United States Van Market Size, Share, and COVID-19 Impact Analysis, By Tonnage Capacity (Up To 2 Tons, 2 To 3 Tons, and 3 To 5.5 Tons), By Propulsion (Electric, Hybrid, Internal Combustion Engine, Hybrids, and Others), and United States Van Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationUnited States Van Market Insights Forecasts to 2035

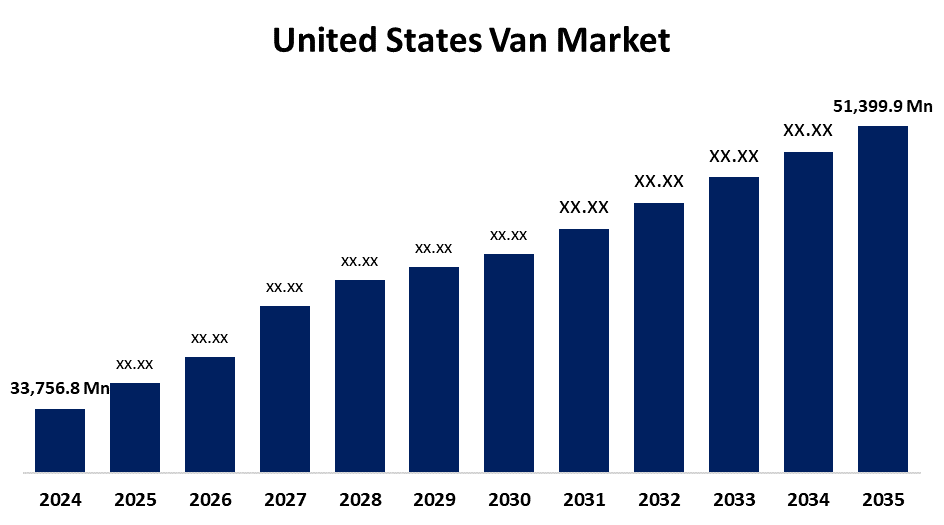

- The US Van Market Size Was Estimated at USD 33,756.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.90% from 2025 to 2035

- The US Van Market Size is Expected to Reach USD 51,399.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United States Van Market Size is anticipated to reach USD 51,399.9 Million by 2035, growing at a CAGR of 3.90% from 2025 to 2035. The expansion of the United States van market is propelled by an increase in last-mile deliveries and e-commerce, as well as consumers' move to electric vans.

Market Overview

A van is a type of vehicle mostly used for transporting consumers or goods. As companies and governments place a greater emphasis on sustainability and lowering carbon emissions, the growing demand for electric vans is propelling the van industry's expansion. Electric van adoption by fleet operators has been aided by regulatory rules, subsidies, and incentives for electric vehicles (EVs), especially in the delivery and logistics industries. Additionally, the price and usefulness of electric vans have increased due to developments in battery technology and the growth of charging infrastructure. These elements are speeding up the switch to electric vans, together with growing fuel prices and growing consciousness of environmental effects. The growing need for adaptable cars made for the nation's many industries, such as small enterprises, construction, and agriculture. As van customisation services have grown in popularity, individuals and companies can now modify vans for special uses, including food trucks, mobile offices, and specialised service vehicles. The "van life" idea has also become very popular in the United States, where many consumers are turning vans into mobile homes for travel and minimalist living. A family-run business founded by veterans, vanLife LLC is situated in Virginia, USA, and provides a convenient and exciting vanLife experience. Travellers are allowed to explore the open road with the company's fleet of well-equipped rental vans. In the US, Rivian has expanded its electric delivery van sales beyond its prior exclusive contract with Amazon to include fleets of all sizes. The business has tested these vans with several sizable fleets in the United States and is getting ready to sell them in other markets.

Report Coverage

This research report categorizes the market for the United States van market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States van market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States van market.

United States Van Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 33,756.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 3.90% |

| 2035 Value Projection: | USD 51,399.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 288 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Tonnage Capacity and By Propulsion |

| Companies covered:: | Ford Motor Co, General Motors Company, GM Motor (Chevrolet), Ram Trucking, Inc., Rivian, Winnebago Industries, Blue Bird Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growth of the United States van market is boosted by an increase in consumers' disposable income and demand. This increase in purchasing power makes it possible for a wider range of consumers to purchase vans for either personal or business use, which propels market expansion. Government policies and supportive regulatory frameworks also contribute to this rise by providing tax breaks and subsidies, which increase the appeal of buying a van. Additionally, rising health and environmental consciousness is encouraging buyers to choose vans that meet sustainability requirements, satisfying the demand for environmentally friendly automobiles. The combined impact of social, political, and economic issues highlights the van market's strong increasing trajectory.

Restraining Factors

The United States van market faces obstacles like the substantial upfront expenses and capital expenditures related to buying and running vehicles. For new businesses and smaller operators that might find it difficult to obtain the required funds, this substantial financial need might be a considerable obstacle.

Market Segmentation

The United States Van Market Share is classified into tonnage capacity and propulsion.

- The up to 2 tons segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States van market is segmented by tonnage capacity into up to 2 tons, 2 to 3 tons, and 3 to 5.5 tons. Among these, the up to 2 tons segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the need for cheap, small, and fuel-efficient vehicles, particularly for last-mile and city operations. These vans provide businesses with the option to effectively transport smaller loads and easily maneuver in heavy traffic in urban city streets. The growth of e-commerce and same-day delivery service has also helped drive demand for lightweight vehicles, as it provides a clear distinction in this space.

- The internal combustion engine segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the propulsion, the United States van market is segmented into electric, hybrid, internal combustion engine, hybrids, and others. Among these, the internal combustion engine segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by continued demand for vehicles that are reliable, affordable, and accessible. For businesses in areas with limited charging infrastructure, ICE vans can provide predictable infrastructure (fuel or petrol stations). They are still often cheaper than electric or hybrid vans (up front) and are therefore attractive to fleet operators and SMEs with constrained budgets. In markets where range, fuelling, and price remain the key deciding factors, ICE vans still dominate the market even when there is a proliferation of alternative energy sources.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States van market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ford Motor Co

- General Motors Company

- GM Motor (Chevrolet)

- Ram Trucking, Inc.

- Rivian

- Winnebago Industries

- Blue Bird Corporation

- Others

Recent Development

- In February 2025, Rivian (RIVN) announced that it had opened orders for its Rivian Commercial van beyond its initial launch partners, potentially paving the way for a lucrative business opportunity. The van was built on the same platform as the electric delivery vans Rivian produced for Amazon (AMZN). Although Rivian originally had an exclusive agreement to produce 100,000 vans for Amazon, the retail giant was using only 20,000 at the time.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States van market based on the following segments:

United States Van Market, By Tonnage Capacity

- Up To 2 Tons

- 2 To 3 Tons

- 3 To 5.5 Tons

United States Van Market, By Propulsion

- Electric

- Hybrid

- Internal Combustion Engine

- Hybrids

- Others

Need help to buy this report?