United States Socks Market Size, Share, and COVID-19 Impact Analysis, By Product (Athletic, Formal, and Casual), By Raw Material (Cotton, Nylon, Wool, and Others), and United States Socks Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited States Socks Market Insights Forecasts to 2035

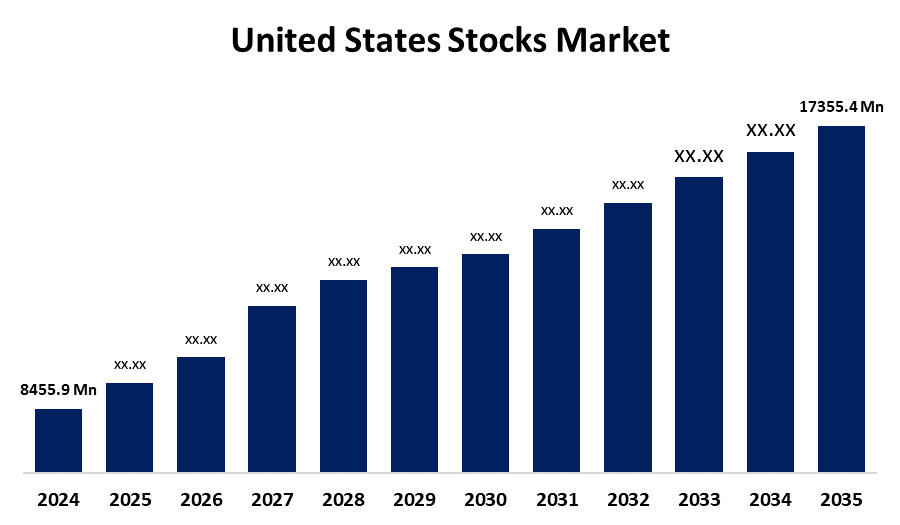

- The US Socks Market Size Was Estimated at USD 8455.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.76% from 2025 to 2035

- The US Socks Market Size is Expected to Reach USD 17355.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Socks Market Size is anticipated to reach USD 17355.4 Million by 2035, growing at a CAGR of 6.76% from 2025 to 2035. The expansion of the United States socks market is propelled by the widespread rise in the importance of wearing formal attire among white-collar professionals.

Market Overview

The socks are soft garments worn on the feet that are usually constructed from knitted or woven materials such as cotton, wool, nylon, or mixes. They are usually made to cover at least the foot and frequently reach the ankle or calf. Adult spending on exercise and wellness is expected to fuel growth in overall footwear accessories, including sports and ankle socks. In addition to the rise in diabetic foot conditions, many medical experts have been investing more money in published research papers about foot health in recent years, in comparison to earlier. The growing demand for eco-friendly and sustainable socks is creating huge market opportunities. There is a profitable market for sock manufacturers to take advantage of as consumers become increasingly aware of the environmental impact of their clothing purchases, especially when it comes to socks. It is important to recognize the environmental benefits of reducing and reusing materials such as recycled fabrics, including reclaimed cotton and plastic bottles, to create a market opportunity for consumers looking for durable and sustainable socks.

The United States government has implemented a number of trade and economic policies that are centred on textiles to boost domestic production of socks and hosiery. This increases demand for U.S.-based production since federal organisations, including the USPS, are required to purchase textiles such as socks and uniforms made from domestic fibres.

Report Coverage

This research report categorizes the market for the United States socks market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States socks market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States socks market.

United States Stocks Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8455.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.76% |

| 2035 Value Projection: | USD 17355.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product and By Raw Material |

| Companies covered:: | Drymax Socks, Jockey International, Hanesbrands Inc, Skechers USA Inc Class A, Nike Inc Class B, VF Corp, Under Armour Inc Class A, Puma S.E., Adidas A.G., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States socks market is boosted because of their comfort and performance. Busy customers want socks that are not just stylish but also allow them to perform well in any activity while providing superior comfort. The more consumers want socks that provide arch support, wick away sweat, and reduce friction, the more it can be observed in the athletic and sports sock market. Producers are combining new materials and technologies, such a cushioned, moisture-wicking fabrics and ergonomic shapes, into their sock designs. And as consumers place importance on comfort and comfort for all-day wear in their daily wardrobe, the comfort emphasis also spans beyond sports and fitness.

Restraining Factors

The United States socks market faces obstacles like supply chain disruptions. This problem comes because the market is dependent on a difficult landscape of suppliers, manufacturers, and distributors that sometimes span all continents.

Market Segmentation

The United States socks market share is classified into product and raw material.

- The casual segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States socks market is segmented by product into athletic, formal, and casual. Among these, the casual segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because it is versatile and comfy enough for multiple uses. They come in a multitude of colours and patterns, and are usually made from a mix of synthetic, cotton, or wool fibres. The most popular varieties of casual socks are crew socks, ankle socks, and no-show socks. Casual socks can be worn with jeans, shorts, trainers, and more.

- The cotton segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the raw material, the United States socks market is segmented into cotton, nylon, wool, and others. Among these, the cotton segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled as it has natural fibres that allow for a better circulation of air, decreasing the chance of foot sweat and discomfort.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States socks market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Drymax Socks

- Jockey International

- Hanesbrands Inc

- Skechers USA Inc Class A

- Nike Inc Class B

- VF Corp

- Under Armour Inc Class A

- Puma S.E.

- Adidas A.G.

- Others

Recent Development

- In December 2022, the LYCRA Company made a significant breakthrough by introducing its groundbreaking Thermolite Everyday Warmth Technology for socks. This innovation is designed to ensure that feet stay comfortably warm, setting a new standard for sock technology and enhancing the overall sock-wearing experience.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States socks market based on the following segments:

United States Socks Market, By Product

- Athletic

- Formal

- Casual

United States Socks Market, By Raw Material

- Cotton

- Nylon

- Wool

- Others

Need help to buy this report?