United States Stainless Steel Paint Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Water-based Paints and Solvent-based Paints), By Application Method (Spray Application and Brush Application), and United States Stainless Steel Paint Market Insights, Industry Trend, Forecasts to 2035

Industry: Construction & ManufacturingUnited States Stainless Steel Paint Market Insights Forecasts to 2035

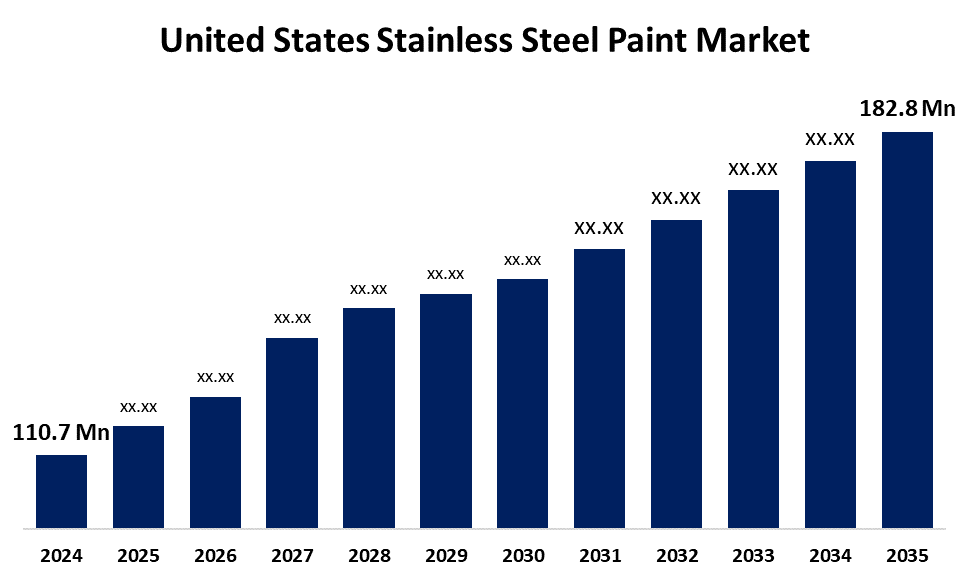

- The United States Stainless Steel Paint Market Size was Estimated at USD 110.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.67% from 2025 to 2035

- The United States Stainless Steel Paint Market Size is Expected to Reach USD 182.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States stainless steel paint market is anticipated to reach USD 182.8 million by 2035, growing at a CAGR of 4.67% from 2025 to 2035. The U.S. stainless steel paint market grows due to rising demand for corrosion-resistant coatings in industrial and architectural sectors. Advances in low-VOC, high-temperature paints meet environmental and performance needs. Increased infrastructure development, focus on aesthetics, and maintenance-free durability further drive market expansion across various industries.

Market Overview

The United States stainless steel paint market refers to the industry focused on protective and decorative coatings specifically formulated for stainless steel surfaces across various sectors such as construction, automotive, industrial equipment, and infrastructure. These specialized paints enhance corrosion resistance, durability, and aesthetic appeal of stainless steel, especially in harsh or high-moisture environments. Market growth is primarily driven by increasing demand for corrosion-resistant materials, ongoing infrastructure development, and rising use of stainless steel in modern architecture and industrial machinery. Strengths of the market include technological advancements in coating formulations, such as low-VOC, high-temperature-resistant, and eco-friendly products that meet strict environmental standards. Opportunities are emerging from the rising adoption of stainless steel in green building projects and the growth of the industrial and marine sectors. Additionally, innovations in application techniques, such as spray and powder coating, are opening new avenues for efficiency and quality improvement. Government initiatives supporting sustainable construction, environmental protection, and industrial modernization are also contributing to market expansion by encouraging the use of long-lasting and eco-conscious coating solutions.

Report Coverage

This research report categorizes the market for the United States stainless steel paint market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States stainless steel paint market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States stainless steel paint market.

United States Stainless Steel Paint Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 110.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.67% |

| 2035 Value Projection: | USD 182.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 176 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product Type, By Application Method, and COVID-19 Impact Analysis |

| Companies covered:: | IVC Industrial Coatings, Walter Wurdack, Inc., Induron Protective Coatings, Chesapeake Mechanical & Coatings, Patton’s Metal Working Solutions, Aremco Products, Sun Coating Company, Indcon, Inc., Madico, Inc., PPG Industries, Sherwin-Williams Company, Axalta Coating Systems, Valspar Corporation, Hempel USA, AkzoNobel Coatings Inc., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The increasing demand for corrosion-resistant and durable coatings in industries such as construction, automotive, and manufacturing. As infrastructure development and urbanization continue to rise, so does the need for protective coatings that can withstand harsh environmental conditions. Advancements in technology have led to the creation of eco-friendly, low-VOC, and high-performance formulations that meet both regulatory standards and consumer preferences. Additionally, the growing focus on aesthetics and maintenance-free materials in modern architecture supports market demand. The expansion of industrial activities and the use of stainless steel in equipment and machinery further fuel this growth. Furthermore, rising awareness of environmental sustainability and long-term cost savings from protective coatings continues to drive the market.

Restraining Factors

The growing costs of advanced coatings and raw materials limit widespread adoption. Strict environmental regulations increase compliance expenses for manufacturers. Additionally, challenges like limited awareness of stainless steel paint benefits and competition from alternative protective coatings hinder market growth. Technical issues such as application complexity and durability concerns in harsh environments also restrict broader usage across industries.

Market Segmentation

The United States stainless steel paint market share is classified into product type and application method.

- The water-based paints segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States stainless steel paint market is segmented by product type into water-based paints and solvent-based paints. Among these, the water-based paints segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to growing environmental concerns and stringent VOC regulations. These paints offer lower toxicity, easier cleanup, and reduced environmental impact compared to solvent-based alternatives. Their improved performance, safety, and compliance with green building standards make them the preferred choice across industries, boosting their market share significantly.

- The spray application segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States stainless steel paint market is segmented by application method into spray application and brush application. Among these, the spray application segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because its efficiency, uniform coverage, and faster drying times compared to brush application. Spray methods allow for consistent coatings on complex surfaces, reducing labor costs and improving productivity. These advantages make spray application the preferred choice in industrial and large-scale projects, driving its dominance in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States stainless steel paint market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IVC Industrial Coatings

- Walter Wurdack, Inc.

- Induron Protective Coatings

- Chesapeake Mechanical & Coatings

- Patton's Metal Working Solutions

- Aremco Products

- Sun Coating Company

- Indcon, Inc.

- Madico, Inc.

- PPG Industries

- Sherwin-Williams Company

- Axalta Coating Systems

- Valspar Corporation

- Hempel USA

- AkzoNobel Coatings Inc.

- Others

Recent Developments:

- In February 2021, PPG (NYSE: PPG) announced the launch of PPG HI-TEMP 1027™HD coating, which is a next-generation, ambient-cure coating engineered for challenging corrosion-under-insulation (CUI) conditions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S., regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States stainless steel paint market based on the below-mentioned segments:

USA Stainless Steel Paint Market, By Product Type

- Water-based Paints

- Solvent-based Paints

USA Stainless Steel Paint Market, By Application Method

- Spray Application

- Brush Application

Need help to buy this report?