United States Trocars Market Size, Share, and COVID-19 Impact Analysis, By Product (Disposable and Reusable), By Tip (Bladeless Trocars, Optical Trocars, Blunt Trocars, and Bladed Trocars), and United States Trocars Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Trocars Market Insights Forecasts to 2035

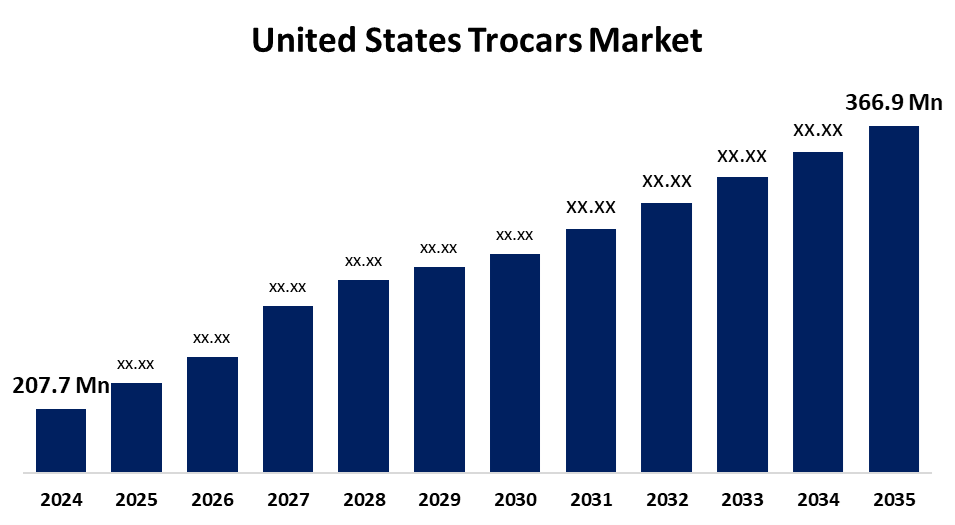

- The US Trocars Market Size Was Estimated at USD 207.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.31% from 2025 to 2035

- The US Trocars Market Size is Expected to Reach USD 366.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States Trocars Market Size is anticipated to reach USD 366.9 Million by 2035, Growing at a CAGR of 5.31% from 2025 to 2035. The expansion of the United States trocars market is propelled by an ageing population, favourable reimbursement policies, and an increasing dependence on laparoscopy.

Market Overview

A trocar is a type of specialised surgical tool used to enter bodily cavities. One of the factors driving the growth of the trocars industry is the increasing prevalence of chronic diseases. These include liver disorders, endometriosis, some cancers, and irritable bowel syndrome (IBS). A considerable number of consumers are still afflicted with these disorders, leading to an upsurge in surgical procedures and further stimulating the demand for trocars. Furthermore, as the prevalence of certain tumours such as colorectal cancer rises, there is an increasing need for minimally invasive procedures that enhance patient outcomes and hasten recovery. In the United States, there were roughly 150,000 new cases of colorectal cancer in 2024, according to data published by the Colon Cancer Coalition. Of additional importance, a majority of interventions target an older demographic, which is more susceptible to chronic diseases, such as cancer or heart events. Additionally, anticipate population growth, with a particular emphasis on the baby boomer group as a developing demographic trend. Therefore, expect a larger, aging population, which will foster the need for additional surgical interventions and an overall expanding trocars market.

The U.S. federal policy and regulation frameworks have been key to funding growth and innovation in the U.S. trocar markets. The U.S. FDA and Center for Devices and Radiological Health (CDRH) oversee trocar safety and effectiveness through a rigorous 510(k) process and pre-market approval process, while at the same time encouraging innovation through its Breakthrough Devices Program and Total Product Life Cycle (TPLC) Advisory Program.

Report Coverage

This research report categorizes the market for the United States trocars market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States trocars market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States trocars market.

United States Trocars Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 207.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.31% |

| 2035 Value Projection: | USD 366.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 94 |

| Segments covered: | By Product, By Tip |

| Companies covered:: | Applied Medical Resources, The Cooper Companies Inc, Teleflex Inc, Johnson & Johnson, Stryker Corporation, Medtronic, Baxter International, ConMed Corporation, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States trocars market is boosted by the increasing demand for trocar-guided minimally invasive surgical approaches. These minimally invasive surgical approaches, which allow for reduced length of stay, quicker recovery times, and lower cost of care, are appealing to both patients and providers. Advancements in trocar design, which enhance ergonomics, safety, and material selection, allow for increased efficiency and safety in performing the surgical procedure. As an example, bladeless and optical trocars offer reduced risk of injury during insertion and improved visualization.

Restraining Factors

The United States trocars market faces obstacles like the cost of advanced trocars and associated surgical devices will be excessive for hospitals and clinics, especially smaller facilities. New trocars, which have been developed within the last few years, may be impeded by their extremely high price point.

Market Segmentation

The United States trocars market share is classified into product and tip.

- The disposable segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States trocars market is segmented by product into disposable and reusable. Among these, the disposable segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because of its growing relevance in laparoscopic surgical procedures and diagnostic laparoscopy. Disposable trocars are routinely utilized as access portals to enter cameras into the abdominal cavity in laparoscopic procedures. The disposable designs provide quick and easy setups of each procedure while maintaining sterility, reducing infection risk, and eliminating of reprocessing.

- The bladeless trocars segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the tip, the United States trocars market is segmented into bladeless trocars, optical trocars, blunt trocars, and bladed trocars. Among these, the bladeless trocars segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by its versatility for use, flexible use, and method of entry to access the abdominal cavity during laparoscopic surgery. The industry is also expected to be driven within the next few years by its low risk of infection and ease of use.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States trocars market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Applied Medical Resources

- The Cooper Companies Inc

- Teleflex Inc

- Johnson & Johnson

- Stryker Corporation

- Medtronic

- Baxter International

- ConMed Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States trocars market based on the following segments:

United States Trocars Market, By Product

- Disposable

- Reusable

United States Trocars Market, By Tip

- Bladeless Trocars

- Optical Trocars

- Blunt Trocars

- Bladed Trocars

Need help to buy this report?