United States Tire Machinery Market Size, Share, and COVID-19 Impact Analysis, By Structure (bias tires and radial tires), By End-user (automotive, aircraft, agriculture, and others), and United States Tire Machinery Market Insights, Industry Trend, Forecasts to 2035.

Industry: Automotive & TransportationUnited States Tire Machinery Market Insights Forecasts to 2035

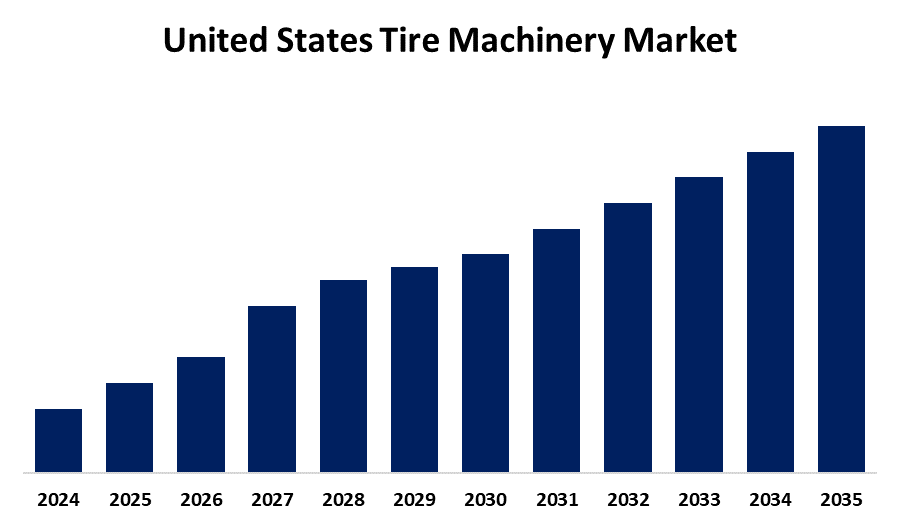

- The United States Tire Machinery Market Size is Expected to Grow at a CAGR of around 4.7% from 2025 to 2035.

- The U.S. Tire Machinery Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States tire Machinery Market Size is Expected to hold a significant share By 2035, Growing at a CAGR of 4.7% from 2025 to 2035. The U.S. tire machinery market is growing due to rising vehicle ownership, increasing demand for replacement tires, advancements in manufacturing technology, and the expansion of electric vehicles and logistics sectors, all supported by favourable government regulations and infrastructure development.

Market Overview

The U.S. tire machinery market is defined as the machinery employed to make tires, like rubber mixers and tire-building machines. Growth in the market is driven by the growing automobile industry, an increase in the number of cars owned, and growing demand for replacement tires. Growth in e-commerce, adoption of electric vehicles, and an intense drive toward automation and technologies further propel the market. Its strength lies in a large vehicle parc, strong road infrastructure, and a healthy tire aftermarket. Huge opportunities lie in the mining, agricultural, and construction sectors with the electrification drive and the need for low-maintenance, long-life tires. Furthermore, government policy and incentives directed towards safety, efficiency, and sustainability, e.g., those related to tire fuel efficiency and rolling resistance, are influencing market dynamics.

Report Coverage

This research report categorizes the market for the United States tire machinery market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States tire machinery market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States tire machinery market.

United States Tire Machinery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.7% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 96 |

| Segments covered: | By Structure, By End-user and COVID-19 Impact Analysis |

| Companies covered:: | Toyo Tire U.S.A. Corp., Goodyear Tire & Rubber Company, Kumho Tire U.S.A., Inc., Michelin North America, Inc., Bridgestone Americas, Inc., Continental Tire the Americas, LLC, Pirelli Tire North America, Hankook Tire America Corp., Yokohama Tire Corporation, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The US tire machinery industry is propelled by various fundamental drivers, which include the growth in the automotive sector, increased vehicle ownership, and the growing demand for replacement tires. Advancements in the e-commerce and logistics industries, as well as the increasing use of electric vehicles, also increase demand. Technological innovations and the impetus for automating tire production also contribute significantly. Also, government policies encouraging fuel efficiency, environmental care, and safety regulations, together with subsidies for agricultural mechanization and the uptake of electric heavy equipment, are impacting market growth. These factors cumulatively stimulate investment and innovation in tire-making machinery.

Restraining Factors

The US tire machinery market is led by various restraining elements, such as the high price of machinery and automation technology, which might be challenging for small and medium-sized manufacturers. Furthermore, the market suffers due to unstable raw material prices and global supply chain disruptions, affecting production schedules and costs. Harsh environmental regulations and compliance can also create challenges, enhancing the complexity of operations and costs for manufacturers based in the country.

Market Segmentation

The U.S. tire machinery market share is classified into structure and end user.

- The radial tires segment accounted for the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States tire machinery market is segmented by structure into bias tires and radial tires. Among these, the radial tires segment accounted for the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to radial tires' better performance and longevity. In particular, radial tires provide benefits such as longer life, improved fuel efficiency, and increased safety through their design. Moreover, their increased traction, lower rolling resistance, and more comfortable ride quality make them perfect for contemporary cars.

- The automotive segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The USA tire machinery market is segmented by end-user into automotive, aircraft, agriculture, and others. Among these, the automotive segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing mainly to the country's robust automobile sector, high rate of car ownership, and huge population. There is a high demand for tires and high demand for equipment to produce, fix, and maintain them.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. tire machinery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Toyo Tire U.S.A. Corp.

- Goodyear Tire & Rubber Company

- Kumho Tire U.S.A., Inc.

- Michelin North America, Inc.

- Bridgestone Americas, Inc.

- Continental Tire the Americas, LLC

- Pirelli Tire North America

- Hankook Tire America Corp.

- Yokohama Tire Corporation

- Others

Recent Developments:

- In October 2024, Toyo Tires has unveiled the Proxes Sport 2, a max-performance summer tire designed for electric sports cars, CUVs and SUVs. The tire has been optimized for spirited driving, offering precise handling and grip.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S., regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States tire machinery market based on the below-mentioned segments

USA Tire Machinery Market, By Structure

- Bias tires

- Radial tires

USA Tire Machinery Market, By End-user

- Automotive

- Aircraft

- Agriculture

- others

Need help to buy this report?