United States Tokenization Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution and Services), By Application Area (Payment Security, User Authentication, Compliance Management, and Others), and United States Tokenization Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialUnited States Tokenization Market Insights Forecasts to 2035

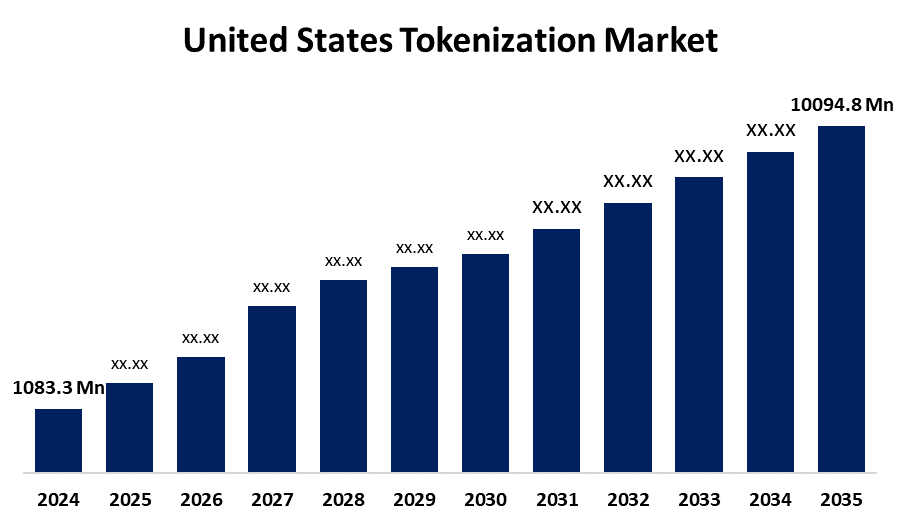

- The US Tokenization Market Size Was Estimated at USD 1083.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 22.5% from 2025 to 2035

- The US Tokenization Market Size is Expected to Reach USD 10094.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Tokenization Market Size is anticipated to reach USD 10094.8 Million by 2035, growing at a CAGR of 22.5% from 2025 to 2035. The expansion of the United States tokenization market is propelled by the growing use of digital procedures and the digital management of all private information.

Market Overview

The tokenisation is the process of using secure mapping systems to transform sensitive or valuable real data or assets into digital or non-sensitive representations called tokens. With advances in technology, advanced data security offerings, solutions, and services have come to the market. The growth of the market continues alongside technological advancement, as both are correlated. When businesses rapidly digitalized their services, technology proved to be a solid method of securing sensitive data. Demand and an explosion of digital payments led to the growth of data security. Organizations must ensure security to protect sensitive data from financial and other fraud types. The increasing use of payment gateways and the rising amount of regulations governing the use of personal data are key trends in the industry. The obligation of being in a secure payment gateway continues to rise, with the growing issue of data breaches in the market. With a transaction involving currency, consumers are trending towards more secure payment gateway options as a result of paying with a payment gateway option.

Report Coverage

This research report categorizes the market for the United States tokenization market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States tokenization market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States tokenization market.

United States Tokenization Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1083.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 22.5% |

| 2035 Value Projection: | USD 10094.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Component and By Application Area |

| Companies covered:: | Visa Inc Class A, Mastercard Inc Class A, American Express Co, Fiserv Inc, tZERO, Tokensoft, Fireblocks, Anchorage Digital, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States tokenization market is boosted by the rapid growth in digital payment systems. To guard against security vulnerabilities created by the volume of digital payments, users in the banking, retail, healthcare, finance, and insurance sectors are already using tokenisation to replace sensitive data with a unique code, called a token. Coupled with increasing rates of security incidents and vulnerabilities related to digital payments, businesses and consumers are looking for ways to improve compliance while reducing risk exposure.

Restraining Factors

The United States tokenization market faces obstacles like the lack of consensus regulations. The security token value draft regulation is still in the early stages of development and expected to change significantly over time. These issues and the aspect of blockchain technology offline is making it harder for tokenisation to gain wider adoption.

Market Segmentation

The United States tokenization market share is classified into component and application area.

- The solution segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States tokenization market is segmented by component into solution and services. Among these, the solution segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven as the market allows industries to become fully digitized, and data security becomes the backbone of this. The solutions component segment is essential for businesses that need quick solutions to data security. The segment also enables industries to abide by the guidelines imposed by regulatory bodies. With the help of the solution component, industries can aid in advancing their data security in broad strokes for many industries.

- The payment security segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application area, the United States tokenization market is segmented into payment security, user authentication, compliance management, and others. Among these, the payment security segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the rapid expansion of digital payments, which has led banks and payment app developers to implement this solution to help protect the sensitive data of consumers. As QR code payments continue to gain traction post-pandemic, tokenization enables users to perform quick payments without worrying about sensitive card data being leaked. This data protection solution enhances the operational performance of payment apps by generating a solid base of security.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States tokenization market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Visa Inc Class A

- Mastercard Inc Class A

- American Express Co

- Fiserv Inc

- tZERO

- Tokensoft

- Fireblocks

- Anchorage Digital

- Others

Recent Development

- In December 2023, Akemona, Inc., an asset tokenization platform and funding portal, announced agreements with new issuers to enable equity token offerings on the Akemona platform. Akemona, Inc., which operates under the U.S. Securities and Exchange Commission (SEC), offers issues with smart bonds and digital stocks and provides asset tokenization services to corporations and financial institutions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States tokenization market based on the following segments:

United States Tokenization Market, By Component

- Solution

- Services

United States Tokenization Market, By Application Area

- Payment Security

- User Authentication

- Compliance Management

- Others

Need help to buy this report?