United States Sunglasses Market Size, Share, and COVID-19 Impact Analysis, By Product (Polarized and Non-polarized), By Material (CR-39, Polycarbonate, Polyurethane, and Others), and United States Sunglasses Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited States Sunglasses Market Insights Forecasts to 2035

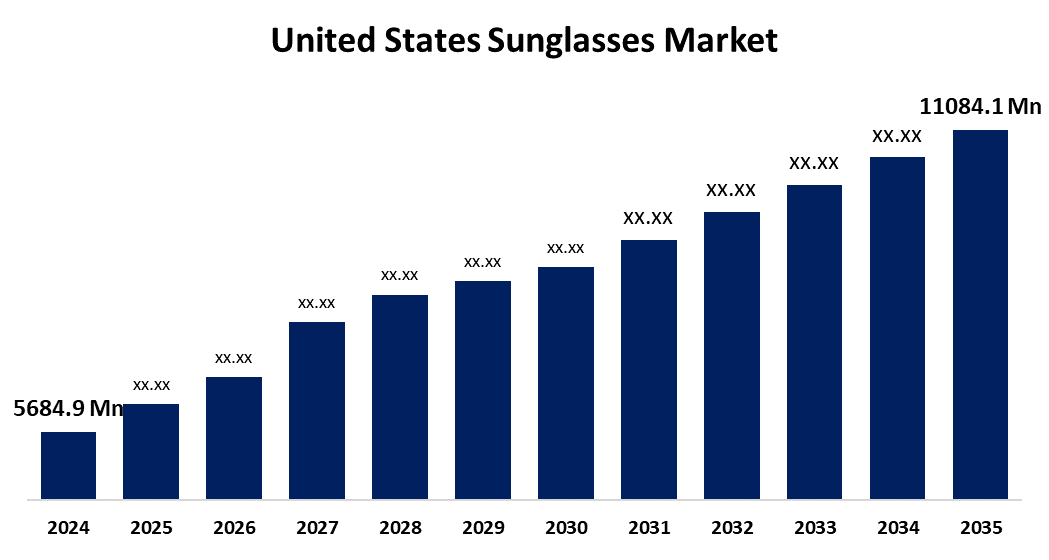

- The US Sunglasses Market Size Was Estimated at USD 5684.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.26% from 2025 to 2035

- The US Sunglasses Market Size is Expected to Reach USD 11084.1 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Sunglasses Market Size is Anticipated to Reach USD 11084.1 Million by 2035, Growing at a CAGR of 6.26% from 2025 to 2035. The expansion of the United States' sunglasses market is propelled by the growing acceptance of eyewear, especially sunglasses, as a necessary component of contemporary life.

Market Overview

Sunglasses are a type of protective eyewear with darkened or polarised lenses that are intended to protect the eyes from intense sunlight and damaging ultraviolet (UV) radiation. They are also known as sunglasses, shades, or sunnies. Growth in the United States sunglasses industry is primarily attributed to growing consumer demand for designer and premium sunglasses and a greater appreciation of UV protection and eye health. Nowadays, sunglasses are equally as much a fashion statement for all demographics as a protective accessory. Prescription and non-prescription options will continue to see strong demand owing to the growing trends in outdoor recreation, sports, and tourism. Online penetration is enhancing both availability and customer access, particularly by direct-to-consumer players. U.S. consumers are demanding more durable, scratch-resistant, customisable, polarized, and tech-enabled lenses. As consumers' growing desire for sustainable brands and eco-friendly materials, customers' preferences are increasingly shaped by conscious consumerism around sustainable products.

In the United States, the primary government organisation responsible for keeping an eye on the eyewear industry is the Food and Drug Administration (FDA). According to the FDA, over-the-counter sunglasses are considered Class I medical devices. The FDA requires all manufacturers, both domestic and foreign, to register their companies, list their products, follow quality-system requirements, and ensure that lenses meet impact-resistance standards (21 CFR 801.410).

Report Coverage

This research report categorizes the market for the United States sunglasses market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States sunglasses market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States sunglasses market.

United States Sunglasses Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5684.9 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.26% |

| 2035 Value Projection: | USD 11084.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 130 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Product, By Material and COVID-19 Impact Analysis. |

| Companies covered:: | State Optical Co, Revolve Group Inc. Class A, Luxottica Group, Safilo Group S.p.A., Kering Eyewear S.p.A., De Rigo S.p.A., CHARMANT Group, Revo and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States sunglasses market is boosted by the eyewear industry, which mostly caters to the fashion sector with customer preferences of sunglasses that enhance facial aesthetics, brand power, and marketing on social media. In the ready-to-wear eyewear category, colourful, shaped eyewear and decorative expression are incorporating and quickly blending with existing eyewear styles. In general, celebrities and leaders in the fashion industry are brand-aware and love bold sunglasses that get noticed. The increased proximity to the market triggered by the fast-growing social media and e-commerce has increased distribution, which generates more growth for the market.

Restraining Factors

The United States sunglasses market faces obstacles, like counterfeiting can negatively impact the price and selling strategies of the major players' products in the market competition. Consumers also frequently confuse counterfeit products with originals, further diluting the original brands.

Market Segmentation

The United States sunglasses market share is classified into product and material.

- The non-polarized segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States sunglasses market is segmented by product into polarized and non-polarized. Among these, the non-polarized segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by fluctuating fashion trends and changes in consumer preferences. One of the main reasons for the rising demand relates to non-polarized sunglasses being considered stylish. Non-polarized sunglasses are an easy fashion accessory because they are available in a variety of styles, colors, and shapes.

- The polycarbonate segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the material, the United States sunglasses market is segmented into CR-39, polycarbonate, polyurethane, and others. Among these, the polycarbonate segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by its fabulous properties; polycarbonate is an extremely popular choice among materials for sunglasses. This versatile material is remarkable with regards to its impact-resistant performance and protects the eyes from forces or impacts that would otherwise break them.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States sunglasses market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- State Optical Co

- Revolve Group Inc. Class A

- Luxottica Group

- Safilo Group S.p.A.

- Kering Eyewear S.p.A.

- De Rigo S.p.A.

- CHARMANT Group

- Revo

- Others

Recent Development

- In May 2024, Innovative Eyewear launched the Eddie Bauer Smart Eyewear, the first rimless design with a ChatGPT voice interface, Bluetooth 100-ft range, quad speakers, mics, and a multi-device charging dock.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States sunglasses market based on the following segments:

United States Sunglasses Market, By Product

- Polarized

- Non-polarized

United States Sunglasses Market, By Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

Need help to buy this report?