United States Virtual Clinical Trials Market Size, Share, and COVID-19 Impact Analysis, By Study Design (Interventional, Observational, Expanded Access), By Indication (Oncology, Cardiovascular), By Phase (Phase I, Phase II, Phase III, Phase IV), and United States Virtual Clinical Trials Market Insights Forecasts to 2033

Industry: HealthcareUnited States Virtual Clinical Trials Market Insights Forecasts to 2033

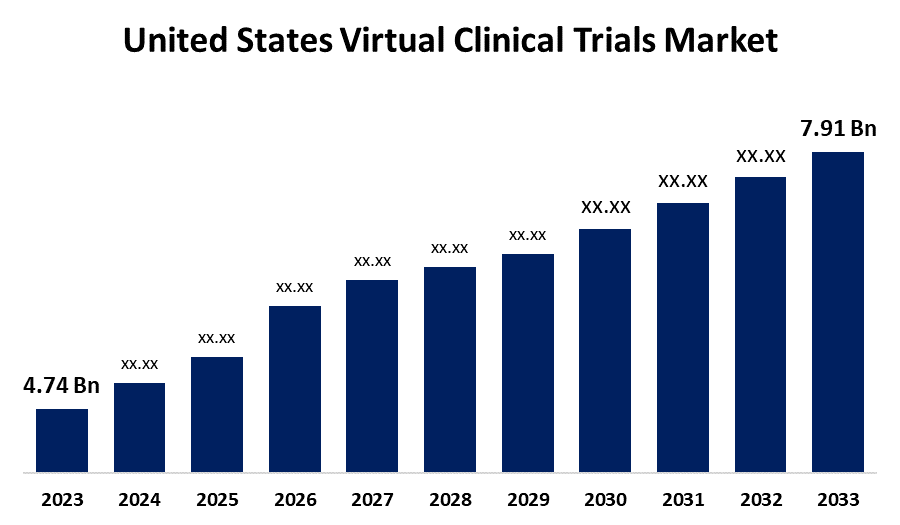

- The United States Virtual Clinical Trials Market Size was valued at USD 4.74 Billion in 2023

- The Market Size is Growing at a CAGR of 5.25% from 2023 to 2033

- The United States Virtual Clinical Trials Market Size is Expected to Reach USD 7.91 Billion by 2033

Get more details on this report -

The United States Virtual Clinical Trials Market Size is expected to reach USD 7.91 Billion by 2033, at a CAGR of 5.25% during the forecast period of 2023–2033.

Market Overview

Virtual Clinical Trials (VCTs), also known as remote or decentralized trials, are a relatively new but underutilized method of conducting clinical research that makes full use of technologies such as apps, online social interaction platforms, and electronic monitoring tools. The market is significantly driven by increased R&D activities, healthcare digitization, and telehealth adoption. Furthermore, technological advancements, collaborations between clinical research organizations, biotechnology companies, and pharmaceutical companies, as well as government support initiatives, are expected to boost the market. Virtual clinical trials (VCT) eliminate the limitations of traditional clinical trials, such as time-consuming procedures and patient recruitment delays, driving demand for the virtual clinical trial market. Furthermore, technological advancements in healthcare infrastructure, as well as collaborations between pharmaceutical, biotechnology, and clinical research companies, are expected to drive the virtual clinical trials market in the coming years. The rise in costs, combined with a higher rate of trial failures and an increase in patient-centric trials, has resulted in a greater demand for clinical trial technology. Virtual clinical trials are expected to grow from high to highest revenue during the forecast period.

Report Coverage

This research report categorizes the market for the United States virtual clinical trials market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States virtual clinical trials market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States virtual clinical Trials market.

United States Virtual Clinical Trials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.74 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.25% |

| 2033 Value Projection: | USD 7.91 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Study Design, By Indication, By Phase |

| Companies covered:: | ICON, plc, Parexel International Corporation, IQVIA, Labcorp Drug Development, Medidata Solutions, Oracle, Signant Health, Medable, Inc., Halo Health Systems, Science 37, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the key factors expected to drive the U.S. virtual clinical trials market over the forecast period is the growing disease burden. For instance, as the burden of chronic, infectious, and/or life-threatening diseases increases, so does the demand for advanced and effective treatments. According to the centers for disease control and Prevention (CDC), 6 out of every 10 people in the United States have a chronic disease, and 4 out of every 10 have two or more chronic diseases, making it the country's leading cause of death. Furthermore, another factor driving the U.S. virtual clinical trials market is an increase in virtual clinical trials in United States. For instance, the number of decentralized and/or virtual clinical trials, as well as mobile healthcare trials, has more than doubled in recent years. Several clinical research organizations (CROs) and eClinical software providers have expanded their capabilities in response to rising demand for these services, attracting significant attention in recent years. Virtual trials provide an innovative solution for improving patient experiences by utilizing digital technologies and other remote services.

Restraining Factors

The strict rules and regulations are expected to be a major impediment to the growth of the United States virtual clinical trials market. For instance, in the United States, the Food and Drug Administration (FDA) regulates clinical trials to ensure that they are designed, conducted, analyzed, and reported in accordance with federal law and good clinical practice guidelines.

Market Segment

- In 2023, the interventional segment accounted for the largest revenue share over the forecast period.

Based on the study design, the United States virtual clinical trials market is segmented into interventional, observational, and expanded access. Among these, the interventional segment has the largest revenue share over the forecast period. The category is being driven by the quick increase in the number of tests being conducted to create new drugs for a variety of ailments. Virtual trials are better suited for chronic diseases and observational studies involving less interventional treatments, such as those in the fields of immunology, gastroenterology, dermatology, respiratory medicine, and endocrinology.

- In 2023, the oncology segment accounted for the largest revenue share over the forecast period.

Based on the indication, the United States virtual clinical trials market is segmented into oncology and cardiovascular. Among these, the oncology segment has the largest revenue share over the forecast period. The rising number of cancer cases as well as the growing number of oncology clinical trials, are driving segment growth. Furthermore, recruiting patients is a major challenge for cancer researchers. The success of this clinical study is jeopardized due to low enrollment rates, which may impede the development of new treatments and their beneficial outcomes. As a result, it is expected that the low rate of recruitment and the need for a larger population for oncology clinical research will promote the use of virtual clinical trials.

- In 2023, the phase II segment accounted for the largest revenue share over the forecast period.

Based on the phase, the United States virtual clinical trials market is segmented into phase I, phase II, phase III, and phase IV. Among these, the phase II segment has the largest revenue share over the forecast period. This is because phase II trials play a crucial role, especially in oncology, and in the present day, oncology accounts for the highest number of ongoing clinical trials.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved in the United States virtual clinical trials market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers and acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ICON, plc

- Parexel International Corporation

- IQVIA

- Labcorp Drug Development

- Medidata Solutions

- Oracle

- Signant Health

- Medable, Inc.

- Halo Health Systems

- Science 37

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2023, Science 37 partnered with Amazon Web Services (AWS). The former will join the AWS Partner Network (APN) to assist the company in reaching more providers and customers, thus improving the company's capabilities in conducting decentralized clinical trials.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States Virtual Clinical Trials Market based on the below-mentioned segments:

United States Virtual Clinical Trials Market, By Study Design

- Interventional

- Observational

- Expanded Access

United States Virtual Clinical Trials Market, By Indication

- Oncology

- Cardiovascular

United States Virtual Clinical Trials Market, By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

Need help to buy this report?