United States Vegetable Seeds Market Size, Share, and COVID-19 Impact Analysis, By Type (Open Pollinated Varieties and Hybrid), By Crop Type (Solanaceae, Root & Bulb, Cucurbit, Brassica, Leafy, and Others), and by United States Vegetable Seeds Market Insights Forecasts to 2033

Industry: AgricultureUnited States Vegetable Seeds Market Insights Forecasts to 2033

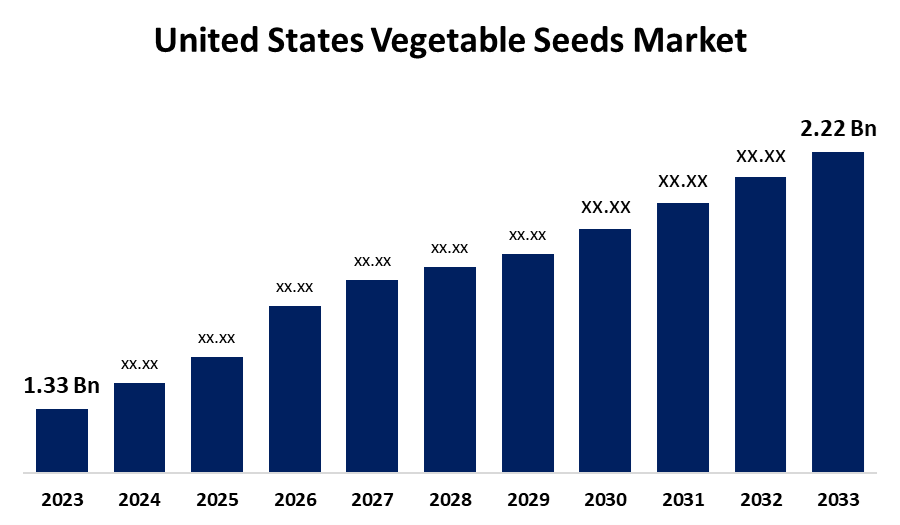

- The United States Vegetable Seeds Market Size was valued at USD 1.33 Billion in 2023.

- The Market is growing at a CAGR of 5.26% from 2023 to 2033

- The United States Vegetable Seeds Market Size is Expected to Reach USD 2.22 Billion by 2033

Get more details on this report -

The United States Vegetable Seeds Market Size is Anticipated to Exceed USD 2.22 Billion by 2033, growing at a CAGR of 5.26% from 2023 to 2033.

Market Overview

Vegetable seed is an agricultural seed that is commonly used in home gardens to grow vegetables or herbs. In this stage, it is commonly marketed as a vegetable or herb seed. The vegetable seeds market refers to the industry for the production, distribution, and sale of seeds for a vast variety of vegetables grown in both conventional and organic ways. Such seeds are used by commercial farmers, home gardeners, and small-scale producers in the country to grow vegetables for direct consumption and processing or exportation purposes. The vegetable market involves a variety of vegetables, including leafy greens, roots, legumes, and cruciferous crops, all of which are essential in the food supply chain. Key drivers that influence the growth of the vegetable seeds market in the United States include increased demand for fresh, locally grown produce that comes with health-conscious consumers. The increasing popularity of organic and non-GMO food also continues to increase the demand for organic vegetable seeds. Home gardening, urban farming, and sustainable agricultural practices all are on the rising trend, as consumers increasingly grow their vegetables. Moreover, high growth in the sector due to seed technology advancement and hybrid varieties with improved disease resistance and yields also underscore growth. Government efforts for innovation and sustainability in agriculture are very important factors. Some of the initiatives provided by the USDA for funding research related to developing seeds and responsible farming practices are considered essential in the development of the market for vegetable seeds.

Report Coverage

This research report categorizes the market for the United States vegetable seeds based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States vegetable seeds market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each United States vegetable seeds market sub-segment.

United States Vegetable Seeds Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.33 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.26% |

| 2033 Value Projection: | USD 2.22 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Crop Type |

| Companies covered:: | Monsanto (Bayer CropScience), Syngenta Seeds, Dow AgroSciences (Corteva Agriscience), John Deere (John Deere Seeding and Planter Solutions), Harris Seeds, Burpee Seeds, Sakata Seed America, Rijk Zwaan USA, Sevia Seed Company, Vitalis Organic Seeds, And Other Key Vendors. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The US vegetable seeds market is characterized by several major factors driving its growth. These range from a health-conscious population demanding fresh, nutrient-rich vegetables from consumers, thereby fostering consumer growth, to the popularity of organic and non-GMO produce that increases demand for organic vegetable seeds. Increasing home gardening and urban farming activities and a shift to more sustainable agricultural practices have also increased market size. Technological progress in seed development, in terms of hybrid varieties with improved disease resistance and higher yield, also complements the growth of the market by providing higher productivity and efficiency.

Restraining Factors

The major restraining factors for the United States vegetable seeds market include high production costs, less availability of arable lands, and challenges related to climate change that determine crop yields. Furthermore, the imported seeds market competition and consumer preference fluctuations act as a barrier.

Market Segment

The U.S. vegetable seeds market share is classified into type and crop type.

- The hybrid segment is expected to hold the largest market share through the forecast period.

The US Vegetable seed market is by type into open-pollinated varieties and hybrids. Among these, the hybrid segment is expected to hold the largest market share through the forecast period. This is attributed to the hybrid seeds being preferred because of their characteristics, which consist of greater yields, more resistance to pathogens, as well as pests, and higher adaptability towards diverse environmental conditions. These qualities make hybrid varieties especially attractive to commercial farmers who are interested in increasing productivity and crop resilience.

- The Solanaceae segment is expected to hold the largest market share through the forecast period.

The US Vegetable seed market is segmented by crop type into Solanaceae, root & bulb, cucurbit, brassica, leafy, and others. Among these, the Solanaceae segment is expected to hold the largest market share through the forecast period. This is attributed to the segment that includes vegetables like tomatoes, peppers, and eggplants, which are widely consumed and cultivated. The strong demand for these vegetables, fueled by the flexibility in preparation, nutritional benefits, and fresh as well as processed applications, enhances the growth of the Solanaceae segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States vegetable seeds market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Monsanto (Bayer CropScience)

- Syngenta Seeds

- Dow AgroSciences (Corteva Agriscience)

- John Deere (John Deere Seeding and Planter Solutions)

- Harris Seeds

- Burpee Seeds

- Sakata Seed America

- Rijk Zwaan USA

- Sevia Seed Company

- Vitalis Organic Seeds

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts regional and country revenue from 2022 to 2033. Spherical Insights has segmented the United States vegetable seeds market based on the below-mentioned segments:

United States Vegetable Seeds Market, By Type

- Open Pollinated Varieties

- Hybrid

United States Vegetable Seeds Market, By Crop Type

- Solanaceae

- Root & Bulb

- Cucurbit

- Brassica

- Leafy

- Others

Need help to buy this report?