United States Steel Fiber Market Size, Share, and COVID-19 Impact Analysis, By Product (Hooked, Deformed, and Straight), By Application (Slabs & Flooring, Pavements & Tunneling, and Precast), and United States Steel Fiber Market Insights, Industry Trend, Forecasts to 2035.

Industry: Construction & ManufacturingUnited States Steel Fiber Market Insights Forecasts to 2035

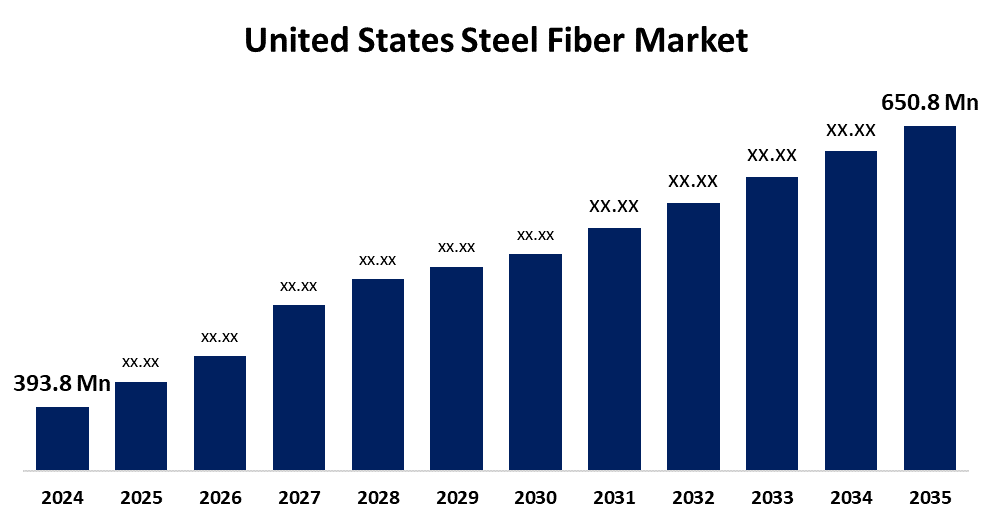

- The United States Steel Fiber Market Size was estimated at USD 393.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.67% from 2025 to 2035

- The United States Steel Fiber Market Size is Expected to Reach USD 650.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Steel Fiber Market Size is Anticipated to reach USD 650.8 Million By 2035, Growing at a CAGR of 4.67% from 2025 to 2035. The U.S. steel fiber market is experiencing growth driven by several factors, including the construction industry's emphasis on durable, high-performance materials has increased demand for steel fibers, which enhance concrete's strength and longevity. Technological innovations in manufacturing processes have improved the quality and cost-effectiveness of steel fibers. Additionally, a focus on sustainable construction practices and infrastructure development further propels market expansion.

Market Overview

The U.S. steel fiber market encompasses the supply and demand for small, discrete pieces of steel used to reinforce concrete and other composite materials. These fibers enhance the strength, durability, and crack resistance of the reinforced material, offering improved performance compared to traditional reinforcement methods. This growth is driven by the increasing demand for durable, high-performance materials in construction, particularly for infrastructure projects like highways, bridges, and tunnels. Technological advancements in manufacturing processes have improved the quality and cost-effectiveness of steel fibers, expanding their use in various construction sectors. Opportunities for market expansion lie in the growing emphasis on sustainable construction practices, as steel fibers can reduce the carbon footprint of buildings and infrastructure projects. Additionally, the adoption of advanced construction techniques like 3D printing and prefabrication is increasing the demand for steel fibers due to their superior reinforcement properties. Government investments in infrastructure and a focus on lightweight, high-performance materials are boosting the use of steel fibers in various applications.

Report Coverage

This research report categorizes the market for the United States steel fiber market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States steel fiber market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States steel fiber market.

United States Steel Fiber Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 393.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.67% |

| 2035 Value Projection: | USD 650.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 186 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Bekaert Corporation, Fibercon International Inc, ABC Polymer Industries, LLC, Nycon Corporation, IntraMicron, Inc, Ribbon Technology Corp., Conventus Polymers, LLC, Sika Corporation, Stanford Advanced Materials, Euclid Chemical, Propex Operating Company, LLC, Helix Steel, BASF Corporation, Forta Corporation, Dayton Superior Corporation, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increased demand for durable and high-performance construction materials has significantly increased the use of steel fibers in concrete reinforcement. Infrastructure development projects, including highways, bridges, and tunnels, require enhanced strength and longevity, making steel fibers a preferred choice. The adoption of precast concrete is increasing, and industrial flooring solutions also fuel demand. Moreover, the growing awareness of crack resistance and load-bearing capabilities provided by steel fibers supports market growth. Technological advancements in fiber production, leading to cost-effective and efficient materials, further boost adoption. Moreover, the shift toward sustainable and resilient construction practices, along with government investments in infrastructure, continues to propel the steel fiber market forward across various sectors.

Restraining Factors

The high initial costs compared to traditional reinforcement materials can deter price-sensitive projects. Limited awareness and expertise in fiber-reinforced concrete among contractors also hinder adoption. Additionally, inconsistent performance standards and a lack of uniform testing methods pose challenges to widespread acceptance. Supply chain disruptions and raw material price fluctuations further impact market stability and hinder consistent growth across regions.

Market Segmentation

The United States steel fiber market share is classified into product and application.

- The hooked segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States steel fiber market is segmented by product into hooked, deformed, and straight. Among these, the hooked segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to its superior bonding characteristics with concrete and its widespread adoption across various industries. Hooked steel fibers offer excellent anchorage within concrete, leading to improved crack control, enhanced tensile strength, and increased structural integrity.

- The slabs & flooring segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States steel fiber market is segmented by application into slabs & flooring, pavements & tunneling, and precast. Among these, the slabs & flooring segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to several factors, including increasing demand for non-structural and architectural building components, rapid urbanization, and extensive infrastructure development.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States steel fiber market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bekaert Corporation

- Fibercon International Inc

- ABC Polymer Industries, LLC

- Nycon Corporation

- IntraMicron, Inc

- Ribbon Technology Corp.

- Conventus Polymers, LLC

- Sika Corporation

- Stanford Advanced Materials

- Euclid Chemical

- Propex Operating Company, LLC

- Helix Steel

- BASF Corporation

- Forta Corporation

- Dayton Superior Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States steel fiber market based on the below-mentioned segments

United States Steel Fiber Market, By Product

- Hooked

- Deformed

- Straight

United States Steel Fiber Market, By Application

- Slabs & Flooring

- Pavements & Tunneling

- Precast

Need help to buy this report?