United States Steel Market Size, Share, and COVID-19 Impact Analysis, By Type (Flat Steel and Long Steel), By Product (Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, and Braids), and United States Steel Market Insights, Industry Trend, Forecasts to 2035. United States Steel Market Insights Forecasts to 2035

Industry: Construction & ManufacturingUnited States Steel Market Size Insights Forecasts to 2035

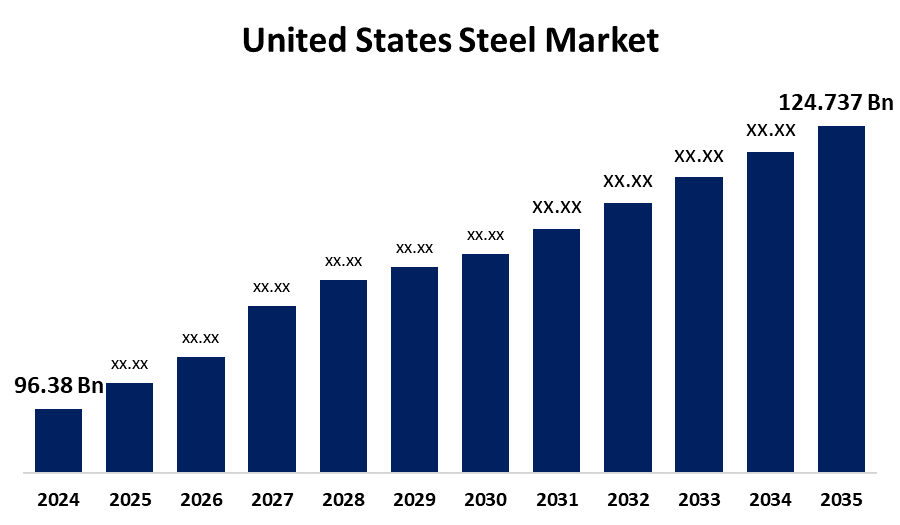

- The United States Steel Market Size was estimated at USD 96.38 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.37% from 2025 to 2035

- The United States Steel Market Size is Expected to Reach USD 124.737 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States steel market is anticipated to reach USD 124.737 billion by 2035, growing at a CAGR of 2.37% from 2025 to 2035. The U.S. steel market growth is driven by expanding construction and automotive sectors, increased infrastructure investments, and rising demand for renewable energy components. Advances in steel manufacturing technology enhance product quality and sustainability, attracting eco-conscious buyers. Government support through tariffs and modernization incentives protects domestic producers and boosts capacity.

Market Overview

The United States steel market defines the production and distribution of various steel products, including flat steel, long steel, structural steel, and specialty steel, used across multiple industries such as construction, automotive, manufacturing, and energy. Steel serves as a fundamental material for infrastructure development, transportation, and industrial machinery. The market is driven by strong demand from urbanization, infrastructure projects, and the automotive sector, alongside growing investments in renewable energy technologies requiring specialized steel components. Key strengths of the U.S. steel industry include advanced manufacturing technologies, a skilled workforce, and a well-established domestic supply chain that supports rapid production and innovation. Opportunities lie in the rising focus on sustainable steel production and the integration of lightweight, high-strength steel to meet evolving industrial and environmental needs. Government initiatives, including tariffs on steel imports and incentives for domestic production modernization, aim to protect the industry from global competition and encourage technological upgrades.

Report Coverage

This research report categorizes the market for the United States steel market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States steel market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States steel market.

United States Steel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 96.38 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.37% |

| 2035 Value Projection: | USD 124.737 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Type, By Product and COVID-19 Impact Analysis |

| Companies covered:: | Nucor Corporation, United States Steel Corporation, Steel Dynamics, Inc., Cleveland-Cliffs Inc., Commercial Metals Company, Gerdau S.A., TimkenSteel Corporation, AK Steel Holding Corporation, ArcelorMittal USA, SSAB Americas, JSW Steel USA, Nippon Steel Corporation, Thyssenkrupp Steel USA, U.S. Steel Tubular Products, Republic Steel, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The strong demand from the construction and automotive sectors, rapid urbanization, and infrastructure development projects fuel the need for structural and flat steel products, essential for buildings, bridges, and vehicles. Additionally, increasing investments in renewable energy, such as wind turbines and solar panels, require specialized steel components, further boosting demand. The growing manufacturing industry also contributes significantly to market growth by using steel in machinery and equipment production. Government initiatives promoting domestic steel production and the modernization of facilities encourage industry expansion, which further drives the market towards advancements in steelmaking technologies, improves product quality, and reduces environmental impact, attracting eco-conscious consumers. Rising adoption of lightweight, high-strength steel in transportation enhances fuel efficiency, driving market growth even more.

Restraining Factors

The fluctuating raw material prices, such as iron ore and coal, increase production costs. Environmental regulations impose strict compliance expenses, slowing expansion. Additionally, competition from alternative materials like aluminium and composites, along with global steel imports causing price volatility, challenges domestic producers limit growth and profitability in the steel market.

Market Segmentation

The United States steel market share is classified into type and product.

- Te flat steel segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States steel market is segmented by type into flat steel and long steel. Among these, the flat steel segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This growth is attributed to its extensive use in automotive, construction, and appliance manufacturing. Flat steel’s versatility in producing sheets, plates, and coils makes it essential for fabricating durable, high-strength components. Its demand is driven by industrial growth and infrastructure development, outpacing long steel, used primarily in structural applications and construction reinforcement.

- The structural steel segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States steel market is segmented by product into structural steel, prestressing steel, bright steel, welding wire and rod, iron steel wire, ropes, and braids. Among these, the structural steel segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its critical role in construction and infrastructure projects like It provides the essential framework for buildings, bridges, and industrial facilities, offering high strength and durability. Growing urbanization and investments in commercial and residential construction drive strong demand, making structural steel the largest and most vital product.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States steel market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nucor Corporation

- United States Steel Corporation

- Steel Dynamics, Inc.

- Cleveland-Cliffs Inc.

- Commercial Metals Company

- Gerdau S.A.

- TimkenSteel Corporation

- AK Steel Holding Corporation

- ArcelorMittal USA

- SSAB Americas

- JSW Steel USA

- Nippon Steel Corporation

- Thyssenkrupp Steel USA

- U.S. Steel Tubular Products

- Republic Steel

- Others

Recent Developments:

- In January 2023, Nucor (NYSE: NUE) introduced Elcyon™, the Company's new sustainable heavy gauge steel plate product made specifically to meet the growing demands of America's offshore wind energy producers building the green economy and its necessary infrastructure.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States steel market based on the below-mentioned segments:

United States Steel Market, By Type

- Flat Steel

- Long Steel

United States Steel Market, By Product

- Structural Steel

- Prestressing Steel

- Bright Steel

- Welding Wire and Rod

- Iron Steel Wire

- Ropes

- Braids

Need help to buy this report?