd

- Fitbit, Inc.

- Garmin Ltd.

- Swatch Group Inc.

- Movado Group, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States watch market based on the following segments:

United States Watch Market, By Product

- Traditional Watch

- Smart Watch

- Hybrid Watch

United States Watch Market, By Type

- Quartz

- Mechanical

Need help to buy this report?