United States Teleradiology Market Size, Share, and COVID-19 Impact Analysis, By Product (X-rays, CT scans, MRI Scans, Nuclear Imaging, and Ultrasound), By Type (Preliminary Tests and Final Tests), and United States Teleradiology Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Teleradiology Market Insights Forecasts to 2035

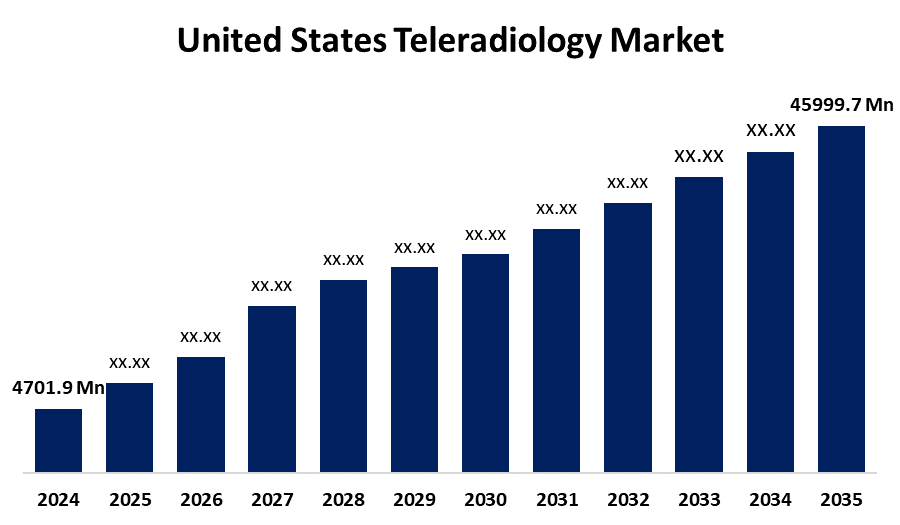

- The US Teleradiology Market Size Was Estimated at USD 4701.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 23.04% from 2025 to 2035

- The US Teleradiology Market Size is Expected to Reach USD 45999.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Teleradiology Market is anticipated to reach USD 45999.7 million by 2035, growing at a CAGR of 23.04% from 2025 to 2035. The expansion of the United States teleradiology market is propelled by the rise in chronic diseases and arthritis, the development of information technology, the rise in imaging surgery, and the rising cost of healthcare.

Market Overview

Teleradiology is the process of sending radiological pictures, including CT scans, MRIs, and X-rays, from one place to another so that a radiologist can interpret them. The lack of medical specialists, particularly subspecialty disciplines like paediatrics, neurology, and muscles and joints radiography, is creating a base for teleradiology systems. Teleradiology boosts diagnostic coverage because it enables those specialists to leverage patient data remotely from wherever they work. Consequently, the market is expected to grow during the forecast period as teleradiology emerges as a medium for early diagnosis. The market will be driven by increasing healthcare expenditures and developments in the teleradiology market due to the company's diversification. Furthermore, the teleradiology department's needs will force the market to grow. For instance, US Radiology Specialists, which is one of the largest physician-owned radiology practices in the country, is expected to start hiring in August 2023 for the United States Radiology Connexia, a new teleradiology company tailored to provide high-quality remote employment opportunities to meet the changing needs of radiologists in each stage of their career. Acquiring access to the subspecialty radiologists will be important to providing the best possible patient care as the demand for outpatient imaging rises across the country through US Radiology's network of imaging sites and medical practices.

Report Coverage

This research report categorizes the market for the United States teleradiology market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States teleradiology market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States teleradiology market.

United States Teleradiology Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4701.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 23.04% |

| 2035 Value Projection: | USD 45999.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Product, By Type and COVID-19 Impact Analysis |

| Companies covered:: | Pediatrix Medical Group Inc, Virtual Radiologic, ONRAD, Inc., USARAD Holdings, Inc., Matrix (Teleradiology Division of Radiology Partners), RamSoft, Inc., Koninklijke Philips N.V., Medica Group PLC, Everlight Radiology, Nines Inc., Others. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States teleradiology market is boosted as the shortage of qualified radiologists working in diagnostic imaging cannot keep pace with the market demand for imaging services and changing technologies at this time. Teleradiology has the potential to be part of the solution and continue to stimulate growth in the market by providing remote diagnosis and access to qualified radiologists without requiring every client to find and qualify a radiologist. As imaging technology is rapidly evolving, the opportunities for teleradiology providers are increasing through minimal investment in medical imaging research and development and imaging technology.

Restraining Factors

The United States teleradiology market faces obstacles because this costly infrastructure may deter the adoption of teleradiology in the future. In order to operate effectively, teleradiology organizations also have to comply with a variety of regulations and standards.

Market Segmentation

The United States teleradiology market share is classified into product and type.

- The x-rays segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States teleradiology market is segmented by product into x-rays, CT scans, MRI Scans, Nuclear Imaging, and Ultrasound. Among these, the x-rays segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven as it is the low cost, the vast adoption of passive technologies in primary diagnosis, and the emergence of technologies like filmless x-ray scanners that contribute to the segment's dominance. Moreover, this application is finding several common applications in areas such as imaging in dentistry, orthopaedics, heart diagnostics, cancer diagnostics, and chest imaging.

- The preliminary tests segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the United States teleradiology market is segmented into preliminary tests and Final tests. Among these, the preliminary tests segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the diagnostic images, which are sent electronically from the medical facility to a distant radiologist who can assess the images immediately and offer preliminary conclusions. This could be a high priority for cases where time matters, such as trauma patients, or urgent treatment awaits.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States teleradiology market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pediatrix Medical Group Inc

- Virtual Radiologic

- ONRAD, Inc.

- USARAD Holdings, Inc.

- Matrix (Teleradiology Division of Radiology Partners)

- RamSoft, Inc.

- Koninklijke Philips N.V.

- Medica Group PLC

- Everlight Radiology

- Nines Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States teleradiology market based on the following segments:

United States Teleradiology Market, By Product

- X-rays

- CT scans

- MRI Scans

- Nuclear Imaging

- Ultrasound

United States Teleradiology Market, By Type

- Preliminary Tests

- Final Tests

Need help to buy this report?