United States Steel Piling Market Size, Share, and COVID-19 Impact Analysis, By Type of Steel Piling (H-Piles, Pipe Piles, Sheet Piles, Bearing Piles, and Mini Piles), By Application Area (Construction, Marine Engineering, Bridge & Roadway Construction, Oil & Gas Industry, and Vertical Signs & Towers), By End User Industry (Residential Construction, Commercial Construction, Infrastructure Projects, Industrial Projects, and Energy Sector), and United States Steel Piling Market Insights, Industry Trend, Forecasts to 2035

Industry: Construction & ManufacturingUnited States Steel Piling Market Insights Forecasts to 2035

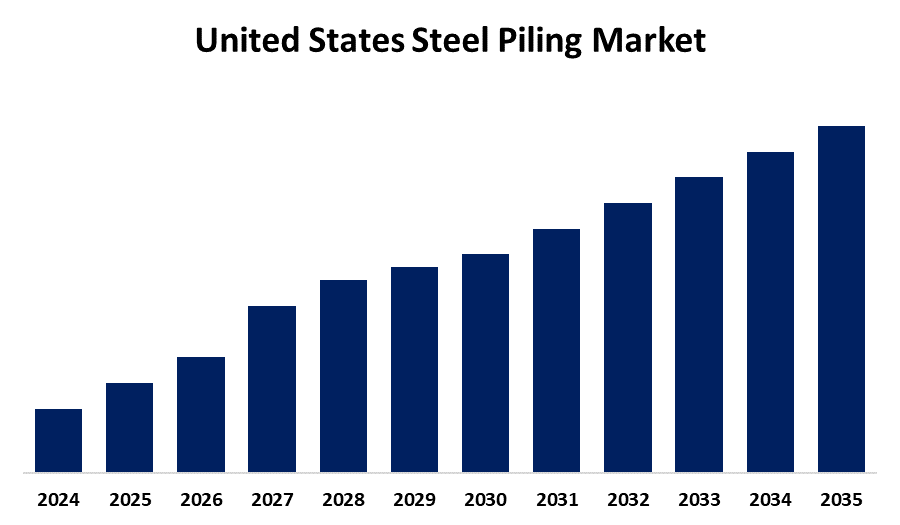

- The USA Steel Piling Market Size is Expected to Grow at a CAGR of around 4.3% from 2025 to 2035.

- The United States Steel Piling Market Size is Expected to Hold a Significant Share by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the U.S. steel piling market is expected to hold a significant share by 2035, growing at a CAGR of 4.3% from 2025 to 2035. The United States steel piling market is experiencing growth driven by increasing demand for infrastructure development, including bridges, highways, and urban expansion, which has significantly boosted the need for durable foundation solutions. Steel piling offers high strength, corrosion resistance, and recyclability, aligning with sustainable construction practices. Technological advancements in manufacturing processes have led to government investments in large-scale projects, improved performance, and cost-effectiveness of steel piles.

Market Overview

The United States steel piling market defines the production and application of steel piles, structural elements used to support foundations in construction projects such as bridges, highways, and marine structures. This development in infrastructure, with significant investments in urbanization and large-scale construction projects increasing the demand for durable foundation solutions, leads the market. Steel piles are favored for their recyclability and durability, aligning well with sustainable building practices. Technological advancements in manufacturing processes also contribute to the market’s positive outlook, as innovations like automated welding systems allow for more precise and faster fabrication of piles, reducing lead times and costs. Government initiatives, including the Bipartisan Infrastructure Law and the Inflation Reduction Act, have allocated substantial funding to infrastructure projects, further boosting demand for steel piling. Additionally, the adoption of advanced manufacturing technologies, such as automation and robotics, enhances production efficiency and product quality, providing manufacturers with a competitive edge. The rising demand for renewable energy projects, including offshore wind farms, is creating new opportunities for steel piling systems.

Report Coverage

This research report categorizes the market for the United States steel piling market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States steel piling market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States steel piling market.

United States Steel Piling Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.3% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Type of Steel Piling, By Application Area, By End User Industry and COVID-19 Impact Analysis |

| Companies covered:: | Nucor Skyline, Shoreline Steel, Blue Iron, Inc., ESC Steel LLC, Northwest Pipe Company, Steel Dynamics, Inc., O’Neal Steel, Michels Corporation, Nicholson Construction Company, TorcSill Foundations, Johnson Bros. Roll Forming Co., Ideal Group, Richards Pipe & Steel, Inc., Steel America, Naylor Pipe Co., Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The ongoing surge in infrastructure development projects, including highways, bridges, ports, and commercial buildings, which require robust and durable foundation solutions, primarily drives the market. Increasing urbanization and industrialization further escalate the demand for steel piling, given its superior strength and longevity compared to alternative materials. Further, growing emphasis on sustainable construction practices promotes the use of recyclable and corrosion-resistant steel piles, aligning with environmental regulations. Government funding and initiatives supporting infrastructure modernization and resilience also play a crucial role in market expansion. Technological advancements in steel piling manufacturing enhance product quality and reduce installation costs, attracting more construction projects. Additionally, the need for deep foundations in challenging soil conditions and rising investments in coastal and marine infrastructure continue to propel the U.S. steel piling market forward.

Restraining Factors

The high raw material costs impact production expenses and pricing. Environmental regulations and permitting delays also hinder project timelines. Additionally, competition from alternative foundation materials like concrete and composite systems limits market penetration. Economic uncertainties and fluctuating infrastructure funding further challenge consistent market growth and long-term investment planning.

Market Segmentation

The United States steel piling market share is classified into type of steel piling, application area, and end user industry.

- The sheet piles segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States steel piling market is segmented by type of steel piling into H-piles, pipe piles, sheet piles, bearing piles, and mini piles. Among these, the sheet piles segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to their widespread use in retaining walls, seawalls, and excavation support. Their interlocking design ensures strength, easy installation, and cost-effectiveness in various soil conditions. High demand in marine and infrastructure projects drives their dominance over other steel piling types.

- The construction segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States steel piling market is segmented by application area into construction, marine engineering, bridge & roadway construction, oil & gas industry, and vertical signs & towers. Among these, the construction segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to rapid urbanization, infrastructure development, and increasing investment in real estate projects drive demand. Steel piles offer strength, durability, and efficiency, making them ideal for diverse construction needs.

- The infrastructure projects segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States steel piling market is segmented by end user industry into residential construction, commercial construction, infrastructure projects, industrial projects, and the energy sector. Among these, the infrastructure projects segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of significant government investments in transportation, bridges, and public utilities. Steel piles provide reliable deep foundation solutions essential for large-scale infrastructure. Their durability, load-bearing capacity, and adaptability to diverse ground conditions make them the preferred choice for foundational support.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States steel piling market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nucor Skyline

- Shoreline Steel

- Blue Iron, Inc.

- ESC Steel LLC

- Northwest Pipe Company

- Steel Dynamics, Inc.

- O'Neal Steel

- Michels Corporation

- Nicholson Construction Company

- TorcSill Foundations

- Johnson Bros. Roll Forming Co.

- Ideal Group

- Richards Pipe & Steel, Inc.

- Steel America

- Naylor Pipe Co.

- Others

Recent Developments:

- In May 2025, Nippon Steel (5401.T), invested $14 billion in U.S. Steel's (X.N), the operations including up to $4 billion in a new steel mill if the Trump administration green lights its bid for the iconic U.S. company, according to a document and three people familiar with the matter.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States steel piling market based on the below-mentioned segments:

U.S. Steel Piling Market, By Type of Steel Piling

- H-Piles

- Pipe Piles

- Sheet Piles

- Bearing Piles

- Mini Piles

U.S. Steel Piling Market, By Application Area

- Construction

- Marine Engineering

- Bridge & Roadway Construction

- Oil & Gas Industry

- Vertical Signs & Towers

U.S. Steel Piling Market, By End User Industry

- Residential Construction

- Commercial Construction

- Infrastructure Projects

- Industrial Projects

- Energy Sector

Need help to buy this report?