United States Spheroids Market Size, Share, and COVID-19 Impact Analysis, By Method (Micropatterned Plates, Low Cell Attachment Plates, Hanging Drop Method, and Others), By Source (Cell Line, Primary Cell, and iPSC-Derived Cells), By Application (Developmental Biology, Personalized Medicine, Regenerative Medicine, Disease Pathology Studies, and Drug Toxicity & Efficacy Testing) and United States Spheroids Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Spheroids Market Insights Forecasts to 2035

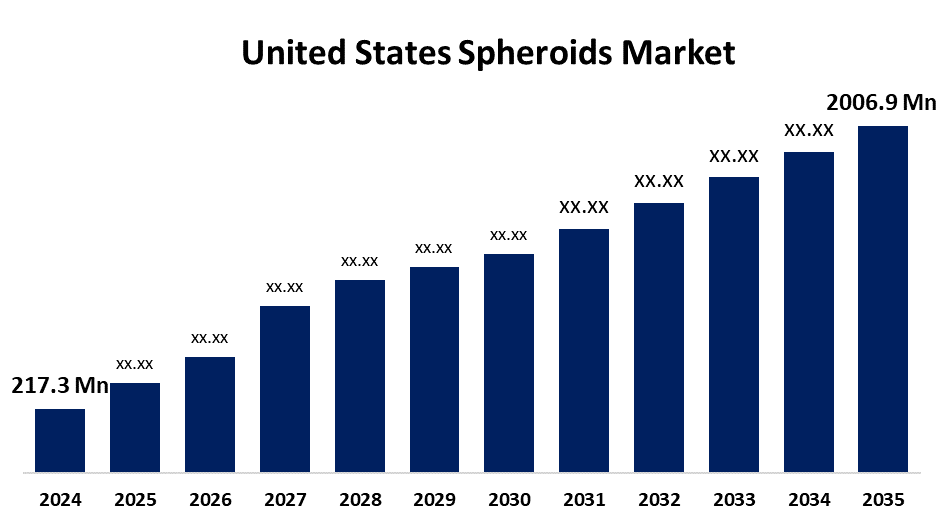

- The US Spheroids Market Size Was Estimated at USD 217.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 22.40% from 2025 to 2035

- The US Spheroids Market Size is Expected to Reach USD 2006.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Spheroids Market is anticipated to reach USD 2006.9 million by 2035, growing at a CAGR of 22.40% from 2025 to 2035. The expansion of the United States' spheroid market is propelled by the growing need for physiologically realistic 3D cell culture models in regenerative medicine, drug development, and cancer research. Compared to conventional 2D cultures, spheroids more accurately reproduce in vivo cellular interactions, nutrition gradients, and tissue architecture, producing more predictive data for medication efficacy and toxicity screening.

Market Overview

Spheroids are three-dimensional (3D) cell aggregates that closely mimic human tissue structure and function. Applications such as drug discovery, regenerative medicine, and disease modelling, among others, have been proposed for spheroids as they model human tissue structure and function. In the field of oncology research, spheroids are the most attractive because they allow researchers to accurately model cancer behavior and treatment responses. The use of spheroid-based systems in a variety of different contexts (biotech, academic, and pharmaceutical) is increasing as a result of new high-throughput screening methodologies that have been developed, increased interest in personalised medicine, and financing of 3D cell culture platforms. There is a strong emphasis by researchers and companies on developing spheroids that mimic complex diseases such as lung cancer, colon cancer, chronic renal disease, and various genetic disorders. Since developing these tiny 3D models opens doors for disease modelling and in-depth biological understanding, this targeted innovation drives an increasing desire for spheroids within the scientific community. Also, new developments in spheroid model development technology increase their usefulness in pharmaceutical research by enhancing the precision of disease analysis and drug. The need for research and drug development models that are more physiologically appropriate has led to a great degree of innovation in the spheroids industry. Advanced scaffold-free and scaffold-based culture systems, integration with organ-on-chip technologies, and AI-based analysis tools for high-content screening and 3D imaging are examples of innovations. Their use in regenerative medicine and disease modelling is greatly enhanced by novel techniques for producing homogeneous spheroids, co-culturing various cell types, and prolonging survival.

The U.S. Food and Drug Administration (FDA) encourages the development of 3D culture and the use of alternative models, including spheroids, to lessen animal testing. The FDA is supporting the creation of more physiologically relevant medications, such as spheroids. Such regulatory backing facilitates the usage of spheroids in academia and industry.

Report Coverage

This research report categorizes the market for the United States spheroids market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States' spheroids market. Recent market developments and competitive strategies such as expansion, Source launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States spheroids market.

United States Spheroids Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 217.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 22.40% |

| 2035 Value Projection: | USD 2006.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 113 |

| Segments covered: | By Method, By Source, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Thermo Fisher Scientific Inc., Corning Incorporated, 3D Biotek LLC, 3D Biomatrix Inc., Cell Microsystems, Danaher, Prellis Biologics, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growth of the United States spheroid market is fueled because spheroid and tumour spheroid models may closely replicate the 3D cellular architecture and milieu of human tissues, and their use is currently being greatly accelerated by the growing need for tissue engineering and organ transplantation. Spheroids are perfect for creating bioengineered tissues, examining transplant viability, and testing the effectiveness of medications because they enable more physiologically relevant investigations of cell-cell and cell-matrix interactions than conventional 2D cultures. Particularly, tumour spheroids are being used more and more in cancer modelling to better imitate in vivo circumstances while studying tumour growth, metastasis, and response to treatment. The scarcity of donor organs, developments in regenerative medicine, and the increased focus on customised therapy development all drive this demand.

Restraining Factors

The United States spheroids market faces obstacles since it can be expensive and technically difficult to achieve consistency and reproducibility in these 3D models on a bigger scale, production scaling remains an issue.

Market Segmentation

The United States' spheroids market share is classified into method, source, and application.

- The hanging drop method segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States spheroids market is segmented by method into micropatterned plates, low cell attachment plates, hanging drop method, and others. Among these, the hanging drop method segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. To promote a spontaneous cell aggregation into spheroids, the section uses gravity. Cell clusters that are both physiologically significant and architecturally sound can be developed using this method. In academic and industrial settings, the hanging drop method has become a popular choice for drug screening, regenerative medicine, and cancer research because of the growing requirement for high-quality, scalable, and reasonably priced 3D culture systems. Its versatility in producing spheroids for various applications and ease of usage boost its appeal and aid in the growth of the spheroid industry.

- The cell line segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the source, the United States spheroid market is segmented into cell line, primary cell, and iPSC-derived cells. Among these, the cell line segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is fueled by offering a standardised, repeatable, and affordable resource to generate 3D spheroid models for a variety of scientific applications, cell lines are a significant supply for spheroids. To investigate stem cell differentiation, treatment resistance, tissue creation, and tumour behaviour, spheroids are frequently created from primary cells, stem cell lines, and established cancer cell lines. Scientists can generate spheroids that model different pathological states, based on the availability of many disease-specific and genetically-modified cell lines, further enhancing the relevance and translation of results from experiments. Furthermore, these cell lines' suitability for high-throughput 3D culture techniques has led to a rise in their use in pharmaceutical and academic research and development, which has fuelled market expansion.

- The developmental biology segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The United States spheroids market is segmented by method into developmental biology, personalized medicine, regenerative medicine, disease pathology studies, and drug toxicity & efficacy testing. Among these, the developmental biology segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. Spheroids greatly improve developmental biology by providing a more accurate 3D model system to study topics such as tissue morphogenesis, cellular differentiation, and organogenesis. In comparison to 2D cultures, spheroids offer the ability to observe cell behavior in a spatial context resembling early embryonic development. Therefore, spheroids are an ideal model to examine the patterns/levels of gene expression in developmental processes and the specific or overlapping signalling pathways involved. Due to their utility in studying early stages of tissue formation and stem cell differentiation, spheroids (including embryoid bodies) are being increasingly used to study the aetiology of congenital diseases and advancements in regenerative medicine. There is a growing need for more complex and scalable 3D culture systems in developmental biology as a result of the expansion of spheroids.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States spheroids market, along with a comparative evaluation primarily based on their Source offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes Source development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Thermo Fisher Scientific Inc.

- Corning Incorporated

- 3D Biotek LLC

- 3D Biomatrix Inc.

- Cell Microsystems

- Danaher

- Prellis Biologics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States spheroids market based on the following segments:

United States Spheroids Market, By Method

- Micropatterned Plates

- Low Cell Attachment Plates

- Hanging Drop Method

- Others

United States Spheroids Market, By Source

- Cell Line

- Primary Cell

- iPSC-Derived Cells

United States Spheroids Market, By Application

- Developmental Biology

- Personalized Medicine

- Regenerative Medicine

- Disease Pathology Studies

- Drug Toxicity & Efficacy Testing

Need help to buy this report?