United States Sports Drinks Market Size, Share, and COVID-19 Impact Analysis, By Soft Drink Type (Protein-Based Sport Drinks, Hypertonic, Isotonic, Hypotonic, and Electrolyte-Enhanced Water), By Packaging Type (Metal Can, PET Bottles, and Aseptic Packages), and US Sports Drinks Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUSA Sports Drinks Market Insights Forecasts to 2035

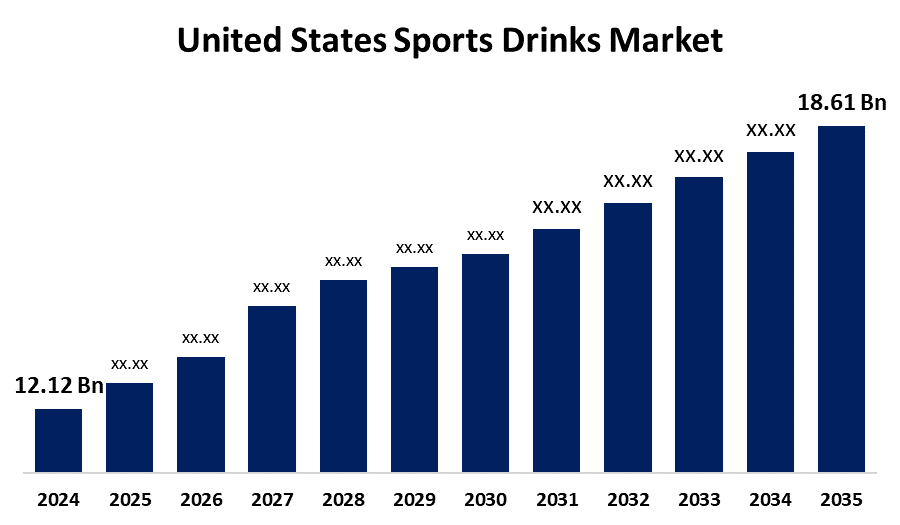

- The US Sports Drinks Market Size was Estimated at USD 12.12 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.98% from 2025 to 2035

- The USA Sports Drinks Market Size is Expected to reach USD 18.61 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Sports Drinks Market Size is anticipated to reach USD 18.61 Billion by 2035, Growing at a CAGR of 3.98% from 2025 to 2035. The United States sports drink market is witnessing a dramatic shift due to shifting consumer tastes and lifestyle habits.

Market Overview

The United States sports drinks market focuses on hydration and performance-enhancing beverages for athletes and active consumers, containing electrolytes, carbohydrates, vitamins, and minerals to replenish lost fluids. A sports drink is a beverage consumed either during or after physical activity to accelerate rehydration, promote recovery, stimulate rapid fluid absorption, and provide carbohydrates for use during exercise. While vitamins, minerals, choline, and carbonation are secondary ingredients, basic sports drinks are designed to replenish lost fluids and electrolytes. Sports drinks are flavored and made to prevent the loss of carbohydrates and water. They encourage the voluntary consumption of fluids, facilitate rapid intestinal absorption, and empty the stomach. Sports drinks are available in three primary varieties: isotonic, hypertonic, and hypotonic. Drinks with a higher sugar content and no electrolytes are hypertonic, whereas isotonic beverages have salt and sugar concentrations comparable to those of the human body. Gymnasts and other low-to-moderate-intensity athletes use hypotonic drinks to increase their voluntary fluid intake and stay hydrated. Increasing public awareness of health and fitness, increased sports participation, and the launch of novel formulas with natural ingredients and functional improvements are some of the key drivers of the market.

Report Coverage

This research report categorizes the market for the US sports drinks market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US sports drinks market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US sports drinks market.

United States Sports Drinks Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12.12 Billion |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 3.98% |

| 2035 Value Projection: | USD 18.61 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 178 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Soft Drink Type, By Packaging Type, and COVID-19 Impact Analysis |

| Companies covered:: | Suntory Holdings Limited, Pisa Global, S.A. de C.V., PepsiCo, Inc., The Coca-Cola Company, Seven and Holdings Co., Ltd., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Individuals committed to fitness and health are seeking simple ways to maintain an active lifestyle. Rehydrating, replenishing lost electrolytes, and boosting energy levels can be achieved quickly and easily with energy and sports drinks that require minimal preparation. These beverages fit seamlessly into busy schedules as they can be consumed while on the go. As more people participate in sports, there is a growing demand for proper electrolyte replenishment and hydration. The primary purpose of sports drinks is to prevent dehydration by hydrating and replenishing essential minerals. The rise of natural sports and energy drinks has capitalized on consumers' desire for healthier, eco-friendly options that contain natural sugars, flavors, colors, and organic or plant-based ingredients, driving market growth.

Restraining Factors

This market faces challenges such as health concerns, regulatory scrutiny, price volatility, competition from functional beverages, and sustainability challenges. Consumers are shifting towards low-sugar alternatives, while stricter regulations may hinder the market growth.

Market Segmentation

The USA sports drinks market share is classified into soft drink type and packaging type.

- The isotonic segment held the largest share of 52.11% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US sports drinks market is segmented by soft drink type into protein-based sport drinks, hypertonic, isotonic, hypotonic, and electrolyte-enhanced water. Among these, the isotonic segment held the largest share of 52.11% in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is attributed to the good energy source, suitable for the adults and geriatric populations, hydrates the body, and maintains the electrolyte balance.

- The PET bottles segment accounted for the largest market share of 94.62% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US sports drinks market is segmented by packaging type into metal can, PET bottles, and aseptic packages. Among these, the PET bottles segment accounted for the largest market share of 94.62% in 2024 and is expected to grow at a significant CAGR during the forecast period. PET bottles are preferred due to their versatility and sustainability, with many companies transitioning to recycled PET materials. Leading brands are investing in and promoting the use of recycled polypropylene (rPP), enhancing their market dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US sports drinks market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Suntory Holdings Limited

- Pisa Global, S.A. de C.V.

- PepsiCo, Inc.

- The Coca-Cola Company

- Seven and Holdings Co., Ltd.

- Others

Recent Developments:

- In January 2025, Coca-Cola introduced an Orange Cream variety, infused with orange and vanilla flavors, in response to consumer demand for the nostalgic taste of orange cream. The company is expanding its beverage portfolio, including waters, teas, and sports drinks, while also innovating its soda portfolio.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US sports drinks market based on the below-mentioned segments:

US Sports Drinks Market, By Soft Drink Type

- Protein-Based Sport Drinks

- Hypertonic

- Isotonic

- Hypotonic

- Electrolyte-Enhanced Water

US Sports Drinks Market, By Packaging Type

- Metal Can

- PET Bottles

- Aseptic Packages

Need help to buy this report?