United States Spectrometry Market Size, Share, and COVID-19 Impact Analysis, By Type (Molecular Spectrometry, Mass Spectrometry, and Atomic Spectrometry), By Application (Pharmaceutical Analysis, Forensic Analysis, Proteomics, and Metabolomics), and United States Spectrometry Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Spectrometry Market Insights Forecasts to 2035

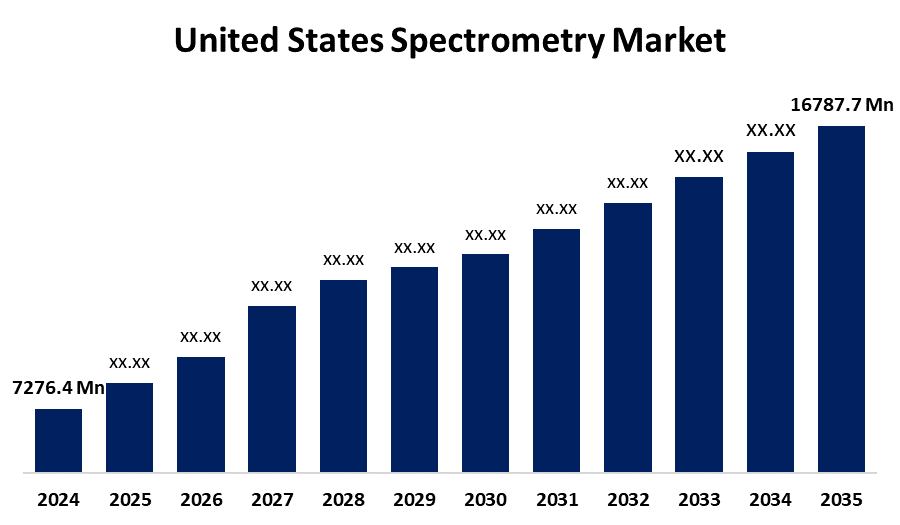

- The US Spectrometry Market Size Was Estimated at USD 7276.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.9% from 2025 to 2035

- The US Spectrometry Market Size is Expected to Reach USD 16787.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Spectrometry Market is anticipated to reach USD 16787.7 million by 2035, growing at a CAGR of 7.9% from 2025 to 2035. The expansion of the United States spectrometry market is propelled by the creation of sophisticated spectroscopic tools and supplies.

Market Overview

Spectrometry is a fascinating analytical technique that encompasses a range of methods, including molecular, atomic, and mass spectrometry. It’s all about measuring how light interacts with matter, and it includes techniques like infrared (IR), nuclear magnetic resonance (NMR), triple quadrupole, x-ray fluorescence, and inorganic mass spectroscopies. This powerful tool is indispensable across various fields such as academic research, forensics, biotechnology, drug development, environmental testing, chemical analysis, astronomy, food safety, and even carbon dating. Spectrometry is so appealing because of its affordability, sensitivity, reliability, and user-friendliness, all while delivering precise quantitative and qualitative data from just tiny sample sizes. It can analyse solids, liquids, and gases, making it particularly adept at uncovering unknown substances in a sample. The U.S. spectrometry market is a cornerstone of the analytical landscape, playing a crucial role in various sectors and scientific endeavors. With its combination of affordability, sensitivity, reliability, and adaptability, spectrometry offers a highly specific and accessible analytical solution that requires minimal sample volumes.

The U.S. government actively promotes the spectrometry ecosystem through infrastructural programs and significant investment. This is primarily accomplished through the S10 Instrumentation Grant series, which consists of the Basic Instrumentation Grant, Shared Instrumentation Grant, and High-End Instrumentation grants, administered by the NIH Office of Research Infrastructure Programs (ORIP). These grants provide institutions with funding for shared-use spectrometers, including mass spectrometers, NMR, X-ray diffraction, and biosensors, in the range of $25,000 to $2 million per instrument.

Report Coverage

This research report categorizes the market for the United States spectrometry market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States spectrometry market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States spectrometry market.

United States Spectrometry Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7276.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.9% |

| 2035 Value Projection: | USD 16787.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Perkin Elmer, Inc., MKS Instruments Inc, Waters Corp, Agilent Technologies Inc, Thermo Fisher Scientific Inc, Bruker Corporation, AB Sciex LLC, LECO Corporation, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States spectrometry market is boosted by the rapid expansion of the biotechnology and pharmaceutical industries. Mass spectrometry has a wide range of applications as an analytical tool in these sectors. Increased investments in areas like personalized medicine and biopharmaceuticals are expected to boost research efforts in biotechnology and pharmaceuticals. Mass spectrometry plays a crucial role for companies in these fields throughout the entire drug discovery process, from the initial stages to clinical trials. As the demand for innovative and advanced instruments rises, so too will the need for mass spectrometry in the biotechnology and pharmaceutical sectors.

Restraining Factors

The United States spectrometry market faces obstacles, like the high price tag on spectrometry instruments. Diagnostic clinics and laboratories often find the costs prohibitive, especially with the latest technological advancements driving prices up.

Market Segmentation

The United States spectrometry market share is classified into type and application.

- The molecular spectrometry segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States spectrometry market is segmented by type into molecular spectrometry, mass spectrometry, and atomic spectrometry. Among these, the molecular spectrometry segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because it plays a significant role in spectrometry in various fields like analytical chemistry, pharmaceuticals, and environmental monitoring. Its knack for delivering detailed molecular insights makes it a go-to for both qualitative and quantitative analysis, which is crucial for researchers and industries.

- The pharmaceutical analysis segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States spectrometry market is segmented into pharmaceutical analysis, forensic analysis, proteomics, and metabolomics. Among these, the pharmaceutical analysis segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the increasing emphasis on drug development and quality assurance in the pharmaceutical industry is driving the need for accurate analytical techniques. As this industry expands, the reliance on spectrometry becomes even more critical for assessing drug formulations, impurities, and pharmacokinetics. Regulatory compliance further fuels the demand for robust analytical methods to guarantee safety and efficacy.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States spectrometry market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Perkin Elmer, Inc.

- MKS Instruments Inc

- Waters Corp

- Agilent Technologies Inc

- Thermo Fisher Scientific Inc

- Bruker Corporation

- AB Sciex LLC

- LECO Corporation

- Others

Recent Development

- In June 2023, Seer, Inc. expanded its collaboration with Thermo Fisher Scientific, integrating Seer's Proteograph XT Assay Kit with Thermo Fisher's Orbitrap Astral Mass Spectrometer. This partnership will enhance access to deep, unbiased proteomics, supporting large-scale studies in cancer and neurodegenerative diseases. The new seer technology access center will provide mass spectrometry services to researchers, enabling high-throughput sample processing with minimal hands-on time, improving biological insights, and advancing clinical outcomes.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States spectrometry market based on the following segments:

United States Spectrometry Market, By Type

- Molecular Spectrometry

- Mass Spectrometry

- Atomic Spectrometry

United States Spectrometry Market, By Application

- Pharmaceutical Analysis

- Forensic Analysis

- Proteomics

- Metabolomics

Need help to buy this report?