United States Steel Pipes & Tubes Market Size, Share, and COVID-19 Impact Analysis, By Type (Seamless Steel Pipes, Welded Steel Pipes, Spiral Welded Pipes, Submerged Arc Welded Pipes, and High-Frequency Welded Pipes), By Application (Oil & Gas, Water & Sewerage, Industrial & Construction, Automotive, and Aerospace), By End-Use (Commercial and Residential), and United States Steel Pipes & Tubes Market Insights, Industry Trend, Forecasts to 2035

Industry: Construction & ManufacturingUnited States Steel Pipes & Tubes Market Insights Forecasts to 2035

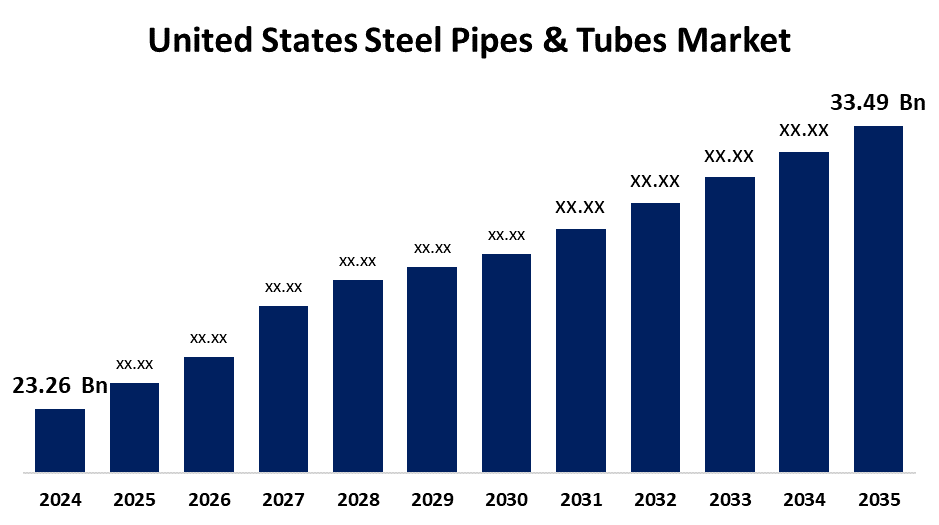

- The United States Steel Pipes & Tubes Market Size was estimated at USD 23.26 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.37% from 2025 to 2035

- The United States Steel Pipes & Tubes Market Size is Expected to Reach USD 33.49 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States steel pipes & tubes market is anticipated to reach USD 33.49 billion by 2035, growing at a CAGR of 3.37% from 2025 to 2035. The U.S. steel piles market is growing due to rising infrastructure spending, urbanization, and climate resilience projects. Federal funding, especially from the Bipartisan Infrastructure Law, supports demand in the transportation and energy sectors.

Market Overview

The United States steel pipes & tubes market encompasses the manufacturing and distribution of steel pipes and tubes used across various industries, including construction, oil and gas, energy, infrastructure, and manufacturing. Steel pipes and tubes are critical for applications requiring strength, durability, and resistance to harsh environments, such as pipelines, structural frameworks, and transportation systems. The market is driven by robust infrastructure development fueled by significant government investments, particularly through initiatives like the Bipartisan Infrastructure Law, which allocates substantial funding for roads, bridges, and energy projects. Urbanization and industrial growth further stimulate demand for steel pipes in commercial and residential construction. The market’s strengths include the inherent recyclability and sustainability of steel, technological advancements improving product quality, and the material’s adaptability to diverse applications. Opportunities lie in expanding renewable energy projects, such as offshore wind farms and hydrogen storage, which require specialized steel tubing solutions. Government initiatives focused on infrastructure modernization and environmental regulations, promoting sustainable materials use, and enhancing market growth prospects.

Report Coverage

This research report categorizes the market for the United States steel pipes & tubes market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States steel pipes & tubes market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States steel pipes & tubes market.

United States Steel Pipes & Tubes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 23.26 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.37% |

| 2035 Value Projection: | USD 33.49 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Type, By Application, By End-Use and COVID-19 Impact Analysis |

| Companies covered:: | US Steel Tubular Products, Zekelman Industries, O’Neal Steel, American Cast Iron Pipe Company, PTC Alliance, Bull Moose Tube, Richards Pipe & Steel Inc, JD Fields & Company, Inc., Tenaris, Vallourec Star, Wheatland Tube, TMK IPSCO, Independence Tube Corporation, Allied Tube & Conduit, Nucor Tubular Products, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The significant government investments under initiatives like the Bipartisan Infrastructure Law are fueling large-scale projects such as bridges, highways, and energy facilities, which require durable and reliable steel piping solutions. Additionally, urbanization and industrial expansion increase the need for steel pipes in construction and manufacturing. Technological advancements in manufacturing processes enhance product quality and reduce costs, making steel pipes more competitive against alternative materials. The growing emphasis on sustainability and recyclability also supports market growth, as steel is highly recyclable. Further, the expanding renewable energy sector, including offshore wind and hydrogen projects, drives demand for specialized steel tubes capable of withstanding harsh environments. These combined factors are propelling the market forward.

Restraining Factors

The volatile raw material prices, particularly for iron ore and scrap metal, affect production costs. Stringent environmental regulations increase compliance burdens for manufacturers. Additionally, competition from low-cost imports, especially from Asia, pressures domestic pricing. Supply chain disruptions and labor shortages further hinder production efficiency.

Market Segmentation

The United States steel pipes & tubes market share is classified into type, application, and end-use.

- The welded steel pipes segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States steel pipes & tubes market is segmented by type into seamless steel pipes, welded steel pipes, spiral welded pipes, submerged arc welded pipes, and high-frequency welded pipes. Among these, the welded steel pipes segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its cost-effectiveness, faster production, and suitability for a wide range of applications, including construction and energy sectors. Compared to seamless pipes, welded pipes offer greater versatility and lower manufacturing costs, making them preferred for infrastructure projects and industrial uses across the country.

- The oil & gas segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States steel pipes & tubes market is segmented by application into oil & gas, water & sewerage, industrial & construction, automotive, and aerospace. Among these, the oil & gas segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the sector’s extensive use of durable, high-strength pipes for exploration, drilling, and transportation of hydrocarbons. The demand for reliable pipelines in upstream, midstream, and downstream operations, coupled with ongoing energy infrastructure investments, makes oil & gas the largest application segment.

- The commercial segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States steel pipes & tubes market is segmented by end-use into commercial and residential. Among these, the commercial segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because commercial construction involves larger-scale projects such as office buildings, factories, and infrastructure, requiring extensive use of steel pipes for structural support and utilities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States steel pipes & tubes market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- US Steel Tubular Products

- Zekelman Industries

- O'Neal Steel

- American Cast Iron Pipe Company

- PTC Alliance

- Bull Moose Tube

- Richards Pipe & Steel Inc

- JD Fields & Company, Inc.

- Tenaris, Vallourec Star

- Wheatland Tube

- TMK IPSCO

- Independence Tube Corporation

- Allied Tube & Conduit

- Nucor Tubular Products

- Others

Recent Developments:

- In June 2021, Bull Moose Tube Company (“BMT”), a Caparo Bull Moose subsidiary, announced plans to build a 350,000 ton per year HSS and Sprinkler pipe mill. The mill is built on Steel Dynamics’ new Sinton, Texas flat-rolled campus.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S., regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States steel pipes & tubes market based on the below-mentioned segments:

USA Steel Pipes & Tubes Market, By Type

- Seamless Steel Pipes

- Welded Steel Pipes

- Spiral Welded Pipes

- Submerged Arc Welded Pipes

- High-Frequency Welded Pipes

USA Steel Pipes & Tubes Market, By Application

- Oil & Gas

- Water & Sewerage

- Industrial & Construction

- Automotive

- Aerospace

USA Steel Pipes & Tubes Market, By End-Use

- Commercial

- Residential

Need help to buy this report?