United States Steel Service Center Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Cut-to-Length, Slitting, Metal Profiling, Blanking, Welding, Packaging & Shipping, Heat Treating, and Painting), By Material Type (Carbon Steel, Stainless Steel, Aluminum, Nickel Alloys, and Titanium), By Application (Automotive, Construction, Energy, Industrial Machinery, and Shipbuilding), By End-User Industry (Manufacturing, Distribution, Fabrication, and Construction), and United States Steel Service Center Market Insights, Industry Trend, Forecasts to 2035

Industry: Construction & ManufacturingUnited States Steel Service Center Market Insights Forecasts to 2035

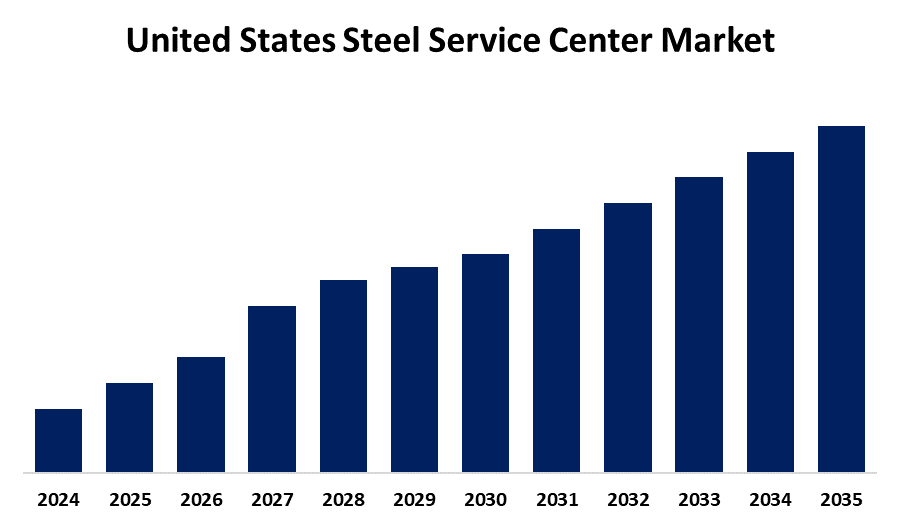

- The USA Steel Service Center Market Size is Expected to Grow at a CAGR of around 3.75% from 2025 to 2035.

- The United States Steel Service Center Market Size is Expected to Hold a Significant Share by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the U.S. Steel Service Center Market Size is Expected to Hold a Significant Share by 2035, Growing at a CAGR of 3.75% from 2025 to 2035. The US steel service center market is driven by increased demand from the construction and automotive industries, technological advancements, and government support. Technological advancements, including automation and precision cutting, have enhanced operational efficiency. Additionally, significant investments in infrastructure and construction sectors are fueling the need for steel, further bolstering the market's expansion.

Market Overview

The U.S. steel service center market defines the steel industry that focuses on providing customized steel processing and distribution services, bridging the gap between steel manufacturers and end-users across various industries. These centers handle steel processing activities like cutting, slitting, and shearing, offering value-added services to meet specific customer needs. This sector is experiencing notable growth, fueled by reshoring and nearshoring trends, advancements, and increased demand for processed steel products. Additionally, significant investments in infrastructure and construction sectors are fueling the need for steel, further bolstering the market's expansion. It offers services such as inventory management, just-in-time delivery, and customized processing, which are essential for industries like automotive, construction, and energy. Moreover, adopting advanced technologies can further streamline operations and improve customer service. Legislative measures by the government, such as the Infrastructure Investment and Jobs Act, the CHIPS and Science Act, and the Inflation Reduction Act, have injected substantial funding into domestic manufacturing and infrastructure projects, indirectly benefiting steel service centers by boosting demand for steel products.

Report Coverage

This research report categorizes the market for the United States steel service center market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States steel service center market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States steel service center market.

United States Steel Service Center Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 3.75% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Service, By Material Type By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Reliance Steel & Aluminum Co., Pennsylvania Steel Company, Inc., Kloeckner Metals Corporation, Marmon/Keystone Corporation, Macsteel Service Centers USA, Steel & Pipe Supply Co., Inc., Service Steel Warehouse, Worthington Industries, O’Neal Industries, Inc., Curtis Steel Co., Inc., Olympic Steel, Inc., Infra-Metals Co., A.M. Castle & Co., Delta Steel, Inc., Ryerson Inc and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A major driver is the revival of domestic manufacturing, accelerated by reshoring and nearshoring efforts, which increases demand for processed steel. Infrastructure development, supported by federal investments through the Infrastructure Investment and Jobs Act and the Inflation Reduction Act, further boosts steel consumption. Technological advancements in automation, precision cutting, and digital inventory systems have enhanced efficiency and responsiveness. Additionally, government-imposed tariffs on imported steel promote reliance on domestic production, benefiting service centers. The rise of sectors like construction, automotive, energy, and renewable industries also contributes to steady demand.

Restraining Factors

The service center industry faces challenges, including volatile steel prices impacting margins, high compliance costs for environmental regulations, labor shortages, supply chain disruptions, and intense competition. These factors increase operational costs, hinder production, and pressure margins, making it difficult for mid-sized firms to invest in infrastructure and equipment.

Market Segmentation

The United States steel service center market share is classified into service type, material type, application, and end-user industry.

- The blanking segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The United States steel service center market is segmented by service type into cut-to-length, slitting, metal profiling, blanking, welding, packaging & shipping, heat treating, and painting. Among these, the blanking segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. This is due to it caters to the diverse needs of various industries by providing customized steel solutions, including cutting, slitting, and shearing. This flexibility allows steel service centers to cater to the unique demands of different applications, making them essential for businesses needing specific steel shapes, sizes, and finishes.

- The carbon steel segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States steel service center market is segmented by material type into carbon steel, stainless steel, aluminum, nickel alloys, and titanium. Among these, the carbon steel segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to its widespread use across diverse industries like construction, automotive, and energy. Carbon steel's affordability, strength, and availability make it a preferred material for a variety of applications, from building infrastructure to manufacturing vehicle components.

- The automotive segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States steel service center market is segmented by application into automotive, construction, energy, industrial machinery, and shipbuilding. Among these, the automotive segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because the industry heavily relies on steel for manufacturing various vehicle components. Steel's high strength, cost-effectiveness, and adaptability in lightweight materials, like Advanced High-Strength Steel (AHSS), are key reasons for its dominance in the automotive industry.

- The manufacturing segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States steel service center market is segmented by end-user industry into manufacturing, distribution, fabrication, and construction. Among these, the manufacturing segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the significant demand for steel-based machinery and equipment in various industries like construction, mining, and chemicals. This is further fueled by investments in mills and a growing preference for local manufacturing, which benefits steel service centers that provide just-in-time delivery of production-ready metals.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States steel service center market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Reliance Steel & Aluminum Co.

- Pennsylvania Steel Company, Inc.

- Kloeckner Metals Corporation

- Marmon/Keystone Corporation

- Macsteel Service Centers USA

- Steel & Pipe Supply Co., Inc.

- Service Steel Warehouse

- Worthington Industries

- O’Neal Industries, Inc.

- Curtis Steel Co., Inc.

- Olympic Steel, Inc.

- Infra-Metals Co.

- A.M. Castle & Co.

- Delta Steel, Inc.

- Ryerson Inc.

- Others

Recent Developments:

- In February 2024, Reliance Steel & Aluminum Co. (NYSE: RS) announced that it has entered into a definitive agreement to acquire all of the outstanding equity interests and related real estate assets of American Alloy Steel, Inc. (“American Alloy”), a leading distributor of specialty carbon and alloy steel plate and round bar, including pressure vessel quality (PVQ) material.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S., regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States steel service center market based on the below-mentioned segments:

USA Steel Service Center Market, By Service Type

- Cut-to-Length

- Slitting

- Metal Profiling

- Blanking

- Welding

- Packaging & Shipping

- Heat Treating

- Painting

USA Steel Service Center Market, By Material Type

- Carbon Steel

- Stainless Steel

- Aluminum

- Nickel Alloys

- Titanium

USA Steel Service Center Market, By Application

- Automotive

- Construction

- Energy

- Industrial Machinery

- Shipbuilding

United States Steel Service Center Market, By End-User Industry

- Manufacturing

- Distribution

- Fabrication

- Construction

Need help to buy this report?