United States Stents Market Size, Share, and COVID-19 Impact Analysis, By Product (Vascular and Non-vascular), By Material (Metallic and Non-metallic), and United States Stents Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Stents Market Size Insights Forecasts to 2035

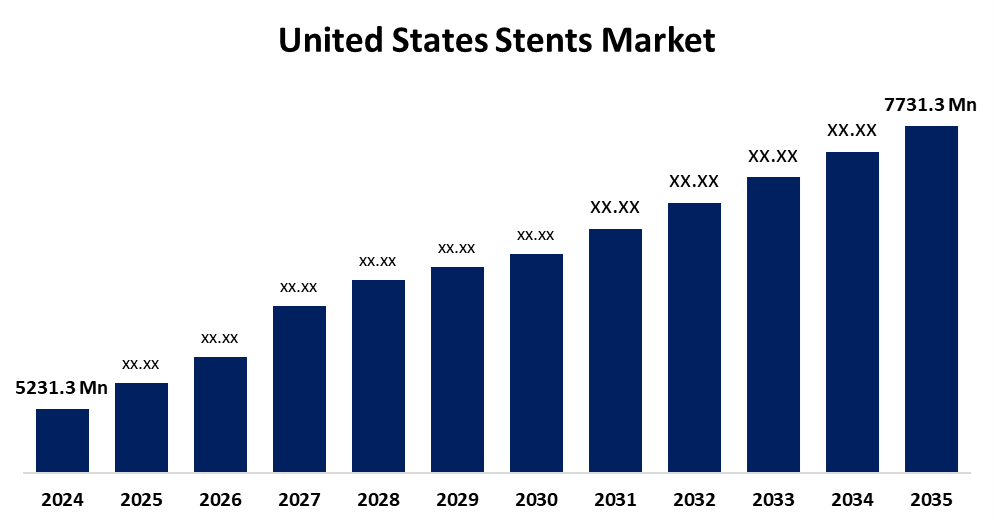

- The US Stents Market Size Was Estimated at USD 5231.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.61% from 2025 to 2035

- The US Stents Market Size is Expected to Reach USD 7731.3 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Stents Market Size is anticipated to reach USD 7731.3 million by 2035, growing at a CAGR of 3.61% from 2025 to 2035. The expansion of the United States Stents market is propelled by the increased frequency of cardiovascular disorders, particularly peripheral arterial disease and coronary artery disease.

Market Overview

A stent is a tiny, tube-shaped medical device that is typically composed of fabric, polymer, or metal mesh. It is intended to be placed into weak or constricted areas of the body, including ducts, blood arteries, or airways, to keep them open and allow for normal flow. The market has grown as a result of numerous businesses investing in creating new goods. The market will get new products, make the latest products available, and get more regulatory approvals, accentuate the ability to give patients the newest options, and then stent usage can be more universal, which can drive the market upward. These companies' competitiveness and market position are strengthened by recent market introductions, such as the Onyx Frontier drug-eluting stent and innovative, specialised, and sophisticated products. Furthermore, there is an abundance of innovation in the stents market, as evidenced by endless trials of innovative concepts and designs. Their minimally invasive nature and pain relief through reduced discomfort have made them ubiquitous. Companies are also continually investing in innovative technology and techniques to meet the growing demand and remain on the bleeding edge of advancement.

The U.S. Food and Drug Administration (FDA) is a key player through its Center for Devices and Radiological Health (CDRH), which sets standards for intravascular stent testing, labelling, and clinical trials. This includes procedures for premarket approval (PMA) and investigational device drug (IND), which expedite the introduction of safe stents.

Report Coverage

This research report categorizes the market for the United States stents market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States stents market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States stents market.

United States Stents Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5231.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.61% |

| 2035 Value Projection: | USD 7731.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Product, By Material and COVID-19 Impact Analysis |

| Companies covered:: | BD, Conmed Corp, W.L. Gore & Associates, Boston Scientific Corp, Stryker Corp, Abbott Laboratories, Medtronic plc, Elixir Medical Corporation, Cook Medical, InspireMD, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States stents market is boosted by a heightened demand for state-of-the-art technology in medical science and healthcare. One reason the stent market grows is that there is a massive number of patients in the geriatric age cohort. Furthermore, the increase in disposable income has meant that individuals are willing to invest in advanced devices and technologies that produce better surgical outcomes. Using the latest technologies, potential clients can have confidence when choosing surgical processes and procedures. The stent market has been aided by the advances made post-pandemic.

Restraining Factors

The United States stents market faces obstacles like the government regulations and laws that have occurred, which have negatively impacted the progress of the stent market, leading to regulatory hurdles. These hurdles, which have occurred with taxes and insurance coverages, have contributed to the difficulty at the average level of individuals having access to modern technology.

Market Segmentation

The United States stents market share is classified into product and material.

- The vascular segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States stents market is segmented by product into vascular and non-vascular. Among these, the vascular segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is propelled because cardiovascular problems, especially coronary artery disease, are becoming more and more common. The creation of bioresorbable vascular scaffolds (BVS) and drug-eluting stents (DES) is an example of technological developments that have improved patient outcomes and treatment efficacy. Additionally, rising healthcare costs and the expanding use of minimally invasive procedures support the market for vascular stents' steady expansion.

- The metallic segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the material, the United States stents market is segmented into metallic and non-metallic. Among these, the metallic segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by their durability and structural integrity, are regularly used in more serious applications, especially peripheral arterial and coronary procedures. They maintain vascular patency and provide immediate structural integrity in acute time frames, such as acute myocardial infarctions and severe peripheral artery disease. Due to their predictability and dependability, metallic stents are frequently selected as first-line therapy.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States stents market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BD

- Conmed Corp

- W.L. Gore & Associates

- Boston Scientific Corp

- Stryker Corp

- Abbott Laboratories

- Medtronic plc

- Elixir Medical Corporation

- Cook Medical

- InspireMD

- Others

Recent Development

- In May 2024, Abbott launched the XIENCE Sierra, a new coronary stent system in India, designed to treat people with blocked arteries. This addition to the XIENCE family offers improved safety for complex cardiac cases. Abbott's innovations have consistently advanced the field of angioplasty, a procedure to open narrowed or blocked arteries, typically involving stent placement to keep the artery open.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States stents market based on the following segments:

United States Stents Market, By Product

- Vascular

- Non-vascular

United States Stents Market, By Material

- Metallic

- Non-metallic

Need help to buy this report?