United States Wallpaper Market Size, Share, and COVID-19 Impact Analysis, By Product (Vinyl, Nonwoven, Paper, Fabric, and Others), By End Use (Residential and Commercial), and United States Wallpaper Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited States Wallpaper Market Size Insights Forecasts to 2035

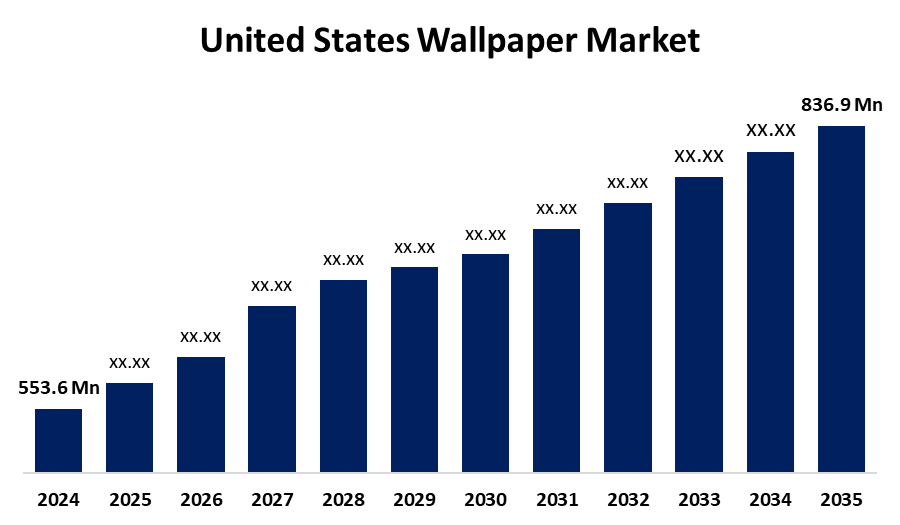

- The US Wallpaper Market Size Was Estimated at USD 553.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.83% from 2025 to 2035

- The US Wallpaper Market Size is Expected to Reach USD 836.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Wallpaper Market Size is anticipated to reach USD 836.9 million by 2035, growing at a CAGR of 3.83% from 2025 to 2035. The expansion of the United States wallpaper market is propelled by the growing popularity of house remodelling projects combined with improvements in printing methods.

Market Overview

Wallpaper is referred to as a decorative covering for interior walls made of long sheets of material, usually paper, vinyl, fabric-backed, or nonwoven, that have been printed, embossed, or painted with images or patterns and adhered to the wall to improve appearance and conceal flaws. The primary force driving the market forward is the increasing technological advancements of wallpaper, which helps make consumers more willing to purchase the product. Modern wallpaper is also long-lasting and aesthetically pleasing. The technique of wallpapering has become much simpler due to self-adhesive wallpaper. Also, a driver of growth is the increasing number of new houses builds and remodels, as an increasing number of builders and homeowners are finding this to be an easy and fun way to add character and personality to a room. This is especially true in houses, as it is important to the consumer to distinguish their space from some of the boring designs used in corporate environments.

The U.S. government has taken a number of steps to assist the wallpaper business, especially in advancing safety and sustainability regulations. Because the USDA Biopreferred Program promotes the use of biobased products, producers like Carnegie Fabrics have created wallcoverings with up to 91% biobased content, including their sugarcane-based Xorel range.

Report Coverage

This research report categorizes the market for the United States wallpaper market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States wallpaper market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States wallpaper market.

United States Wallpaper Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 553.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.83% |

| 2035 Value Projection: | USD 836.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 147 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Product, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | 4walls, F. Schumacher & Co., York Wall Coverings Inc., Brewster Home Fashions, Osborne & Little, The Romo Group, Grandeco, Graham & Brown, Sanderson Design Group, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States wallpaper market is boosted by the growing demand for home decor as consumer interest in interior design grows, and owners are learning to upgrade and modify their interior settings. Growing awareness of design opportunities and possibilities inspired by social media, home renovation television, and online sources is fueling consumers' increased enthusiasm for home decor. Homeowners' awareness of appealing, affordable, and adaptable options, such as wallpapers, allows for creativity around colours, textures, and patterns. IKEA's April 2023 announcement regarding a USD 2.2 billion investment into its US operations to grow and improve its home decor department exemplifies explicit market demand for home decor and home decor upgrades that were reflective of functionality and visuals.

Restraining Factors

The United States wallpaper market faces obstacles like the premium wallpapers are costly from a skilled installation and cost perspective, especially for those consumers with tighter budgets. Furthermore, buyers potentially concerned or prevented by maintenance issues, i.e., peeling, fading, and moisture damage when humid climates are less likely to purchase or value the product and may hinder other buyers.

Market Segmentation

The United States wallpaper market share is classified into product and end use.

- The vinyl segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States wallpaper market is segmented by product into vinyl, nonwoven, paper, fabric, and others. Among these, the vinyl segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by its easy-to-clean features and high traffic zones. It is easy to repair damaged vinyl wallpaper. Vinyl products are projected to increase in popularity due to their ease of use and ability to repair damage. It is found in high-traffic areas like schools and hospitals, so it is a good alternative because of its fire-resistant characteristics.

- The commercial segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end use, the United States wallpaper market is segmented into residential and commercial. Among these, the commercial segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because product sales in offline end-user channels will increase as urbanisation increases and supermarkets and hypermarkets expand their reach to a wide audience. Also, the demand growth for commercial goods is driven primarily by the number of high-traffic areas that are growing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States wallpaper market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 4walls

- F. Schumacher & Co.

- York Wall Coverings Inc.

- Brewster Home Fashions

- Osborne & Little

- The Romo Group

- Grandeco

- Graham & Brown

- Sanderson Design Group

- Others

Recent Development

- In March 2023, Erin Napier partnered with York Wallcoverings to introduce a new collection of peel-and-stick wallpapers, catering to the growing demand for DIY-friendly home décor solutions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States wallpaper market based on the following segments:

United States Wallpaper Market, By Product

- Vinyl

- Nonwoven

- Paper

- Fabric

- Others

United States Wallpaper Market, By End Use

- Residential

- Commercial

Need help to buy this report?