United States Television Market Size, Share, and COVID-19 Impact Analysis, By Type (Smart TV, LCD & Plasma & LED TVs, and CRT & Rear-Projection TVs), By Distribution Channel (Online and Offline), and United States Television Market Insights, Industry Trend, Forecasts to 2035.

Industry: Electronics, ICT & MediaUnited States Television Market Insights Forecasts to 2035

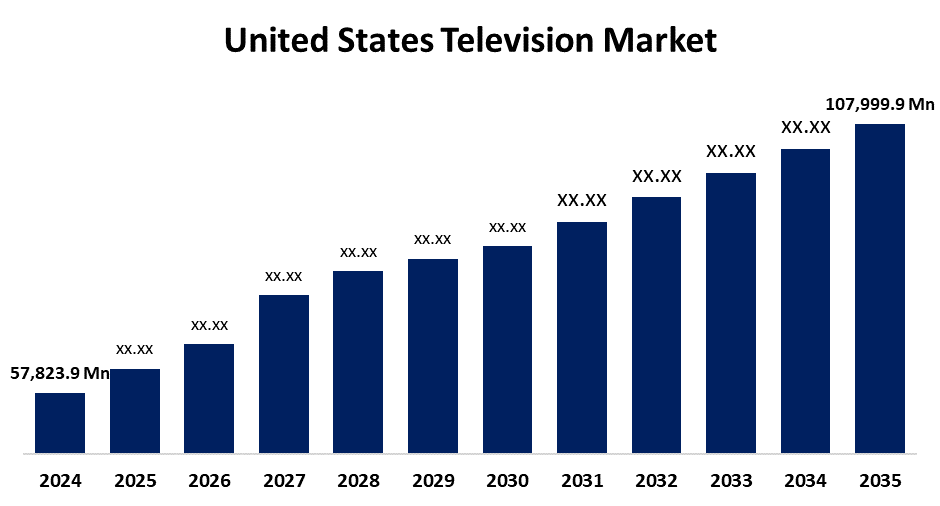

- The US Television Market Size Was Estimated at USD 57,823.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.84% from 2025 to 2035

- The US Television Market Size is Expected to Reach USD 107,999.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Television Market Size is anticipated to reach USD 107,999.9 Million by 2035, growing at a CAGR of 5.84% from 2025 to 2035. The expansion of the United States television market is propelled by growing disposable budgets, technological developments, and changing customer preferences for smart features and bigger screens.

Market Overview

Television (TV) is a communication medium that uses sound and moving pictures to deliver commercials, entertainment, and information. Some of the main factors influencing the industry are the advancement of technology, the consumer discretionary income growth, and the diversity of consumer behaviors. With the popularity of smart TVs and video streaming services, there is a beginning of the demand for a better viewing experience. One of the opportunities the market is anticipated to realise or tap into is the fact that consumers can now purchase televisions more easily and affordably due to the development of more online retailers and the advancement of smart technologies, such as artificial intelligence (AI) on televisions, to advance appliance technology and provide consumers with comfort. Additionally, televisions are now capable of computing to control and monitor smart home devices with related trends of home automation and the Internet of Things. In recent years, demand for televisions with 4K and 8K resolutions, which have better image quality and an incredible viewing experience, has increased. Likewise, the demand for curved and foldable televisions has opened new markets for small multi-use entertainment systems. Warner Bros discovery announced a strategic separation of studio, streaming, and linear cable operations into two companies. The aim is to better align operations and to position the business for future growth in the evolving media ecosystem.

Report Coverage

This research report categorizes the market for the United States television market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States television market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States television market.

United States Television Market Report Coverage

| Report Coverage | Details |

|---|---|

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.84% |

| 2035 Value Projection: | USD 107,999.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 231 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Distribution Channel |

| Companies covered:: | Vizio Holding Corp. Ordinary Shares - Class A, Element Electronics, Samsung, LG, Sony, Hisense, TCL, Insignia, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States television market is boosted by the expanding acceptance of streaming services, virtual reality, and augmented reality. The growth of streaming services has led many customers to ask for higher-grade televisions, with larger sizes, better resolutions, and potential features that might give them a more immersive experience. For example, LG Electronics launched the first OLED panel. LG Electronics' state-of-the-art televisions offer features, such as better resolution and lenses with fewer blackening imperfections that will not typically be found in traditional liquid crystal display models.

Restraining Factors

The United States television market faces obstacles like the evolution of infrastructure and technology. In places with poor internet, smart TVs will not perform, thus affecting the consumer's interest. Additionally, some tech-savvy consumers may find the smart TV interface too complicated to operate and eventually accept.

Market Segmentation

The United States television market share is classified into type and distribution channel.

- The smart TV segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States television market is segmented by type into smart TV, LCD & plasma & LED TVs, and CRT & rear-projection TVs. Among these, the smart TV segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the increased demand for the product among consumers. Smart TVs offer a more meaningful viewing experience and come with greater functionality and applications than standard television. The digitalisation of the broadcasting sector and increased internet penetration rates will contribute to market growth throughout the forecast period.

- The offline segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the United States television market is segmented into online and offline. Among these, the offline segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the supermarkets, hypermarkets, specialty shops, independent retail shops, etc. The organised retail sector has provided better visibility on consumer electronics. Furthermore, it is expected that the fast-growing organised retail sector in the US will further increase demand for products during the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States television market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Vizio Holding Corp. Ordinary Shares - Class A

- Element Electronics

- Samsung

- LG

- Sony

- Hisense

- TCL

- Insignia

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States television market based on the following segments:

United States Television Market, By Type

- Smart TV

- LCD & Plasma & LED TVs

- CRT & Rear-Projection TVs

United States Television Market, By Distribution Channel

- Online

- Offline

Need help to buy this report?