United States Stout Market Size, Share, and COVID-19 Impact Analysis, By Type (Dry Stout, Sweet Stout, Oatmeal Stout, Imperial Stout, Foreign Extra Stout, and Other Specialty Stouts), By Packaging (Bottles, Cans, Kegs, Draft, and Others), and United States Stout Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited States Stout Market Insights Forecasts to 2035

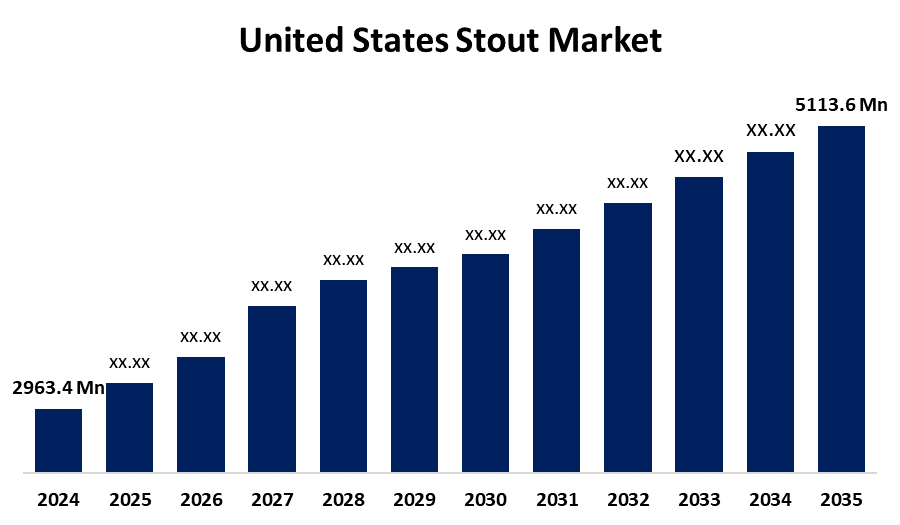

- The US Stout Market Size Was Estimated at USD 2963.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.08% from 2025 to 2035

- The US Stout Market Size is Expected to Reach USD 5113.6 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Stout Market is anticipated to reach USD 5113.6 million by 2035, growing at a CAGR of 5.08% from 2025 to 2035. The expansion of the United States stout market is propelled by consumers' increasing demand for high-end beverages with complex flavours and textures.

Market Overview

Stout is a dark, rich beer style that has a long history and strong flavours. Consumer interest in craft beers, including stouts, has significantly contributed to increased growth in the US stout industry. The emphasis on locally made and artisan beverages, along with the growing interest in specialty and nuanced flavour profiles, can undoubtedly support that demand. Stouts' seasonality, particularly during the winter, is another noteworthy development. As a result, they play a significant role in festivals and celebrations. The expansion of brewpubs and microbreweries around the country is another way that stout is gaining traction in the market. With small breweries producing stout varieties and exploring flavours through various ingredients and brewing techniques, a robust profile that draws curiosity and attention from customers. The increase in alcoholic beverages for sale online, which has especially been illuminated by recent events and changing consumer behaviour, is another noteworthy trend. With that increase in online sales, a great deal of marketing can provide stouts more prominence, which helps a stout brand to become part of the purchase platform. A more specialised audience is being attracted by the growing knowledge and appreciation of the craftsmanship and heritage of stouts, which has helped to develop a generally improving awareness and relevance of the older brewing process.

Report Coverage

This research report categorizes the market for the United States stout market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States stout market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States stout market.

United States Stout Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2963.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.08% |

| 2035 Value Projection: | USD 5113.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 114 |

| Segments covered: | By Type, By Packaging and COVID-19 Impact Analysis |

| Companies covered:: | Boston Beer Co Inc Class A, Molson Coors Beverage Co Class A, Anheuser-Busch InBev SA/NV, The Boston Beer Company, Constellation Brands, Inc., Sierra Nevada Brewing Co., BrewDog plc, Founders Brewing Co., Asahi Group Holdings Ltd, Stone Brewing Co, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States stout market is boosted by the emergence of microbreweries and the expanding scope of beer culture. Microbreweries have attracted customers by focusing on distinct, premium beers that appeal to a wide range of tastes, including stouts that are progressively in demand. A strong market for creative and high-end stout goods is being created by the increasing number of craft brewers, particularly those that specialise in certain stout styles. The growing number of craft brewers, especially those with a focus on specific stout styles, is creating a solid market for innovative and premium stout products.

Restraining Factors

The United States stout market faces obstacles like the high initial investment costs. Investing in advanced technology, such as IoT sensors, automation systems, data analytics platforms, and cybersecurity capabilities, can be quite expensive line items. A digital transformation experience from conventional to digital platforms is potentially expensive for some small and mid-sized oil and gas companies.

Market Segmentation

The United States stout market share is classified into type and packaging.

- The dry stout segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States stout market is segmented by type into dry stout, sweet stout, oatmeal stout, imperial stout, foreign extra stout, and other specialty stouts. Among these, the dry stout segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by its roasted character, light mouthfeel, and low alcohol level. Dry stout, as made famous by iconic brands like Guinness, attracts drinkers from both the established beer drinking community and craft beer newcomers with its balancing bitterness and dryness. This segment is still showing steady growth as brewers innovate with nitrogen-infused and seasonal releases.

- The bottles segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the packaging, the United States stout market is segmented into bottles, cans, kegs, draft, and others. Among these, the bottles segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled due to its shelf stability, durability, and ability to deliver brand visibility. Craft brewers and traditional brewers continue to choose stout in a bottle because of the aesthetics and great ability to maintain flavour quality. Bottle as a packaging format supports their availability across retail aspects like supermarkets and liquor stores.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States stout market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Boston Beer Co Inc Class A

- Molson Coors Beverage Co Class A

- Anheuser-Busch InBev SA/NV

- The Boston Beer Company

- Constellation Brands, Inc.

- Sierra Nevada Brewing Co.

- BrewDog plc

- Founders Brewing Co.

- Asahi Group Holdings Ltd

- Stone Brewing Co

- Others

Recent Development

- In April 2025, Fort Point Beer Co. and HenHouse Brewing Co. finalized a strategic merger, consolidating production at HenHouse’s Santa Rosa facility. The joint entity, Fort Point HenHouse, ranks among Northern California’s top craft breweries, each maintaining brand identity while streamlining operations.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States stout market based on the following segments:

United States Stout Market, By Type

- Dry Stout

- Sweet Stout

- Oatmeal Stout

- Imperial Stout

- Foreign Extra Stout

- Other Specialty Stouts

United States Stout Market, By Packaging

- Bottles

- Cans

- Kegs

- Draft

- Others

Need help to buy this report?