United States Toys Market Size, Share, and COVID-19 Impact Analysis, By Type (Action Figures, Building Sets, Dolls, Games and Puzzles, Sports & Outdoor Toys, Plush, Others), By Age Group (Up to 5 Years, 5 to 10 Years, Above 10 Years), and United States Toys Market Insights Forecasts to 2033

Industry: Consumer GoodsUnited States Toys Market Insights Forecasts to 2033

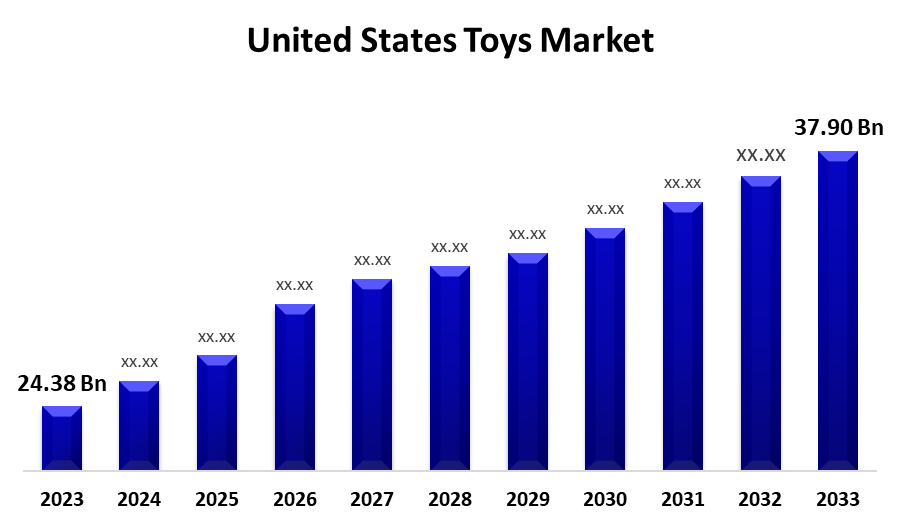

- The United States Toys Market Size was valued at USD 24.38 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.5% from 2023 to 2033.

- The United States Toys Market Size is Expected to Reach USD 37.90 Billion by 2033.

Get more details on this report -

The United States Toys Market Size is expected to reach USD 37.90 Billion by 2033, at a CAGR of 4.5% during the forecast period 2023 to 2033.

Market Overview

Toys are objects intended for children that are designed for play, entertainment, and education. These items serve a variety of functions, such as stimulating creativity, promoting cognitive development, and encouraging social interaction. Toys come in a variety of shapes and sizes, including action figures, dolls, puzzles, board games, building blocks, and electronic devices. They are critical to a child's physical, emotional, and intellectual development. Toys can help children improve their motor skills, hand-eye coordination, and problem-solving abilities. Toy play allows them to explore various scenarios, encouraging emotional expression and empathy. Educational toys are specifically designed to teach concepts such as letters, numbers, and shapes, making learning fun and interactive. Toys have cultural significance as well, as they reflect societal values and trends. By sharing, cooperating, and negotiating with others, children develop social skills as they interact with toys. Toys have also evolved in tandem with technological advancements, incorporating interactive features and digital interfaces to accommodate modern learning methods.

Report Coverage

This research report categorizes the market for United States toys market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States toys market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States toys market.

United States Toys Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 24.38 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.5% |

| 2033 Value Projection: | USD 37.90 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Age Group |

| Companies covered:: | Mattel Inc, Hasbro Inc, Lego, Spin Mater Corp, Vtech, Manhattan Associates, Funko, JAKKS Pacific and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

As economies grow and living standards rise, parents are allocating a larger portion of their income to provide enriching experiences and developmental tools for their children. With more disposable income, parents can prioritize the purchase of high-quality, technologically advanced toys that correspond to their goals for their children's education and entertainment. This trend is especially visible in emerging economies, where a growing middle class wants to provide their children with a diverse range of toys that promote learning, creativity, and skill development. Moreover, parents are increasingly looking for toys that provide more than just entertainment; they prioritize products that aid in their child's cognitive development and educational advancement. Parents choose STEM-focused toys that promote critical thinking, problem-solving, and technological literacy in order to prepare their children for a rapidly changing world. This shift in preference has resulted in an increase in demand for toys that integrate science, technology, engineering, and mathematics concepts in novel and engaging ways, in line with current educational trends.

Restraining Factors

Online games are popular among children because they can be played on smartphones and tablets without the use of a separate play kit. This will most likely pose challenges to the growth of video console kit makers' businesses, stifling industry growth. Furthermore, the occurrence of skin rashes associated with the prolonged use of dolls and construction play kits (due to the presence of harmful chemicals such as phthalates, lead, and flame-retardant chemicals) is influencing consumer preferences.

Market Segment

- In 2023, the sports & outdoor toys segment accounted for the largest revenue share over the forecast period.

Based on the type, the United States toys market is segmented into action figures, building sets, dolls, games and puzzles, sports & outdoor toys, plush, and others. Among these, the sports & outdoor toys segment has the largest revenue share over the forecast period. Parents and caregivers' emphasis on physical activity and a healthy lifestyle drives demand for outdoor and sports-related toys. These toys encourage active play in children, promoting physical development and well-being. Furthermore, the allure of outdoor and sports toys stems from their ability to provide a variety of experiences.

- In 2022, the 5 to 10 years segment accounted for the largest revenue share over the forecast period.

Based on the age group, the United States toys market is segmented into Up to 5 years, 5 to 10 years, and above 10 years. Among these, the 5 to 10 years segment has the largest revenue share over the forecast period. This age group is distinguished by a critical period of cognitive and physical development in which children are especially receptive to learning through play. Children actively engage in exploring their surroundings, honing their motor skills, and developing their social abilities as they progress from early childhood to pre-adolescence. Children in this age range are more capable of comprehending complex concepts and engaging in imaginative play scenarios, making them an ideal target audience for a wide range of toys. Parents seeking to improve their child's cognitive development are particularly interested in educational toys that stimulate creativity, critical thinking, and problem-solving.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States toys market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mattel Inc

- Hasbro Inc

- Lego

- Spin Mater Corp

- Vtech

- Manhattan Associates

- Funko

- JAKKS Pacific

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In 2023, Toys "R" Us and Macy's have collaborated to create a "Hot Toy List" for the upcoming holiday season. Geoffrey's Hot Toy List for 2023 is named after the iconic Toys "R" Us mascot, Geoffrey, and features a mix of beloved classics and the latest trending toys and games. This partnership between Toys "R" Us and Macy's is a natural fit, especially given that Toys "R" Us now operates year-round within every Macy's-branded store.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States toys market based on the below-mentioned segments:

United States Toys Market, By Type

- Action Figures

- Building Sets

- Dolls

- Games and Puzzles

- Sports & Outdoor Toys

- Plush

- Others

United States Toys Market, By Age Group

- Up to 5 Years

- 5 to 10 Years

- Above 10 Years

Need help to buy this report?