United States Tequila Market Size, Share, and COVID-19 Impact Analysis, By Product (Blanco, Reposado, Anejo, and Super Premium), By Grade (Value, Premium, High-End Premium, and Super Premium), and United States Tequila Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited States Tequila Market Insights Forecasts to 2035

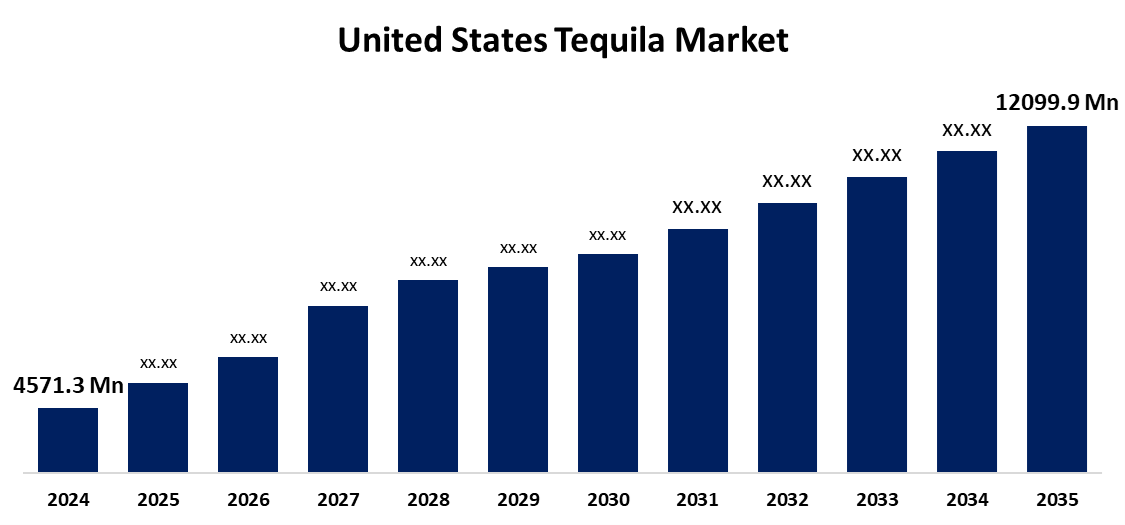

- The US Tequila Market Size Was Estimated at USD 4,571.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.25% from 2025 to 2035

- The US Tequila Market Size is Expected to Reach USD 12,099.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States Tequila Market Size is anticipated to Reach USD 12,099.9 Million by 2035, Growing at a CAGR of 9.25% from 2025 to 2035. The expansion of the United States' tequila market is propelled by the rising demand for artisanal and high-end tequila.

Market Overview

Tequila is a distilled alcoholic beverage exclusively created from the fermentation of the blue weber agave plant. One of the primary objectives driving the tequila market in the U.S. is the mounting demand from consumers for high-end premium spirits. As customers are becoming increasingly aware of tequila's origin and craftsmanship, they are growing more likely to favor 100% agave tequila, particularly aged varieties like reposado and anejo. For instance, humano tequila introduced joven, blanco, anejo, and reposado tequila in the U.S. market in August 2024. In addition, they are tapping into a growing segment characterized by demand for craft beverages and an overarching trend of seeking authentic, artisanal goods. Several significant reasons have contributed to the growth of the tequila market and the premiumization of the spirits sector as a whole, which was fuelled by rising disposable income and consumer demand for unusual experiences. The rise of celebrity tequila brands and celebrity endorsements only increases the commercial good news about the spirit industry's excitement and high-end possibilities. Celebrity endorsements affect consumer perceptions during the buying process and indirectly influence purchasing decisions, as they are an important part of tequila sales in the United States. They have helped strengthen the connection between celebrities and the spirit. In addition, celebrity endorsements add to tequila's perception as a premium product; they also inject a variety of people into the tequila category, especially younger drinkers who admire and idolize the same stars.

Report Coverage

This research report categorizes the market for the United States tequila market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States tequila market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States tequila market.

United States Tequila Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4,571.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 9.25% |

| 2035 Value Projection: | USD 12,099.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Product, By Grade |

| Companies covered:: | Pattern Brands, Brown-Forman Corporation, Heaven Hill Distilleries, Inc, Sazerac Company Inc., Constellation Brands, Inc., Jose Cuervo, Don Julio, Casamigos, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the main factors driving the expansion of the US tequila industry is the growing appreciation of various artisan spirits among consumers the demand for distilled spirits from blue agave plants. Consumer demand for tasty, exciting, exotic alcohol-based beverages with unique taste and their expanding appeal is creating growth in the tequila market. Major producers such as Patron Spirits used flavours such as floral, black pepper, turmeric, and pumpkin to lure consumers and take advantage of new flavours.

Restraining Factors

The United States tequila market faces obstacles because low or no alcohol beverages are becoming popular as consumers gain awareness regarding the harmful effects of alcohol consumption. A significant number of alcohol consumers, nearly 52% of U.S. consumers, are actively trying to reduce consumption, according to the 2019 IWSR report.

Market Segmentation

The United States tequila market share is classified into product and grade.

- The Blanco segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States tequila market is segmented by product into Blanco, reposado, Anejo, and super premium. Among these, the Blanco segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by it as it provides the base for many different cocktails, especially traditional margaritas and palomas. Its dominance in the marketplace is largely based on the versatility of the product, which ensures that it will be a permanent fixture at the bar and restaurant level.

- The super premium segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the grade, the United States tequila market is segmented into value, premium, high-end premium, and super premium. Among these, the super premium segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is propelled because it reflects changing consumer preferences and market forces. Consumers want super premium spirits, primarily to experience a more original and refined drinking experience.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States tequila market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pattern Brands

- Brown–Forman Corporation

- Heaven Hill Distilleries, Inc

- Sazerac Company Inc.

- Constellation Brands, Inc.

- Jose Cuervo

- Don Julio

- Casamigos

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States tequila market based on the following segments:

United States Tequila Market, By Product

- Blanco

- Reposado

- Anejo

- Super Premium

United States Tequila Market, By Grade

- Value

- Premium

- High-End Premium

- Super Premium

Need help to buy this report?