United States Turf and Ornamental Protection Market Size, Share, and COVID-19 Impact Analysis, By Function (Fungicide, Herbicide, Insecticide, Molluscicide, and Nematicide) and By Application (Chemigation, Foliar, Fumigation, Seed Treatment, and Soil Treatment), and United States Turf and Ornamental Protection Market Insights, Industry Trend, Forecasts to 2035.

Industry: AgricultureUnited States Turf and Ornamental Protection Market Insights Forecasts to 2035

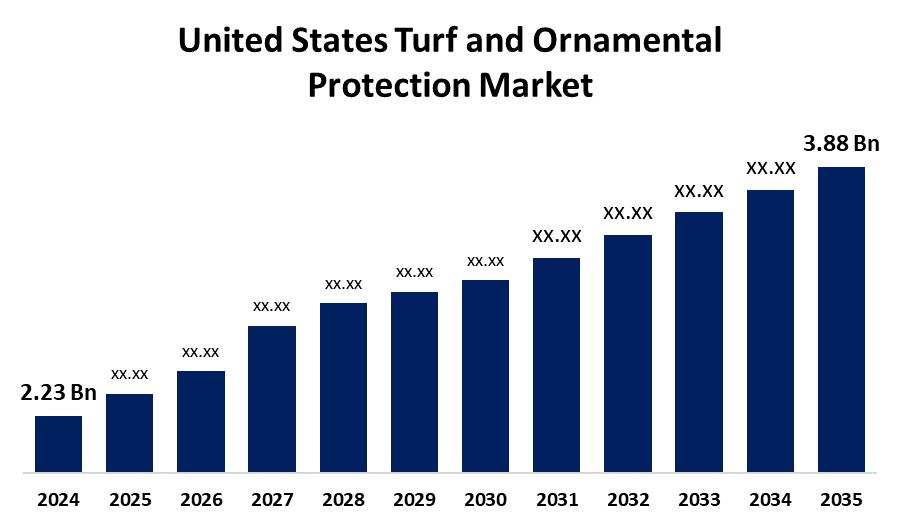

- The U.S. Turf and Ornamental Protection Market Size was estimated at USD 2.23 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.16% from 2025 to 2035

- The USA Turf and Ornamental Protection Market Size is Expected to Reach USD 3.88 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The US Turf and Ornamental Protection Market Size is Anticipated to reach USD 3.88 Billion By 2035, Growing at a CAGR of 5.16% from 2025 to 2035. The U.S. turf and ornamental protection market is growing steadily, driven by demand for aesthetic landscapes, sustainable practices, and innovative crop protection solutions tailored for lawns, golf courses, and ornamental plants.

Market Overview

The United States turf and ornamental protection market refers to products and solutions intended to protect lawns, gardens, golf courses, sports fields, and other landscaped turf and ornamental plants from pests, diseases, and environmental stress. The market covers chemical and biological products like herbicides, insecticides, fungicides, and biopesticides, as well as adjuvants and fertilizers. Moreover, factors for growth in the U.S. turf and ornamental protection industry are the growing interest in environmentally friendly landscaping options, urbanisation increasing the demand for green space, and the growth of the golf and sporting industry, all compelling the demand for environmentally responsible and efficient turf care products. Furthermore, major players are driven the market with innovations like slow-release fertilizers, green herbicides and fungicides, AI-based pest monitoring systems, and intelligent irrigation technologies, making it more efficient, sustainable, and targeted for turf and ornamental care.

Report Coverage

This research report categorizes the market for the U.S. turf and ornamental protection market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States turf and ornamental protection market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA turf and ornamental protection market.

United States Turf and Ornamental Protection Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.23 Billion |

| Forecast Period: | 2025-2035 |

| 2035 Value Projection: | USD 3.88 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Function, By Application and COVID-19 Impact Analysis |

| Companies covered:: | American Vanguard Corporation, BASF SE, Corteva Agriscience, Environmental Science US LLC (Envu), FMC Corporation, Gowan Company, Mitsui & Co. Ltd (Certis Belchim), Nufarm Ltd, Syngenta Group, UPL Limited, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The U.S. turf and ornamental protection industry is drive by expanding demand for attractive landscapes, greater emphasis on lawn maintenance due to improved disposable incomes, and the growing environmentally conscious consumer seeking sustainable solutions. Urbanization and the increase in recreational areas, including parks and sports fields, also fuel the growth of the market, along with the formulation of advanced chemicals that provide lasting protection with a low environmental footprint.

Restraining Factors

Restraining factors are high prices of premium turf care products, regulatory restrictions on the use of chemical pesticides, low awareness of sustainable options, and environmental concern regarding the long-term effect of some chemicals for protecting turf.

Market Segmentation

The United States turf and ornamental protection market share is classified into function and application.

- The herbicide segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States turf and ornamental protection market is segmented by function into fungicide, herbicide, insecticide, molluscicide, and nematicide. Among these, the herbicide segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by the prevalence of weed infestations affecting turf and ornamental crops. Common weeds such as crabgrass, goosegrass, barnyardgrass, and foxtail necessitate extensive herbicide application to maintain the health and appearance of these areas.

- The foliar segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States turf and ornamental protection market is segmented by application into chemigation, foliar, fumigation, seed treatment, and soil treatment. Among these, the foliar segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its efficiency in targeting specific plant areas, quick absorption of active ingredients, and ability to combat pests and diseases directly on leaves and stems. This method offers precise, fast, and effective pest control.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US turf and ornamental protection market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- American Vanguard Corporation

- BASF SE

- Corteva Agriscience

- Environmental Science US LLC (Envu)

- FMC Corporation

- Gowan Company

- Mitsui & Co. Ltd (Certis Belchim)

- Nufarm Ltd

- Syngenta Group

- UPL Limited

- Others

Recent Developments:

- In April 2023, Nufarm introduced a new liquid formulation fungicide, Tourney EZ, specifically for turf and ornamental crops on the back of customer demand, which further reinforces the company's position in turf and ornamental crop protection.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the USA turf and ornamental protection market based on the below-mentioned segments

United States Turf and Ornamental Protection Market, By Function

- Fungicide

- Herbicide

- Insecticide

- Molluscicide

- Nematicide

United States Turf and Ornamental Protection Market, By Application

- Chemigation

- Foliar

- Fumigation

- Seed Treatment

- Soil Treatment

Need help to buy this report?