United States Switchgear Market Size, Share, and COVID-19 Impact Analysis, By Voltage (Low, Medium, High), By Insulation (Air, Gas, Oil, Vacuum), By Installation (Indoor, Outdoor), and United States Switchgear Market Insights Forecasts to 2033

Industry: Energy & PowerUnited States Switchgear Market Insights Forecasts to 2033

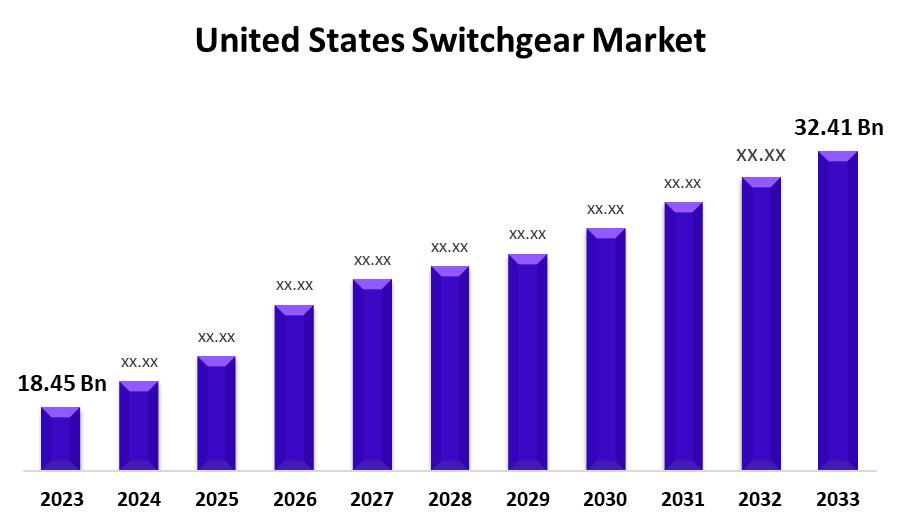

- The United States Switchgear Market Size was valued at USD 18.45 Billion in 2023

- The Market Size is Growing at a CAGR of 5.8% from 2023 to 2033

- The United States Switchgear Market Size is Expected to Reach USD 32.41 Billion by 2033

Get more details on this report -

The United States Switchgear Market Size is expected to reach USD 32.41 Billion by 2033, at a CAGR of 5.8% during the forecast period 2023 to 2033.

Market Overview

In an electrical power system, switchgear is the apparatus that controls, regulates, and switches on or off the electrical circuit. Switches, fuses, circuit breakers, isolators, relays, current and potential transformers, indicating instruments, lightning arresters, and control panels are examples of switchgear devices. The power supply system is linked directly to the switchgear system. It is installed on the high and low voltage sides of the power transformer. It is used to turn off the equipment's power so that it can be tested and maintained, as well as to clear the fault. When a fault in the power system occurs, a large number of current flows through the equipment, destroying it and disrupting service. Therefore, automatic protective devices, also known as switchgear, are required to safeguard the lines, generators, transformers, and other electrical equipment. The basic components of automatic protective switchgear are the relay and circuit breaker. When any part of the system fails, the relay for that part of the system activates and closes the breaker's trip circuit, effectively disabling it. The healthy part of the system continues to supply loads as usual, resulting in no equipment damage and no total supply disruption. Outdoor switchgear and indoor switchgear are the two main types of switchgear. For voltages greater than 66kV, the output switchgear is used.

Report Coverage

This research report categorizes the market for United States switchgear market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States switchgear market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States switchgear market.

United States Switchgear Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 18.45 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.8% |

| 2033 Value Projection: | USD 32.41 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Companies covered:: | Siemens, ABB, General Electric, Schneider Electric, Mitsubishi Electric Corporation, Ormazabal, CG Power & Industrial Solutions Ltd, CHINT Group, HYOSUNG HEAVY INDUSTRIES, Hyundai Electric & Energy Systems Co., Ltd., Powell Industries, Regal Rexnord Corporation, E+I Engineering, Fuji Electric Co., Ltd, Hitachi, Ltd, Eaton, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing strain on electrical infrastructure has resulted in the need for either replacing or refurbishing the electrical equipment required to ensure a reliable and uninterrupted power supply. According to the Department of Energy Report, only a system capable of handling sudden power spikes and drops can ensure uninterrupted power. Furthermore, the importance of the United States switchgear market has only grown in recent years as infrastructure spending has increased. Furthermore, the energy generation mix is changing dramatically as a result of the implementation of various electrification programs, increased use of renewable energy sources, rapid digitalization, a growing preference for smart grid infrastructure, changing regulatory norms, and the emergence of disruptive technologies such as the installation of distributed energy resources and microgrid. Thus, during the forecast period, the aging electricity distribution infrastructure is expected to drive the growth of the United States switchgear market.

Restraining Factors

Stringent environmental and safety regulations in the high voltage switchgear market are a barrier. In addition, rising competition from the unorganized sector of the overall switchgear market is expected to limit the growth of the high voltage switchgear market in the coming years.

Market Segment

- In 2023, the low segment accounted for the largest revenue share over the forecast period.

Based on the voltage, the United States switchgear market is segmented into low, medium, and high. Among these, the low segment has the largest revenue share over the forecast period. The segment connects power sources to end users, ensuring safe and efficient electricity distribution. The increased emphasis on renewable energy sources and the incorporation of decentralized power generation has created a need for flexible and smart switchgear systems that can accommodate these changing energy landscapes.

- In 2022, the gas segment accounted for the largest revenue share over the forecast period.

Based on the insulation, the United States switchgear market is segmented into air, gas, oil, and vacuum. Among these, the gas segment has the largest revenue share over the forecast period. The growing demand for dependable and efficient power distribution infrastructure, particularly in developing economies, is propelling the gas segment forward. These advanced switchgear systems provide numerous benefits, such as improved safety features, compact size, and superior environmental performance.

- In 2022, the outdoor segment accounted for the largest revenue share over the forecast period.

Based on the installation, the United States switchgear market is segmented into indoor and outdoor. Among these, the outdoor segment has the largest revenue share over the forecast period. The growing demand for dependable and efficient power distribution systems in a variety of industries and utility sectors has fueled the demand for tough outdoor installations. These installations offer enhanced protection against harsh environmental conditions such as extreme temperatures, moisture, and dust, ensuring a continuous power supply.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States switchgear market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Siemens

- ABB

- General Electric

- Schneider Electric

- Mitsubishi Electric Corporation

- Ormazabal

- CG Power & Industrial Solutions Ltd

- CHINT Group

- HYOSUNG HEAVY INDUSTRIES

- Hyundai Electric & Energy Systems Co., Ltd.

- Powell Industries

- Regal Rexnord Corporation

- E+I Engineering

- Fuji Electric Co., Ltd

- Hitachi, Ltd

- Eaton

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In January 2022, ABB and Samsung Electronics collaborated to develop technologies for smart IoT connections, energy management, and energy savings in commercial and residential buildings.

In December 2022, Eaton introduced the HMH series of medium-voltage switchgear designed for use in secondary distribution frameworks, industrial facilities, and compact kiosk-type transformer substations. The metal-encased switchgear is manufactured in-house and goes through all routine type-approval tests. The units can be put into service quickly and safely. Furthermore, because of its compact and minimal size, HMH Series modular switchgear can be quickly and securely installed in kiosk type transformer substations.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States switchgear market based on the below-mentioned segments:

United States Switchgear Market, By Voltage

- Low

- Medium

- High

United States Switchgear Market, By Insulation

- Air

- Gas

- Oil

- Vacuum

United States Switchgear Market, By Installation

- Indoor

- Outdoor

Need help to buy this report?