United States Urometer Market Size, Share, and COVID-19 Impact Analysis, By Product (100ml, 200ml, 400ml, 450ml, and 500ml), By Application (Palliative Care, Operative Procedures, Emergency Trauma, and Others), By End-User (Clinics, Hospitals, Home Healthcare, and Others), and US Urometer Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUSA Urometer Market Insights Forecasts to 2035

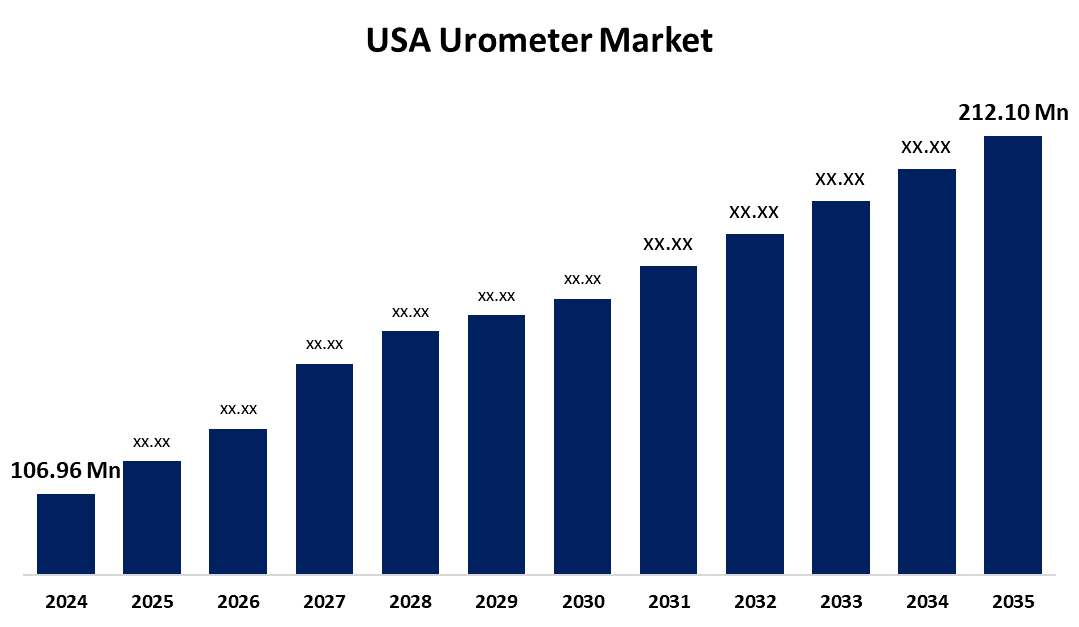

- The US Urometer Market Size was Estimated at USD 106.96 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.42% from 2025 to 2035

- The USA Urometer Market Size is Expected to reach USD 212.10 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Urometer Market Size is anticipated to reach USD 212.10 billion by 2035, Growing at a CAGR of 6.42% from 2025 to 2035. The market growth is attributed to the increasing prevalence of urological illness and the growing proportion of the geriatric population.

Market Overview

The US urometer market is a segment that focuses on manufacturing, distributing, and using urometers for precise urine output measurement in healthcare settings, especially in clinics, hospitals, home healthcare, and intensive care units (ICUs) for the monitoring of kidney disorders, urinary tract infections, and post-operative conditions. Urometers are instruments that measure urine output precisely, giving vital information for treating electrolyte disorders and fluid imbalances. They are especially crucial in situations where a drop in blood volume is expected, such as shock, severe burns, and major illnesses or injuries. Because it lowers hospital readmissions, lowers healthcare costs, and improves patient comfort, the growing demand for home healthcare offers the urometer market a substantial opportunity. The growing elderly population and long-term illnesses like kidney disease and urine incontinence also have an impact on the industry. Caregivers monitor patients remotely because of advancements in intelligent and portable urometers with wireless connectivity and live monitoring features. The usage of urometers at home is encouraged by the incorporation of digital health solutions such as telemedicine and remote patient monitoring. This market is anticipated to develop significantly as healthcare systems move toward decentralized care models.

Report Coverage

This research report categorizes the market for the US urometer market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US urometer market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US urometer market.

United States Urometer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 106.96 Million |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 6.42% |

| 2035 Value Projection: | USD 212.10 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 199 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | Cardinal Health, ConvaTec Group PLC, Teleflex Inc., Observe Medical, Medline Industries, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The rising incidence of urological conditions such as kidney stones, urinary tract infections, and bladder dysfunctions is driving a notable expansion in the urometer market. An important factor in the diagnosis and treatment of these disorders is the aging population. Urometers are essential for this purpose. Urinary problems can be caused by obesity, bad diets, and unhealthy lifestyles. More and more medical facilities throughout the world are utilizing sophisticated urometers to improve patient care and diagnostic precision. Technological developments, including disposable urometers, electronic health records, and smart urometers with real-time tracking, have propelled market expansion. More durable, lightweight, and user-friendly urometers are also the result of advances in material science. Hospital and home healthcare automation has fueled the demand for advanced urometers. Market expansion will be sustained by the continuous advancements in urometer technology.

Restraining Factors

The risk of catheter-associated urinary tract infections (CAUTIs), the high cost of sophisticated urometers, regulatory obstacles, a lack of knowledge about home healthcare, presence of alternative fluid monitoring technologies might impede the market growth.

Market Segmentation

The USA urometer market share is classified into product, application, and end-user.

- The 500ml segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US urometer market is segmented by product into 100ml, 200ml, 400ml, 450ml, and 500ml. Among these, the 500ml segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is attributed to the increased prevalence of incontinence, bladder cancer, and other urological conditions. The growing elderly population and hospital admissions, especially of elderly patients, will fuel segment expansion.

- The operative procedures segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US urometer market is segmented by application into palliative care, operative procedures, emergency trauma, and others. Among these, the operative procedures segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to increased surgical procedures requiring post-operative care and growing knowledge of diagnosing and treating urological issues in the US.

- The hospitals segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US urometer market is segmented by end-user into clinics, hospitals, home healthcare, and others. Among these, the hospitals segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental expansion is ascribed to the rising admissions in the emergency ward, growing cases of urological diseases in the aged population, and increasing proportion of surgical procedures.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US urometer market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cardinal Health

- ConvaTec Group PLC

- Teleflex Inc.

- Observe Medical

- Medline Industries

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US urometer market based on the below-mentioned segments:

US Urometer Market, By Product

- 100ml

- 200ml

- 400ml

- 450ml

- 500ml

US Urometer Market, By Application

- Palliative Care

- Operative Procedures

- Emergency Trauma

- Others

US Urometer Market, By End-User

- Clinics

- Hospitals

- Home Healthcare

- Others

Need help to buy this report?