United States Tea Market Size, Share, and COVID-19 Impact Analysis, By Product (Herbal, Black, Green, and Oolong), By Distribution Channel (Convenience Stores, Hypermarkets, and Specialty Stores), and US Tea Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited States Tea Market Insights Forecasts to 2035

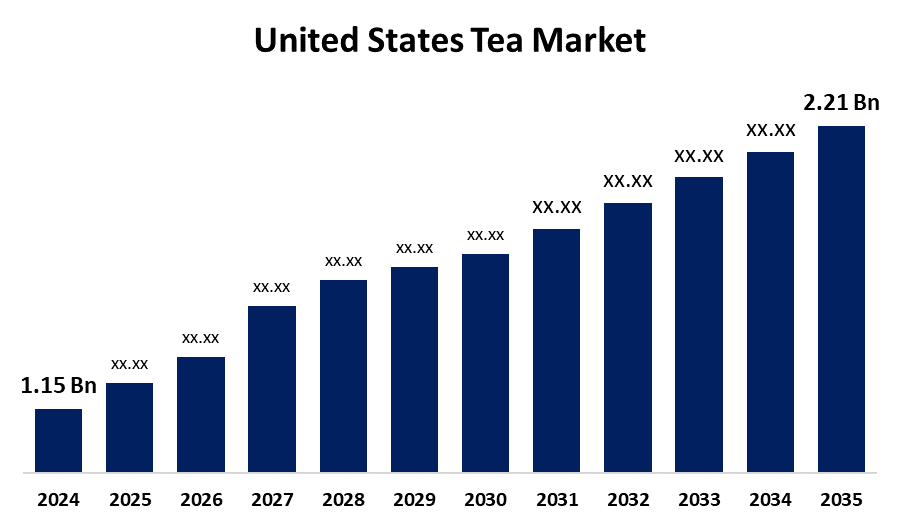

- The US Tea Market Size was estimated at USD 1.15 Billion in 2024

- The Market Size is expected to grow at a CAGR of around 6.12% from 2025 to 2035

- The USA Tea Market Size is expected to reach USD 2.21 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The US Tea Market Size is anticipated to reach USD 2.21 Billion by 2035, growing at a CAGR of 6.12% from 2025 to 2035.

Market Overview

The United States tea market is the industry that produces, imports, distributes, and consumes tea products like black, green, and mate, excluding herbal, instant, and ready-to-drink beverages. Tea is a widely consumed non-alcoholic beverage that generates substantial foreign exchange earnings for nations across the globe. It is the most widely consumed beverage. It contains natural phenolic antioxidants that are found in food. Inflammatory bowel disease, liver disease, diabetes, neurodegenerative diseases, cardiovascular disease, some types of cancer, and weight loss can all be prevented by regular consumption. The three main types of tea are unfermented green tea, partially fermented Oolong tea, and fully fermented black tea. Tea is made from the leaves of the Camellia sinensis plant. To produce finished tea, leaves are harvested from the field and processed in processing plants; the tea plantation is climate-dependent and season-specific. The convenience and health advantages of ready-to-drink (RTD) tea products are driving up demand for them. Health-conscious consumers favor these products because they are available in a variety of flavors and are frequently enhanced with vitamins and minerals. Tea is becoming more popular due to new flavors and advancements in tea brewing technology. The popularity of internet shopping has increased the market for specialty and high-end tea products by making them more widely available. New demographics are being drawn in by this trend, which is promoting the discovery of new tea varieties.

Report Coverage

This research report categorizes the market for US tea market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US tea market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US tea market.

United States Tea Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.15 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.12% |

| 2035 Value Projection: | USD 2.21 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 287 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Product and By Distribution Channel |

| Companies covered:: | PepsiCo, Unilever, Caraway Tea, R. Twining and Company Limited, Bigelow Tea, The Republic of Tea, Starbucks Coffee Company, Dilmah Ceylon Tea Company PLC, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The US tea market is thriving due to innovative blends and targeted marketing initiatives. The growing awareness of the health benefits of green tea, including reduced risk of heart disease, stroke, and cancer, is driving demand for healthier alternatives. The development of flavored and specialty teas, supported by health-focused marketing, appeals to a wider audience. The population growth is affecting the demand for tea, with urban dwellers increasingly seeking easy-to-use, health-conscious products. The growing middle class in developing nations is also driving this trend, as they are more inclined to adopt tea due to its health benefits and social features. This demographic and economic change is positively generating the tea market revenue, ensuring a steady increase in the consumption of tea.

Restraining Factors

The import dependence, shifting consumer preferences, alternative beverages and specialty teas, possible tariffs, sustainability issues brought on by water usage and pesticide regulations, and competition from coffee and other beverages.

Market Segmentation

The USA tea market share is classified into product and distribution channel.

- The black segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US tea market is segmented by product into herbal, black, green, and oolong. Among these, the black segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to its potent flavor and adaptability, black tea, which is made from the camellia sinensis plant, is a widely consumed beverage worldwide. It is used both ceremonially and daily, and its popularity is influenced by its health benefits, which include heart health support and antioxidant qualities.

- The hypermarkets segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US tea market is segmented by distribution channel into convenience stores, hypermarkets, and specialty stores. Among these, the hypermarkets segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. A wide range of tea products is available in supermarkets and hypermarkets, which improves the shopping experience by letting customers physically inspect, read labels, and compare costs. Premium tea products become more affordable through promotions and discounts, and consumer interest and sales are boosted by the strategic positioning and accessibility of both domestic and foreign brands.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US tea market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PepsiCo

- Unilever

- Caraway Tea

- R. Twining and Company Limited

- Bigelow Tea

- The Republic of Tea

- Starbucks Coffee Company

- Dilmah Ceylon Tea Company PLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US tea market based on the below-mentioned segments:

United States Tea Market, By Product

- Herbal

- Black

- Green

- Oolong

United States Tea Market, By Distribution Channel

- Convenience Stores

- Hypermarkets

- Specialty Stores

Need help to buy this report?