United States Tampon Market Size, Share, and COVID-19 Impact Analysis, By Material (Cotton, Blended, Rayon, and Others), By Distribution (Supermarket & Hypermarket, Pharmacy, Specialty Stores, and Online), and United States Tampon Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited States Tampon Market Insights Forecasts to 2035

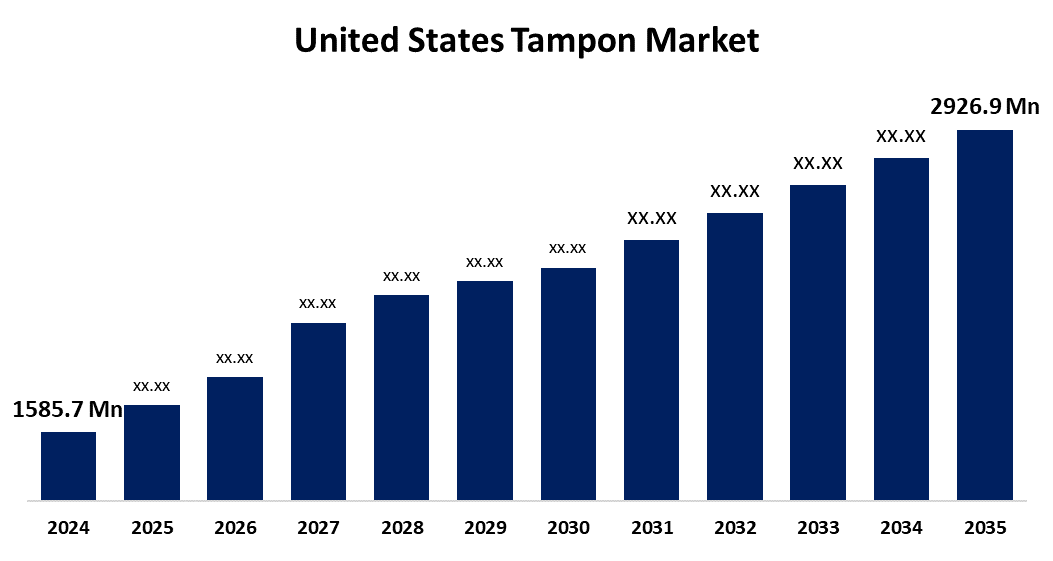

- The US Tampon Market Size Was Estimated at USD 1585.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.73% from 2025 to 2035

- The US Tampon Market Size is Expected to Reach USD 2926.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States Tampon Market Size is Anticipated to Reach USD 2926.9 Million by 2035, Growing at a CAGR of 5.73% from 2025 to 2035. The expansion of the United States tampon market is propelled by changing consumer tastes and heightened consciousness regarding menstrual health.

Market Overview

A tampon is a cylindrical plug that is used to collect fluids or prevent bleeding. It is constructed of absorbent materials like cotton or rayon. One of the major referral partners of the tampon market is the increase in understanding and acceptance of period hygiene products. Menstruation has often been viewed through the lens of taboo and secrecy, while societal acceptability diminishes as conversations about menstrual health become more common. As the acceptability grows, there is a broader array of women able to engage with their menstrual cycle and to look at hygiene options available to them. Tampon adoption and social acceptance among various cohort groups have increased when combined with advancements in education on promoting menstrual health. Women are increasingly demanding discreet, portable, and effective menstrual hygiene products as the demands of workdays and travel expand. Tampons offer women the freedom to simply take care of menstrual hygiene and move uninterrupted through their day. As more women with increasingly physically demanding and mobile jobs, demand is also growing. Changes in societal attitudes toward menstruation are also encouraging open discussion and acceptance, making working women more able to access and use these products. Increasingly dynamic relationships between economic participation, lifestyle demands, and potential health implications are contributing to sustained and rising demand for tampons.

Report Coverage

This research report categorizes the market for the United States tampon market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States tampon market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States tampon market.

United States Tampon Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1585.7 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.73% |

| 2035 Value Projection: | USD 2926.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 150 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Distribution, By Material and COVID-19 Impact Analysis. |

| Companies covered:: | Coca-Cola Co, First Quality, Cencora Inc, Kimberly-Clark Corp, Edgewell Personal Care Co, Procter & Gamble Co, Johnson & Johnson, Cora and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States tampon market is boosted by the surge in female awareness of personal grooming and the increased female working workforce. In addition, US is beginning to create education campaigns encouraging menstrual hygiene. Tampons are easy to transport and discreet while providing a barrier against leakage. Increased participation in sports and other physical activities has a positive impact on the usage of tampons for the best fit and performance.

Restraining Factors

The United States tampon market faces obstacles like the availability of so many alternative period products. Some consumers are also choosing menstrual cups due to perceived environmental impact and the potential for cost savings associated with choosing a reusable product, as consumers continue to address sustainability concerns.

Market Segmentation

The United States tampon market share is classified into material and distribution.

- The rayon segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States tampon market is segmented by material into cotton, blended, rayon, and others. Among these, the rayon segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because tampons made of rayon, a synthetic fiber with high absorbency, can easily work alongside cotton, a natural fiber that is subtle and delicate. The production of combined tampons creates a product that absorbs menstrual fluid effectively and feels soft against the skin, and combines performance and comfort. These qualities often appeal to consumers looking for comfort and performance throughout their menstrual cycle.

- The supermarket & hypermarket segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution, the United States tampon market is segmented into supermarket & hypermarket, pharmacy, specialty stores, and online. Among these, the supermarket & hypermarket segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the large selection of assorted products and retail prices; these retail formats are becoming the preferred shopping experience for women looking for tampons. When consumers have a selection of brands, sizes, and types of tampons in a single location, the customers can make their best decision based on their unique situation and personal preferences.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States tampon market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Coca-Cola Co

- First Quality

- Cencora Inc

- Kimberly-Clark Corp

- Edgewell Personal Care Co

- Procter & Gamble Co

- Johnson & Johnson

- Cora

- Others

Recent Development

- In March 2025, Stanford alumni launched Sequel tampons, designed with spiral grooves for enhanced leakage protection, and partnered with Stanford Athletics, the first NCAA tampon collaboration. Targeting athletes, Sequel expanded into women’s sports leagues, leveraging brand ambassadors and performance validation to build a strong presence in the competitive tampon innovation landscape.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States tampon market based on the following segments:

United States Tampon Market, By Material

- Cotton

- Blended

- Rayon

- Others

United States Tampon Market, By Distribution

- Supermarket & Hypermarket

- Pharmacy

- Specialty Stores

- Online

Need help to buy this report?