United States Surfactants Market Size, Share, and COVID-19 Impact Analysis, By Source (Synthetic and Biobased), By Application (Homecare, Personal Care, I&I Cleaners, Food Processing, Oilfield Chemicals, Agriculture Chemicals, Textiles, Emulsion Polymers, Paints & Coatings, Construction, and Others), and United States Surfactants Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Surfactants Market Insights Forecasts to 2035

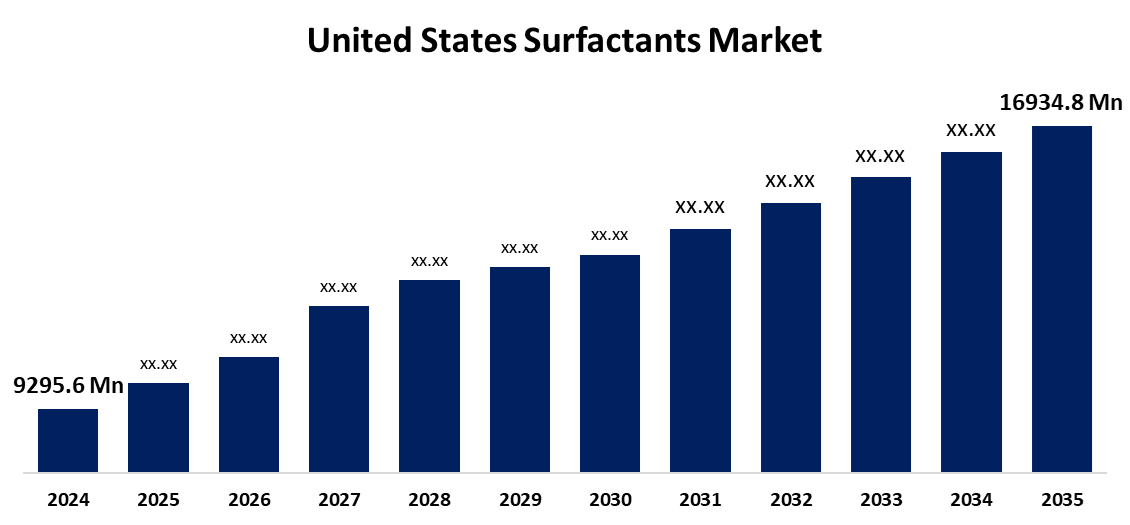

- The US Surfactants Market Size Was Estimated at USD 9,295.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.60% from 2025 to 2035

- The US Surfactants Market Size is Expected to Reach USD 16,934.8 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States Surfactants Market Size is anticipated to reach USD 16,934.8 Million by 2035, Growing at a CAGR of 5.60% from 2025 to 2035. The expansion of the United States surfactants market is propelled by the rising demand for personal care products, such as skincare, haircare, and cosmetics. To improve the washing and foaming qualities of products like shampoos, shower gels, and lotions, these compounds are essential.

Market Overview

Surfactants refer to chemicals that minimize surface tension between substances, which enables easier emulsification, foaming, wetting, and cleaning processes. The essential function of surfactants occurs in both domestic and industrial detergent formulations. Surfactants serve as effective cleaning agents because they enhance distribution and wetting, and emulsification properties that drive market growth. The adaptable nature of surfactants allows their application in diverse industries, including industrial operations, textiles, and agriculture. The market is becoming more conscious of the advantages of environmentally friendly and biodegradable surfactants over petroleum-based synthetic surfactants. The use of bio-surfactants aligns with eco-friendly trends because they serve as emulsifiers while also functioning as biocides and anticorrosive agents. The shift towards natural and organic personal care products is influencing the market for surfactants free of hazardous chemicals and additives. The US government encourages industries to shift from petrochemical derivatives toward plant-based substitutes, which advances environmentally friendly technologies. The US surfactants market presents multiple growth prospects to organizations that develop innovative and sustainable product solutions. Because the market needs ecologically friendly personal care and household cleaning goods, consumers are investigating new formulas and production methods. Businesses that focus most heavily on sustainability and clean labelling will likely receive benefits from rising consumer knowledge about ingredient safety and transparency. The US surfactant producers implement specific actions to meet rising chemical safety regulations that apply across the country.

Report Coverage

This research report categorizes the market for the United States surfactants market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States surfactants market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States surfactants market.

United States Surfactants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9,295.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.60% |

| 2035 Value Projection: | USD 16,934.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 212 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Source, By Application |

| Companies covered:: | Stepan Co, Huntsman Corp, Dow Inc, Chemical Associates, Air Products and Chemicals, Kraton Corporation, Univar Solutions, Eastman Chemical Company, Huntsman Corporation, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States surfactants market is driven by businesses focusing more on sustainable practices, and this shift towards green chemistry is considerable impacts the US surfactants industry. These prominent companies are setting a trend expected to greatly influence the industry over the next ten years by investing in research and development aimed at reducing the environmental impact of their surfactants.

Restraining Factors

The United States surfactants market faces obstacles like products derived from enzymes, polymers, and natural surfactants function better than surfactants. These goods are also reasonably priced and environmentally friendly.

Market Segmentation

The United States surfactants market share is classified into source and application.

- The synthetic segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States surfactants market is segmented by source into synthetic and biobased. Among these, the synthetic segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The market is dominated by synthetic surfactants, which gained popularity because they are widely available and used in household detergents, shampoos, and cleaning products. It is projected that ongoing research and development initiatives to improve the performance and environmental profile of surfactants will reduce the adverse environmental consequences, driving market growth.

- The homecare segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States surfactants market is segmented into homecare, personal care, I&I cleaners, food processing, oilfield chemicals, agriculture chemicals, textiles, emulsion polymers, paints & coatings, construction, and others. Among these, the homecare segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by household cleaning products, including dishwashing liquids, laundry detergents, and hand wash, along with sanitisers and cleansers. The solution components require these substances because they function as surfactants, which enable dispersion, wetting, washing, and emulsification. The usage of surfactants in this market has expanded because consumers now understand hygiene better, particularly after the pandemic.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States surfactants market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Stepan Co

- Huntsman Corp

- Dow Inc

- Chemical Associates

- Air Products and Chemicals

- Kraton Corporation

- Univar Solutions

- Eastman Chemical Company

- Huntsman Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States surfactants market based on the following segments:

United States Surfactants Market, By Source

- Synthetic

- Biobased

United States Surfactants Market, By Application

- Homecare

- Personal Care

- I&I Cleaners

- Food Processing

- Oilfield Chemicals

- Agriculture Chemicals

- Textiles

- Emulsion Polymers

- Paints & Coatings

- Construction

- Others

Need help to buy this report?