United States Tallow Market Size, Share, and COVID-19 Impact Analysis, By Animal Source (Cattle/Bovine, Sheep/Goat, and Pig), By Application (Food & Beverage, Animal/Pet Feed, Pharma, Personal care & Cosmetics, and Other), and United States Tallow Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited States Tallow Market Insights Forecasts to 2035

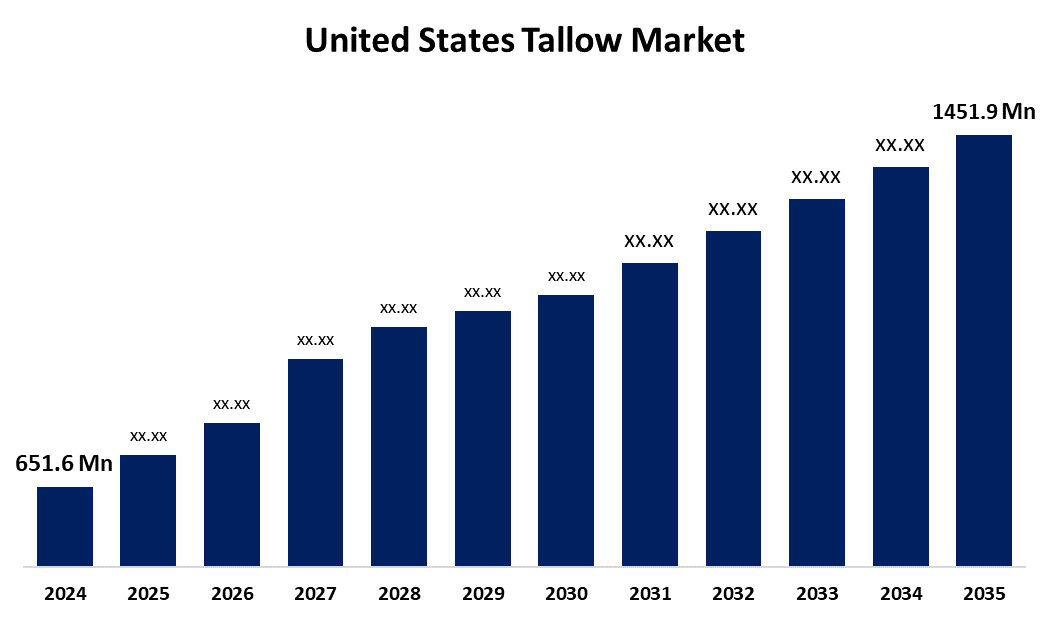

- The US Tallow Market Size Was Estimated at USD 651.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.56% from 2025 to 2035

- The US Tallow Market Size is Expected to Reach USD 1451.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Tallow Market Size is Anticipated to Reach USD 1451.9 Million by 2035, Growing at a CAGR of 7.56% from 2025 to 2035. The expansion of the United States tallow market is propelled by the increased use of tallow in the cosmetics and pharmaceutical industries, as well as the rising consumption of meat products.

Market Overview

Tallow is a rendered animal fat that is usually made from the suet of beef or mutton. Since tallow is an animal byproduct and the demand for meat and meat products is growing, it is more profitable. Demand for meat and meat products is expanding. Tallow is a byproduct of the extraction and consumption of meat. The continuous demand for meat processing and supply from meat processing plants that create tallow will likely impact the market demand and application of tallow in various sectors. The ability of meat processing plants to continue to increase capacity is a major factor influencing product demand. These facilities process large volumes of animal carcasses, giving rise to a far greater amount of fat (as a byproduct) and, in turn, a continual supply of tallow. Tallow is in demand and useful as a functional, flexible fat component that is extracted and used for a variety of purposes, such as animal consumption and industrial purposes. Tallow is also of interest in support of several skin health and cosmetic products. Tallow has properties that ensure skin hydration and nutrition because of its unique emollient and moisturizing properties. The unique fatty acid components of a particular tallow mean they work well for skin lipid barriers to provide hydration and form a protective layer. Research and development into new rendering techniques, new fatty-acid derivatives, and circular supply chains is encouraged by USDA financing programs, which include prizes to support the development of value-added lipids.

Report Coverage

This research report categorizes the market for the United States tallow market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States tallow market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States tallow market.

United States Tallow Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 651.6 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.56% |

| 2035 Value Projection: | USD 1451.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Animal Source, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Baker Commodities, Jacob Stern & Sons, Vantage Specialty Chemicals, Cargill, Darling Ingredients Inc, Parchem, Valley Proteins Inc., Griffin Industries Inc., JBS USA and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The growth of the United States tallow market is boosted as it has a common ingredient in pet foods and animal feeds. The principal benefit of fats in animal diets is their contribution of energy. With about 37 kJ/g, fats provide the highest amount of energy of any ingredient in a diet or feed column. Tallow is usually pressed into cakes to be used as animal feed, on farms, i.e., for dog and hog feed, or as fish bait. Tallow contains less than 3% free fatty acids, as tallow is primarily made up of saturated fatty acids, its triglyceride structure is resistant to oxidative rancidity. Thus, a level of 3-4% can be added to poultry dinners.

Restraining Factors

The United States tallow market faces obstacles, as the manufacturing supply chain planning is complicated by the availability and price volatility of raw materials due to fluctuating cattle numbers, disease outbreaks, and seasonal production.

Market Segmentation

The United States tallow market share is classified into animal source and application.

- The cattle/bovine segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States tallow market is segmented by animal Source into cattle/bovine, sheep/goat, and pig. Among these, the cattle/bovine segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the easy access to tallow from cattle and especially cows. Beef tallow is likely to be a more economical option than the other, fax large supplies of beef and mutton are produced and consumed. Synergy, a producer of flavours and ingredients, supplies a variety of beef flavours including roasted beef, beef steak, pan juice, and beef tallow. Increased uptake from the marketplace can be expected to result in revenue-generating opportunities for this market.

- The food & beverage segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States tallow market is segmented into food & beverage, animal/pet feed, pharma, personal care & cosmetics, and other. Among these, the food & beverage segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by increased shelf stability and the best preservative features. As the negative health concerns associated with trans fats become prevalent, tallow has been studied as a potential alternative to partially hydrogenated oils, which are a major source of trans fats. Tallow could act as a replacement for a natural, nonhydrogenated fat in food preparation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States tallow market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Baker Commodities

- Jacob Stern & Sons

- Vantage Specialty Chemicals

- Cargill

- Darling Ingredients Inc

- Parchem

- Valley Proteins Inc.

- Griffin Industries Inc.

- JBS USA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States tallow market based on the following segments:

United States Tallow Market, By Animal Source

- Cattle/Bovine

- Sheep/Goat

- Pig

United States Tallow Market, By Application

- Food & Beverage

- Animal/Pet Feed

- Pharma

- Personal care & Cosmetics

- Other

Need help to buy this report?