United States Vaccine Market Size, Share, and COVID-19 Impact Analysis, By Type (Subunit, mRNA, Inactivated, Live Attenuated, and Viral vector vaccines), By Route of Administration (Oral, Parenteral, and Nasal), and United States Vaccine Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareUnited States Vaccine Market Insights Forecasts to 2035

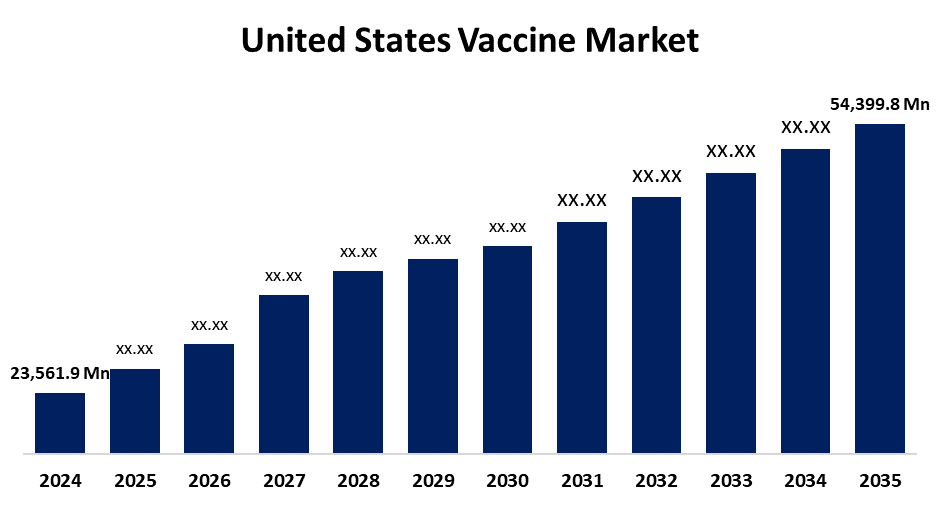

- The US Vaccine Market Size Was Estimated at USD 23,561.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.90% from 2025 to 2035

- The US Vaccine Market Size is Expected to Reach USD 54,399.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Vaccine Market Size is anticipated to reach USD 54,399.8 Million by 2035, growing at a CAGR of 7.90% from 2025 to 2035. The expansion of the United States vaccine market is propelled by a rise in vaccinations against diseases.

Market Overview

Vaccines are biological preparations that teach the immune system to identify and combat particular pathogens, such as bacteria or viruses, without actually causing the disease. One of the major factors increasing the demand for effective immunizations is the country’s growing incidence of infectious diseases. Government intentions to raise vaccination rates and increase public awareness of vaccines are other justifications for raising vaccination rates, which are driving up vaccination rates and expanding the market. Market growth is also being spurred by the increased government and non-government organisations' funding to support product development, a positive reimbursement environment in the country, increasing investment in R&D, and dedication to creating and introducing new goods. The market is expected to grow in the forecast period due to rapid advancements in technology, new influenza vaccine approvals from the US FDA, and intense competition among the players. An example is CSL Seqirus announced in June 2022 that it had completed a USD 156 million expansion of its manufacturing facility in the U.S. This could assist with its development of the cell-based influenza vaccines in prefilled syringes. Another example is that Seqirus submitted a report in October 2021 stating that the FDA in the United States had approved FLUCELVAX QUADRIVALENT, a quadrivalent influenza vaccine. The vaccine is now licensed in the U.S for infants starting at age 6 months. Also, this offering is the first and only approved influenza vaccine in the United States that is based on cells.

Report Coverage

This research report categorizes the market for the United States vaccine market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States vaccine market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States vaccine market.

United States Vaccine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 23,561.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.90% |

| 2035 Value Projection: | USD 54,399.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Route of Administration |

| Companies covered:: | Moderna Inc, Merck & Co Inc, Pfizer Inc, Emergent BioSolutions, Johnson & Johnson, Novavax, Inovio Pharmaceuticals, Inc., GlaxoSmithKline, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States vaccine market is boosted by marketing and increased awareness, with a rise in patient demand for items. Manufacturers are increasing their vaccine production capacity to meet this increase in demand, and, in turn, this will stimulate the market growth during the forecast period. The ideal circumstances for product creation, research, and approval further bolster the growth of the U.S. vaccines industry. Manufacturers are now leaning towards product development based on mRNA. Compared to conventional vaccinations, these have several advantages, namely a shorter manufacturing period and no possibility of side effects.

Restraining Factors

The United States vaccine market faces obstacles like the increasing incidence of infectious diseases. There are still constraints, including the duration of development and product introduction, and the expense of vaccines, which are expected to hinder the growth of the vaccine market. Vaccine manufacturing is a delicate, vital process that generally takes between ten to fifteen years.

Market Segmentation

The United States vaccine market share is classified into type and route of administration.

- The subunit segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States vaccine market is segmented by type into subunit, mRNA, inactivated, live attenuated, and viral vector vaccines. Among these, the subunit segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the increase in the incidence of infectious diseases, the need for safe and effective vaccinations, and the increasing emphasis on preventive healthcare. Also growing is the need for more effective vaccinations against cancer, autoimmune diseases, and allergies. For example, the biotechnology company Curevo Vaccine (Curevo), which specializes in developing vaccines for infectious diseases, completed a $26 million series A1 funding round in November 2022. This funding was for the development of the adjuvanted subunit vaccine CRV-101, which protects against shingles in elderly people.

- The parenteral segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the route of administration, the United States vaccine market is segmented into oral, parenteral, and nasal. Among these, the parenteral segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by increased efficacy, faster absorption, and lower risk of contamination and degradation. One of the reasons for the dominance of this category has to do with a larger majority of vaccines are delivered intramuscularly or subcutaneously, compared to other delivery methods.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States vaccine market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Moderna Inc

- Merck & Co Inc

- Pfizer Inc

- Emergent BioSolutions

- Johnson & Johnson

- Novavax

- Inovio Pharmaceuticals, Inc.

- GlaxoSmithKline

- Others

Recent Development

- In August 2023, Pfizer Inc. received US FDA approval for ABRYSVO (Respiratory Syncytial Virus Vaccine) for the prevention of LRTD and severe LRTD caused by RSV in infants from birth up to six months of age by active immunization of pregnant individuals at 32 through 36 weeks of gestational age.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States vaccine market based on the following segments:

United States Vaccine Market, By Type

- Subunit

- mRNA

- Inactivated

- Live Attenuated

- Viral vector vaccines

United States Vaccine Market, By Route of Administration

- Oral

- Parenteral

- Nasal

Need help to buy this report?